The intentions of the US administration to smooth out the conflict between the US and China through the allegations that the trade war as a whole and the new import duties in particular are not inevitable, and the conciliatory tone of the Chinese president allowed the bulls for Brent and WTI to go counterattack. Xi Jinping is ready to liberalize the access of foreigners to the financial markets of the Middle Kingdom and to reduce tariffs for the supply of cars from other countries to its territory. If, after a mutual demonstration of arms, the conflicting parties sit down at the negotiating table, the acceleration factor of global demand will again play on the side of fans of oil. This circumstance makes it possible to count on the speedy recovery of the long-term upward trend.

As investor confidence grows in the successful resolution of the trade dispute between Washington and Beijing, their attention shifts to the situation in the Middle East and the conjuncture of the US oil market. The increase in the number of drilling rigs from Baker Hughes by 11 in the week to April 6 and production at 10.46 million b/d are "bearish" factors for Brent and WTI. Fortunately, Bloomberg experts expect a reduction in reserves of 1.5 million, and the escalation of tension in Syria and Iran increases the risks of reducing supplies from this region.

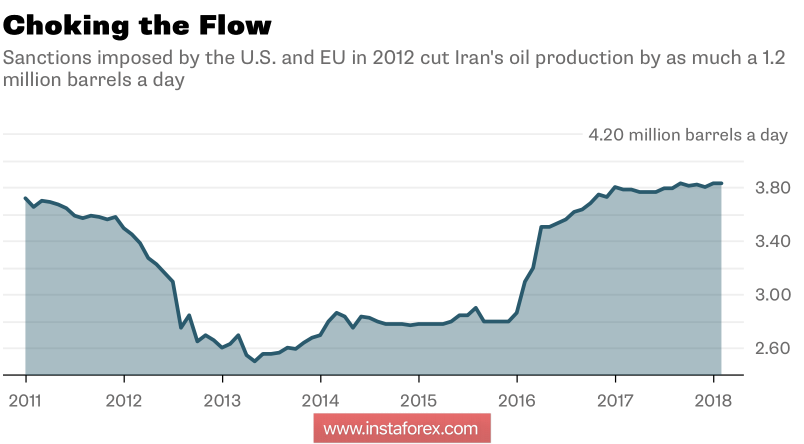

Donald Trump is ready to punish the regime of Bashar al-Assad and his allies, including Russia, for another chemical attack that killed civilians, and changes in the composition of his administration increase the likelihood of renewal of economic sanctions against Tehran, which is allegedly implementing a nuclear program. This is reaffirmed by Citigroup, Societe Generale, Royal Bank of Canada, Mitsubishi UFJ Financial Group. True, most of these banks believe that exports from Iran will decrease by only 350-500 thousand b/d, but the figures are not as much as in 2012. Then it was about 1.2 million b/d. The main reason is the reluctance of the EU to support the actions of the United States.

The dynamics of Iranian oil exports

Thus, the markets somewhat exaggerate the factor of new economic sanctions against Tehran, which makes it three times to think before opening long positions from current levels. Moreover, the speculative net longs for Brent still hover near historical highs. If something goes wrong, the massive locking in of profit by hedge funds can return the "bulls" for oil from heaven to earth. JP Morgan expects to see the average price of the North Sea grade at $69.5 per barrel in 2018, which does not exclude the growth of futures quotes significantly above the psychologically important mark of $70 with their subsequent return to current levels.

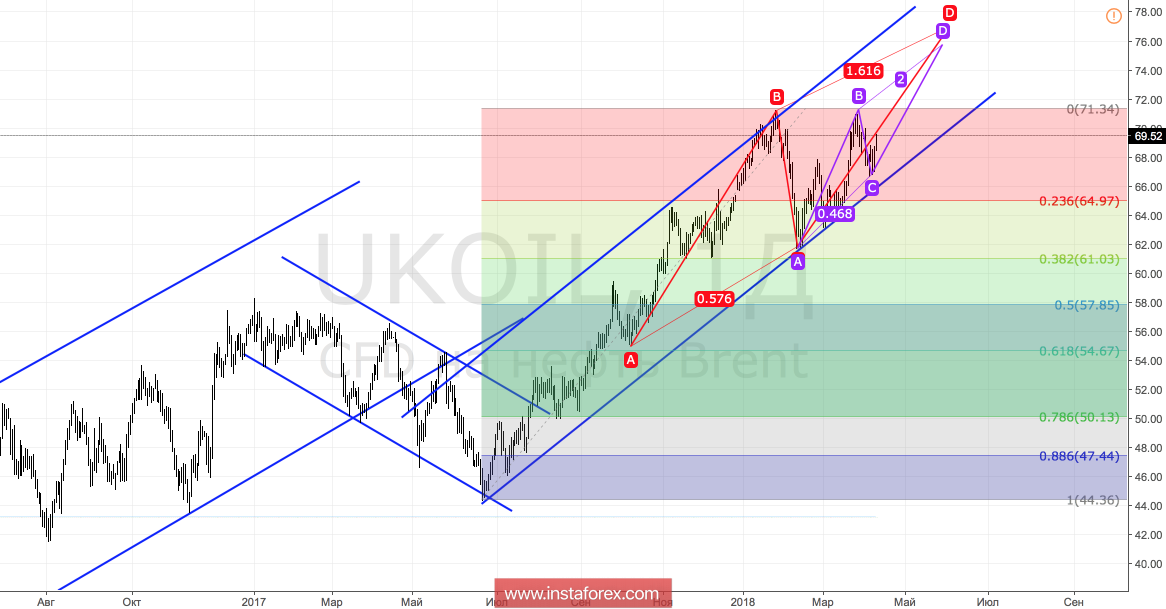

Technically, the inability of the "bears" to take Brent's quotes out of the upward trading channel and storm the support at $ 65 per barrel indicate their weakness. Control over oil is kept by the bulls. At the same time, the update of the March maximum activates AB=CD patterns with targets by 161.8% and 200%. They correspond to the region $ 75.7-77.

Brent, daily chart