Despite a good report on employment in the private sector of the US, other data failed to support US dollar buyers, as they were worse than economists' forecasts, indicating a possible slowdown in economic growth.

According to the report of Automatic Data Processing Inc. and Moody's Analytics, the number of jobs in the private sector increased by 241,000 in March 2018, while economists were expecting an increase in the number of jobs by 200,000. As noted in the ADP, the market continues to experience a rapid increase in employment, and despite this, the demand for labor remains quite high.

Data for February were revised upwards, to 246,000 new jobs, whereas previously it was reported that 235,000 were created.

Let me remind you that a more important report on the number of jobs outside the US agriculture will be released tomorrow. Economists forecast an increase in the number of jobs by 178,000.

Some support to the US dollar was provided by data from the Ministry of Trade on orders for manufactured goods in the US, which in February rose by 1.2% to $ 498.0 billion. Economists predicted that orders will grow in February by 1.7%. In February, orders for durable goods increased by 3.0% compared with the previous month, while earlier it was reported on the growth of 3.1%.

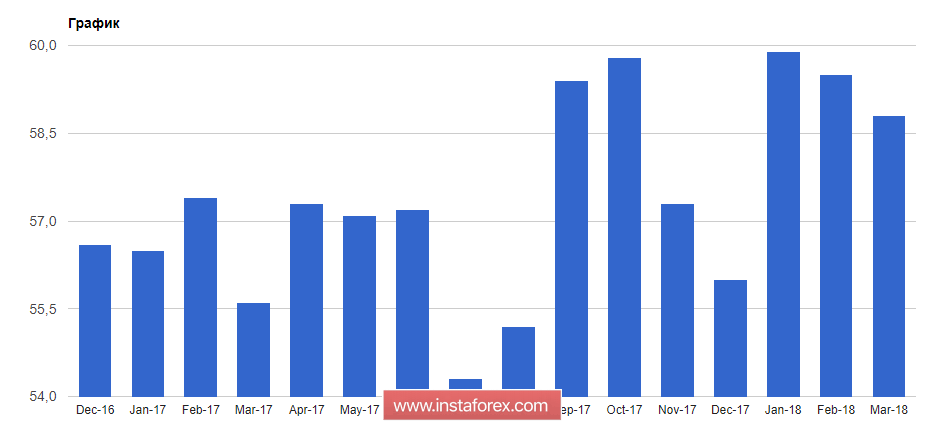

The data on activity in the US services sector, which in March this year demonstrated slower growth rates, leveled good results. According to the report, the Institute of Supply Management, the index of supply managers for the non-manufacturing sector of the US in March fell to 58.8 points against 59.5 points in February. Economists had expected the index to be 59.0 points.

Yesterday afternoon, Fed spokesman James Bullard, who said that the current interest rate level is right for the economy. In his opinion, temporary factors that carry risks are weakening, and inflation will approach the target level in the next few years. Bullard also noted that he does not yet see the need for a further increase in rates.

As for the technical picture of the EUR / USD pair, it remained unchanged on the side of buyers of the US dollar. The movement tends to the lower border of the descending channel, which now coincides with the support level and a new monthly minimum of 1.2240. In the case of its breakthrough, we can expect a larger downward trend in the trading instrument, with the update of 1.2195 and 1.2150.