The pound, paired with the dollar, is confidently moving towards this year's high to 1.4345. The target pound-dollar pair reached this at the end of January: then the main British macroeconomic indicators showed unexpected growth, thereby increasing the likelihood of rate hikes within this year. However, just a week later there was a collapse of the US stock market, after which the US currency went up all over the market, and the bulls of the gbp/usd had to postpone its offensive. In March, the pound also tried several times to enter the 42nd figure, but the dollar in each case took revenge.

On Friday, the pound was determined. The currency is substantially and practically recoillessly strengthened not only in pairing with the greenback, but also in crosses - paired with the euro, the yen, the franc, the Australian dollar, etc. The relative weakness of the US dollar only strengthens the momentum of the upward movement of the gbp/usd, but it is not its primary cause.

The main argument for the growth of the pound is the market's expectation regarding the tightening of monetary policy by the Bank of England at the May meeting, that is, literally in a month (May 10). At the beginning of the year, the probability of an increase in the rate was rather low: experts linked this issue with Brexit. By the general expectation of the market, the British regulator should return to this issue not earlier than autumn.

However, the Bank of England was frankly surprised by its determination. Mark Carney did not project the process of the country's exit from the EU with the process of normalizing monetary policy, although at that time London and Brussels exchanged rather harsh statements. Therefore, when Britain and the EU agreed on the bulk of the text of the future agreement, the likelihood of an increase in the rate ahead of the planned time in many respects grew. On Thursday, Bank of England spokesman Ian McCafferty actually confirmed the regulator's intention to raise the rate by 25 basis points at the next meeting.

Such "hawkish" rhetoric inspired bulls of the gbp/usd, because, after the failed PMI indices and weak data on the volume of industrial production, the market was ready to prolong the pause in the process of raising the rate, at least until August. Unexpected optimism of the UK regulator provoked a strong pound growth throughout the market.

However, the dollar index continues to be below the mark of 90 (at the moment - 89.7). The continuing tensions in the Middle East and the absence of a "peace deal" with China weighs on the dollar, especially on the last trading day of a chaotic week. According to the American press, next week the trade war with China will continue. According to an insider, the US will expand the list of goods subject to additional customs duties. Now the list might include mobile phones, shoes and clothes.

In addition, the White House plans to significantly limit the amount of investment by PRC private companies in modern American technologies (including licensing of certain types of operations). In turn, China, according to rumors, began to gradually reduce the volume of purchases of US treasury securities. Thus, the US-China trade relations continue to be desired, despite the peace-loving tone of the statements of the leaders of these countries. If next week the White House aggravates the situation, the dollar will again be under pressure all over the market. And even more so when paired with the pound, which received support from both foreign policy and the UK regulator.

The situation in Syria also exerts additional pressure on the US currency. At the moment, political tension on this issue has been somewhat reduced: apparently, the parties involved are negotiating non-public communication channels. What will end this dialogue is unknown, so the dollar will remain under pressure before reaching any intelligible compromise.

Thus, the British currency at the moment dominates in tandem with the dollar, taking advantage of the weakness of the greenback and supporting domestic fundamental factors. The upward trend of the gbp/usd may get its continuation next week, if key macroeconomic indicators show a positive trend. On Tuesday (April 17), we learn about the growth of labor in Britain, and the next day - the index of consumer prices. If unemployment stays at least at the same level, and inflation shows minimal growth compared to the previous period, the pound may update this year's high with a new price framework.

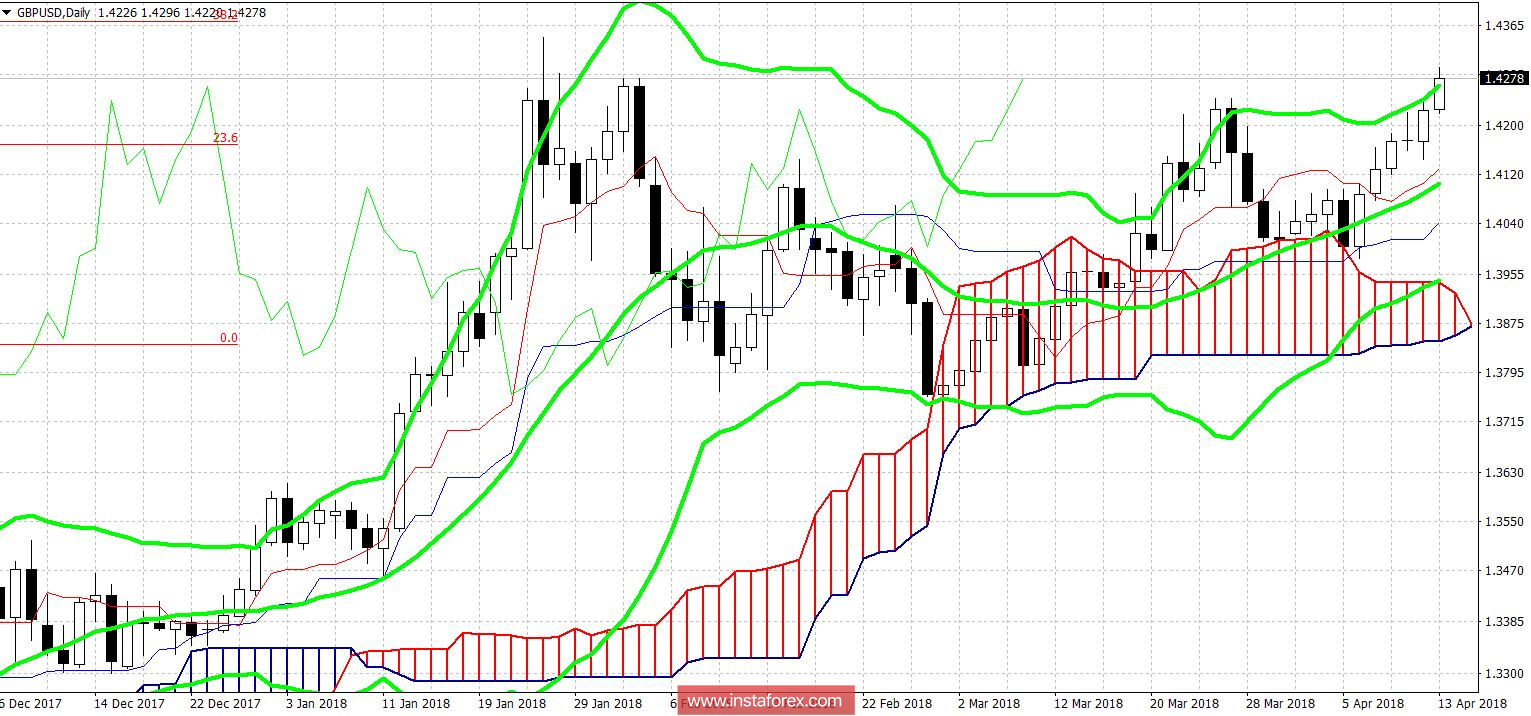

From the technical point of view, the price increase is also forecasted. And on all the "senior" timeframes - D1, W1 and MN.