The US dollar only temporarily rose against the euro and the pound on Friday following the release of a good report on the state of the labor market in the US. This continues to amaze the market with its high level of sustained growth for a long time.

This also suggests that the Federal Reserve will not hesitate to raise interest rates. However, it is only one excellent indicators of the labor market and this is not enough. Moreover, the committee closely follows the level of inflation, as repeatedly stated by its representatives.

Federal Reserve Boston President Rosengren said on Friday that the Fed could raise rates more than three times in 2018. For this, there are various the tools. He also noted that they consider both expedient regular and gradual rate increases, as the recent economic data was quite good.

As for inflation, Rosengren expects it to reach the target level of 2% by the end of this year.

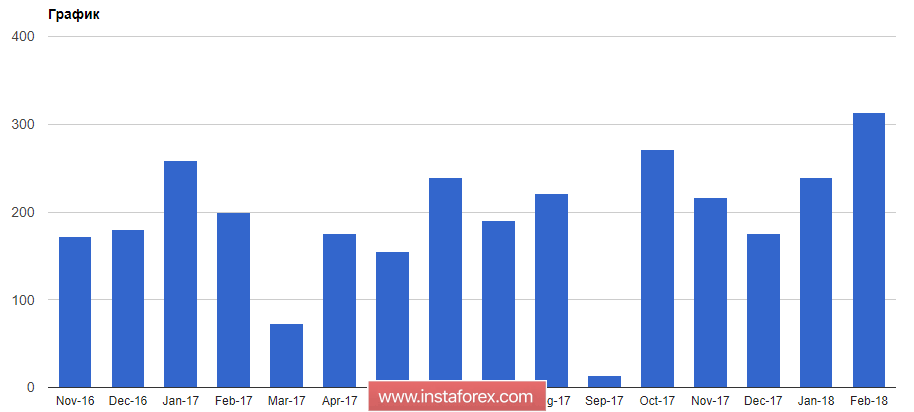

As noted above, the report on the number of jobs in the US for the month of February this year provided temporary support to the US dollar. According to the US Department of Labor, the number of jobs outside of US agriculture in February 2018 increased by 313,000. The unemployment rate remained unchanged at 4.1%. Economists expected that the number of jobs outside agriculture in February will increase by 205,000 and unemployment will be at 4.0%.

On the afternoon of Friday, US Treasury Secretary Mnuchin made a statement saying that the president might consider lifting the fees for some other countries in the next two weeks.

It is important to note that at the end of last week, US President Donald Trump signed a decree on the introduction of duties on steel and aluminum, which caused a number of dissatisfaction with a significant number of European politicians. This was evident from the speech of European Commissioner for Trade Cecilia Malmstrom, who stated that the EU's executive body had revised the plan against possible fees from the US. Furthermore, the EU has serious doubts about the validity of the measures.

Mnuchin also announced the possibility of negotiations with North Korea, which he expects in the future. However, from his words, there will be no relaxation in terms of sanctions during the talks.

As for the technical picture of the EURUSD pair, it remained unchanged. The inability of buyers to break above the level at 1.2340 retains the possibility of a downward correction, which, in the long run, may cause a more serious sale of risky assets with their return to the area of larger support at 1.2275. It is here that a further upward trend will depend on. The breakdown at the level of 1.2275 will lead to the development of the "head-shoulders" model and to a larger fall of the EURUSD pair in the area of 1.2230 and 1.2150.