The trade war between the US and China continues to gain momentum.

In response to the US measures, China also introduced a series of tariffs on American goods. As it became known, the Chinese authorities announced 25% of duties on important items of US exports. In particular, we are talking about aircraft and cars. Soybeans, chemicals, and beef also fell under duties.

In total, the Ministry of Trade reported that duties cover 106 types of products. The approximate amount that will affect US imports to China is also worth $50 billion. However, it should be noted that whether the plan for the introduction of duties and groups of goods have been worked out, so far no specific entry lines for new fees have been reported from China.

In response to this, US President Donald Trump announced during the Asian session that the US will consider the possibility of imposing import duties on goods for another $ 100 billion, since, in his view, China's response measures are unfair.

As for the fundamental statistics, despite the weak data on the labor market as well as the growth of the US budget deficit, the US dollar remained strong against a number of major currencies.

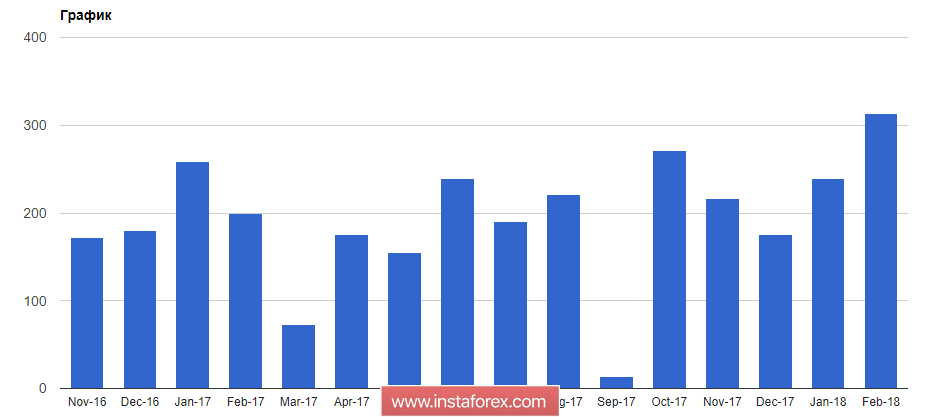

According to a report by the US Department of Labor, the number of initial applications for unemployment benefits for the week from 25 to 31 March increased by 24,000 and amounted to 242,000. Economists had expected the number of applications to be at 225,000.

Today, a report from the Ministry of Labor on the number of employed in the non-agricultural sector is expected, which can support the US dollar if the data are much better than economists' forecasts. Also, there will be published data on the unemployment rate in the US, which is near its historical lows.

As noted above, the US foreign trade deficit increased in February of this year due to a serious decrease in the surplus of foreign trade in services.

According to the report of the US Department of Commerce, the foreign trade deficit grew by 1.6% compared to the previous month and amounted to $57.6 billion. Import and export grew by 1.7% compared to January. Economists had expected a deficit of $57 billion.

As for the technical picture of the pair, the demand for the US dollar is likely to remain until the release of data on the labor market. If the data coincides with the forecasts, profit can be fixed on long positions in the US dollar by the end of the week, which will lead to an upward correction in the EURUSD pair. In this case, it is possible to expect the growth of the trading instrument in the area of 1.2280 and 1.2310. If the pressure on the euro continues, the next levels of support will be the areas of 1.2190 and 1.2150.