Dear colleagues.

For the EUR / USD pair, we follow the downward structure from March 27. We expect the continuation of the movement after the breakdown of 1.2210. For the GBP / USD pair, the continuation of the development of the downward structure from March 27 is expected after the breakdown of 1.4001. For the USD / CHF pair, we follow the upward cycle from March 26. The continuation of the movement towards to the top is expected after the breakdown of 0.9641. For the USD / JPY pair, the subsequent goals for the top are determined from the local upward structure on April 2. For the EUR / JPY pair, we follow the formation of the upward structure of March 22. The development of this level is expected after the breakdown of 131.75. For the GBP / JPY pair, subsequent targets for the top were determined from the local upward structure on April 2.

The forecast for April 6:

Analytical review of currency pairs in the scale of H1:

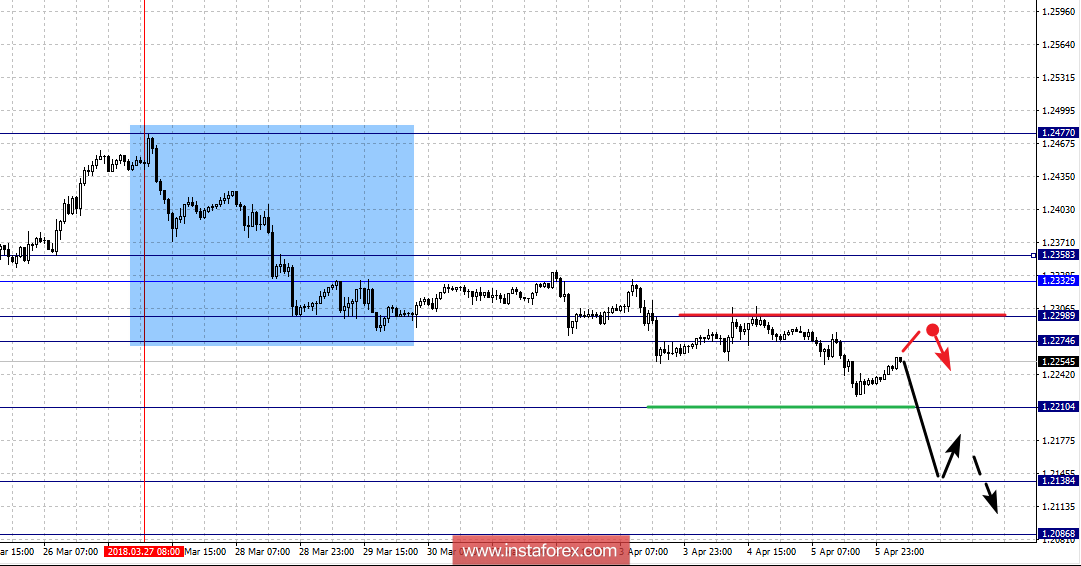

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2358, 1.2332, 1.2298, 1.2274, 1.2210, 1.2138 and 1.2086. Here, we continue to follow the downward cycle from March 27. The continuation of the movement towards the bottom is expected after the breakdown of 1.2210. In this case, the target is 1.2138. Near this level is the consolidation of the price. For the potential value for the downward movement, consider the level of 1.2086. From this level, we expect a pullback to the top.

Short-term upward movement is expected in the area of 1.2274 - 1.2298. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2332. The range of 1.2332 - 1.2358 is the key support for the downward structure. Before reaching this level, we expect the initial conditions for the upward cycle.

The main trend is the downward structure of March 27.

Trading recommendations:

Buy: 1.2274 Take profit: 1.2296

Buy 1.2300 Take profit: 1.2330

Sell: 1.2210 Take profit: 1.2140

Sell: 1.2136 Take profit: 1.2090

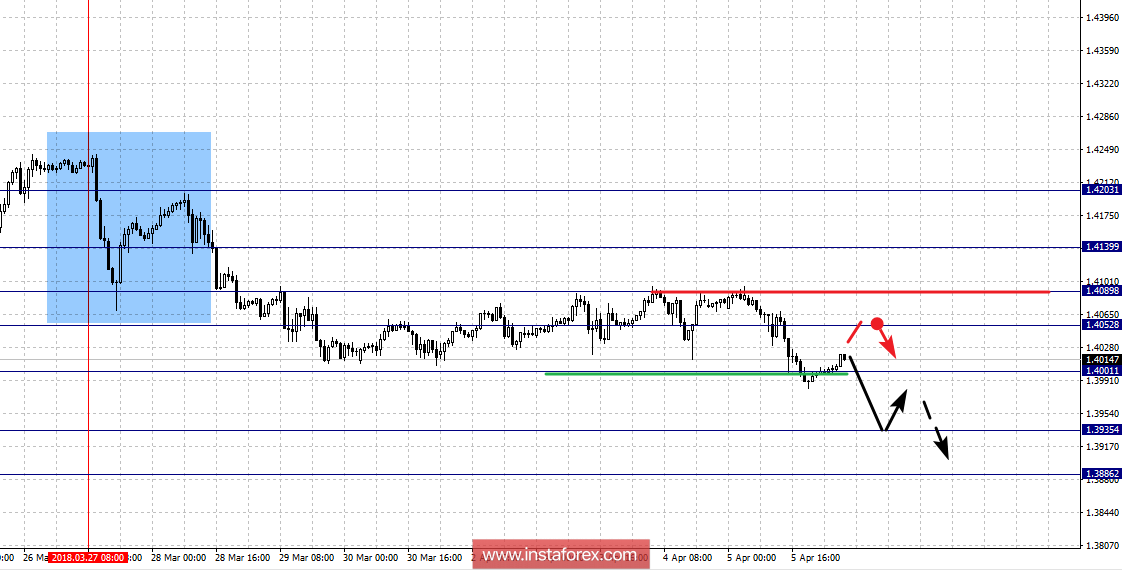

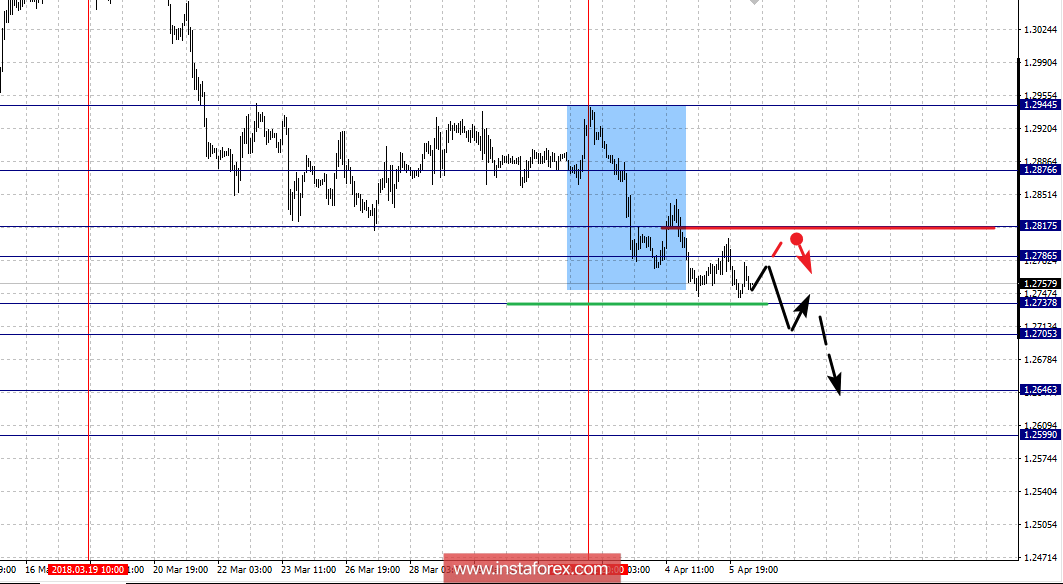

For the GBP / USD pair, the key levels on the scale of H1 are 1.4203, 1.4139, 1.4089, 1.4052, 1.4001, 1.3935 and 1.3886. Here, we follow the development of the downward structure of March 27. The breakdown at the level of 1.4000 should be accompanied by a pronounced movement towards the bottom. Here, the target is 1.3935. For the potential value for the bottom, consider the level of 1.3886. Upon reaching this level, we expect a pullback to the top.

Short-term uptrend is possible in the area of 1.4052 - 1.4089. The breakdown of the last value will lead to in-depth movement. Here, the target is 1.4139. This level is the key support for the downward structure.

The main trend is the downward structure of March 27.

Trading recommendations:

Buy: 1.4052 Take profit: 1.4086

Buy: 1.4092 Take profit: 1.4136

Sell: 1.4000 Take profit: 1.3940

Sell: 1.3932 Take profit: 1.3890

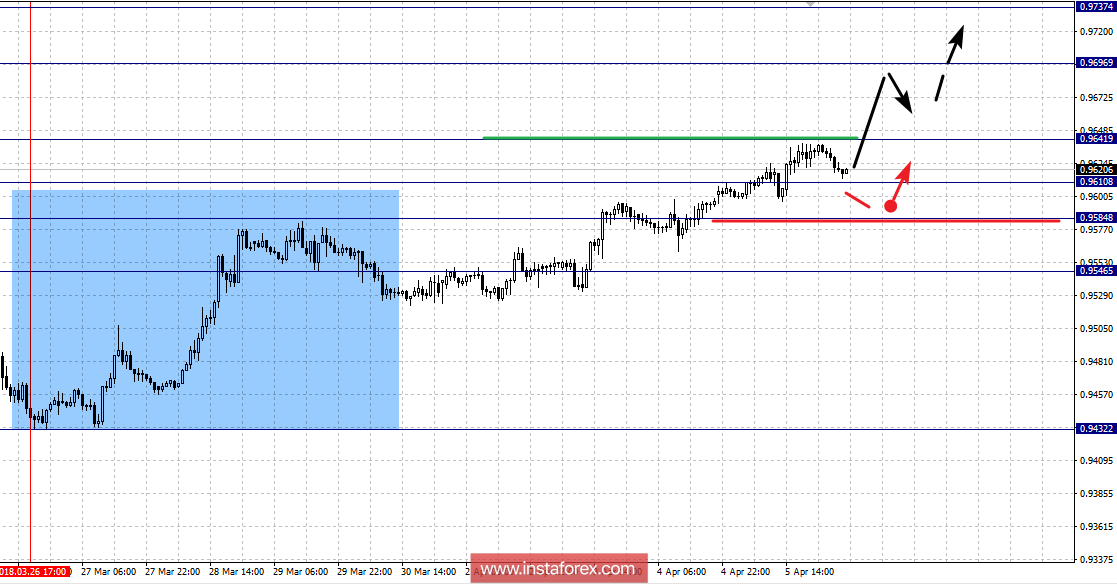

For the USD / CHF pair, the key levels in the scale of H1 are: 0.9737, 0.9696, 0.9641, 0.9610, 0.9584 and 0.9546. Here, we follow the upward cycle of March 26. The continuation of the movement towards the top is expected after the breakdown of 0.9641. In this case, the target is 0.9696. Near this level is the consolidation of the price. For the potential value for the top, we consider the level of 0.9737. Upon reaching this level, we expect a departure towards correction.

Short-term downward movement is possible in the area of 0.9610 - 0.9584. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9546. This level is the key support for the upward structure.

The main trend is the upward cycle of March 26.

Trading recommendations:

Buy: 0.9641 Take profit: 0.9694

Buy: 0.9698 Take profit: 0.9735

Sell: 0.9610 Take profit: 0.9588

Sell: 0.9582 Take profit: 0.9555

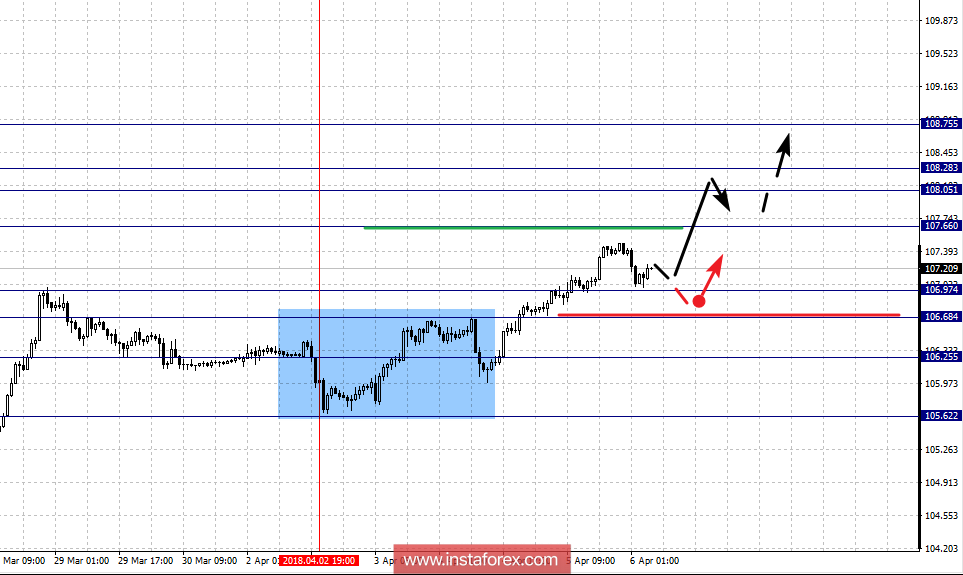

For the USD / JPY pair, the key levels on the scale are: 108.75, 108.28, 108.05, 107.66, 106.97, 106.68, 106.25 and 105.62. Here, we follow the upward cycle from March 23. The subsequent goals were determined from the local structure on April 2. The continuation of the movement towards the top is expected after the breakdown of 107.66. In this case, the target is 108.05. In the area of 108.05 - 108.28 is the consolidation of the price. For the potential value for the top, consider the level of 108.75. From this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 106.97 - 106.68. The breakdown of the last value will lead to in-depth correction. Here, the target is 106.24. This level is the key support for the top.

The main trend is the upward cycle of March 23, the local structure of April 2.

Trading recommendations:

Buy: 107.66 Take profit: 108.05

Buy: 108.30 Take profit: 108.75

Sell: 106.95 Take profit: 106.68

Sell: 106.66 Take profit: 106.27

For the CAD / USD pair, the key H1 scale levels are: 1.2876, 1.2817, 1.2786, 1.2737, 1.2705, 1.2646 and 1.2599. Here, the subsequent goals for the downward movement were determined from the local structure on April 2. Short-term downward movement is possible in the area of 1.2737 - 1.2705. The breakdown of the last value should be accompanied by a pronounced movement towards the level of 1.2646. Upon reaching this level, we expect the consolidation of the price. For the potential value for the bottom, consider the level of 1.2599. Upon reaching this level, we expect a rollback towards correction.

Short-term upward movement is expected in the corridor of 1.2786 - 1.2817. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2876.

The main trend is the local structure for the bottom of April 2.

Trading recommendations:

Buy: 1.2786 Take profit: 1.2815

Buy: 1.2820 Take profit: 1.2872

Sell: 1.2735 Take profit: 1.2707

Sell: 1.2703 Take profit: 1.2650

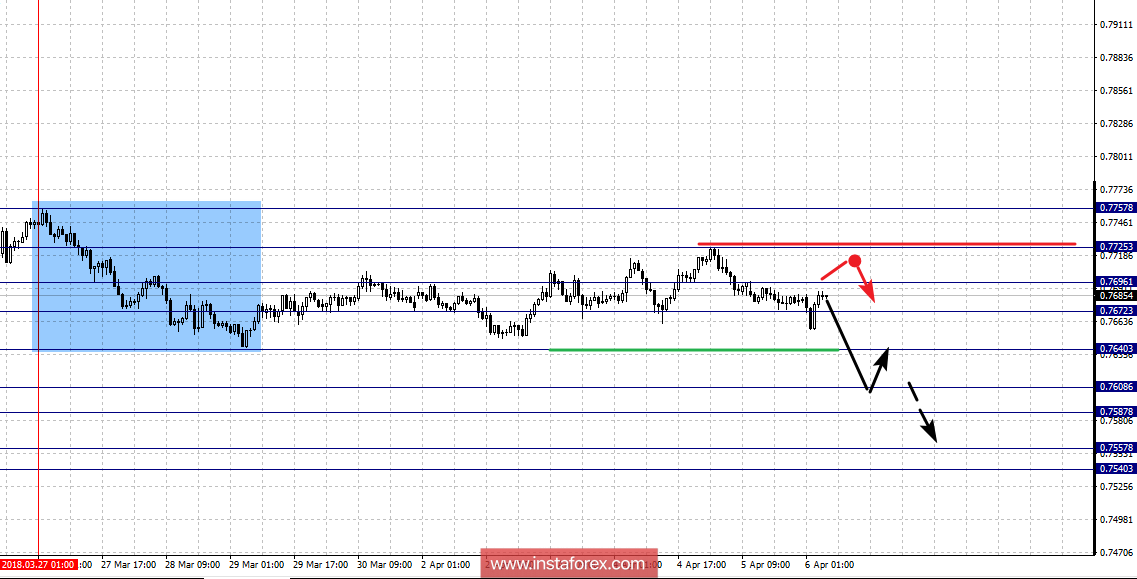

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7725, 0.7696, 0.7672, 0.7640, 0.7608, 0.7587, 0.7557 and 0.7540. Here, we follow the downward structure of March 27. The continuation of the movement towards the bottom is expected after the breakdown of 0.7640. In this case, the target is 0.7608. In the area of 0.7608 - 0.7587 is the consolidation of the price. The breakdown at the level of 0.7585 will allow us to count on the movement towards the potential target of 0.7557. In the area of 0.7557 - 0.7540 is the consolidation of the price.

Short-term uptrend is possible in the area of 0.7672 - 0.7696. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7725. This level is the key support for the downward structure.

The main trend is the local downward structure of March 27.

Trading recommendations:

Buy: 0.7672 Take profit: 0.7694

Buy: 0.7698 Take profit: 0.7725

Sell: 0.7640 Take profit: 0.7608

Sell: 0.7606 Take profit: 0.7588

For the of EUR / JPY pair, the key levels on the scale of H1 are: 133.64, 132.61, 131.73, 130.92, 130.25, 129.57 and 128.87. Here, we continue to follow the formation of the upward structure of March 22. The continuation of the movement towards the top is expected after the breakdown of 131.73. In this case, the target is 132.61. Near this level is the consolidation of the price. Before reaching it, we expect the formation of pronounced initial conditions for the upward cycle. The potential value for the upward structure so far is the level of 133.64.

Short-term downward movement is possible in the area of 130.92 - 130.25. The breakdown of the last value will lead to in-depth correction. Here, the target is 129.57. This level is the key support for the upward structure from March 22.

The main trend is the upward structure of March 22.

Trading recommendations:

Buy: 131.75 Take profit: 132.60

Buy: 132.63 Take profit: 133.62

Sell: 130.90 Take profit: 130.30

Sell: 130.20 Take profit: 129.60

For the GBP / JPY pair, the key levels on the scale of H1 are: 153.01, 152.06, 151.40, 150.47, 149.46, 148.89, 148.27 and 147.56. Here, we determine the subsequent goals from the local upward structure on April 2. The continuation of the movement towards the top is expected after the breakdown of 150.47. In this case, the target is 151.40. In the range of 151.40 - 152.06, we expect short-term upward movement as well as the consolidation of the price. For the potential value for the top, consider the level of 153.00. Upon reaching this level, we expect a rollback towards the bottom.

Short-term downward movement is possible in the area of 149.46 - 148.89. The breakdown of the last value will lead to the development of a downward structure. In this case, the first target is 148.30. Up to this level, we expect the initial conditions for the downward cycle to be formalized. For the potential value for the bottom, consider the level of 147.56.

The main trend is the local structure for the top of April 2.

Trading recommendations:

Buy: 150.50 Take profit: 151.40

Buy: 151.45 Take profit: 152.00

Sell: 149.46 Take profit: 148.92

Sell: 148.87 Take profit: 148.30