On the eve of the height of the biggest trade war in the last 10 years between China and the United States, investors are betting on strengthening safe-haven assets, which include the Japanese yen, the US dollar, and gold.

Yesterday, statements were made by the administration of President Trump, which set out a plan for imposing duties at a rate of 25%, which would affect China's imports by about $ 50 billion. The Trump Administration requires China to make a serious trade and investment concessions, which were discussed in more detail last week, but before the implementation of which never came to pass.

It is worth recalling that in turn, the authorities of Beijing announced a response. As noted in the report of the Ministry of Finance of China, duties will be increased by 25% for American pork and a number of other commodity items, as well as 15% for fruits and 120 commodities from the United States.

Despite the current situation, the chance to resolve the conflict remains, but for this, it is necessary to resort to a mechanism for resolving the conflicts of the World Trade Organization, to observe the rules, as practice shows, the US recently also does not particularly want.

Yesterday, a representative of the Federal Reserve, Lael Brainard, could give some support to the US dollar, which said that the economy has become more favorable than the oncoming wind, which indicates a likely increase in inflation expectations in the near future. In her opinion, it is critically important for the Fed to achieve an inflation rate of 2%. Brainard criticized the current policy of the White House, saying that trade policy is a factor of uncertainty for the prospects of the US and world economy.

As for the technical picture of the EUR / USD currency pair, so far everything is on the side of the sellers of the European currency and the movement is aiming for the lower border of the descending channel, which now coincides with the support level and the new monthly minimum, 1.2240. In the case of its breakthrough, we can expect a larger downward trend in the trading instrument, with the update of 1.2195 and 1.2150.

The Australian dollar strengthened its position against the US dollar today in the Asian session after the release of good data on retail sales in Australia, which will support the economy of the country.

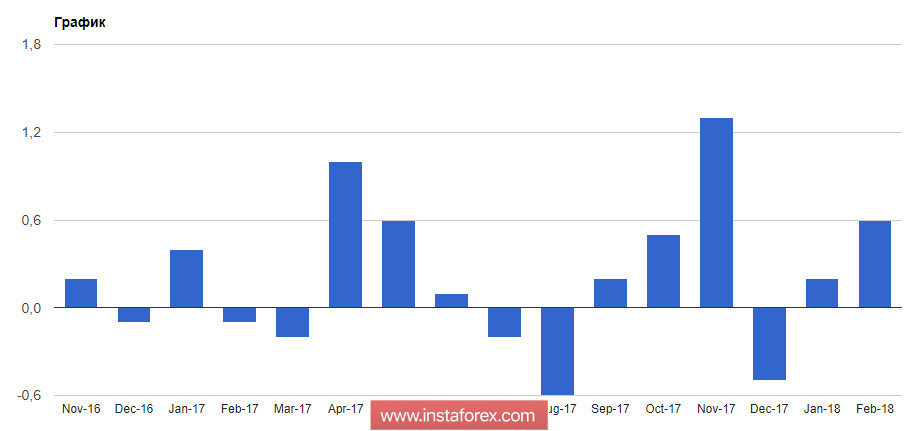

According to the report of the statistics agency, retail sales in Australia in February this year rose by 0.6% compared to January, while economists forecast growth of only 0.3%.

The number of permits for housing construction in Australia in February fell sharply by 6.2% compared to January and by 3.1% compared to the same period in 2017.