Dear colleagues.

For the EUR / USD pair, the continuation of the movement to the top is expected after the breakdown of 1.2400. At the moment, the price is in the area of the initial conditions. For GBP / USD pair, the price is in the correction zone. For the USD / CHF pair, we expanded the potential for the upward movement from April 10 to the level of 0.9754. For the USD / JPY pair, the continuation of the movement to the top is expected after the breakdown of 107.66. For the EUR / JPY pair, we follow the formation of the upward structure of March 22. The continuation of the movement to the top is expected after the breakdown of 132.85. For the GBP / JPY pair, the continuation of the movement to the top is expected after the breakdown at the level of 153.75.

The forecast for April 18:

Analytical review of currency pairs in the scale of H1:

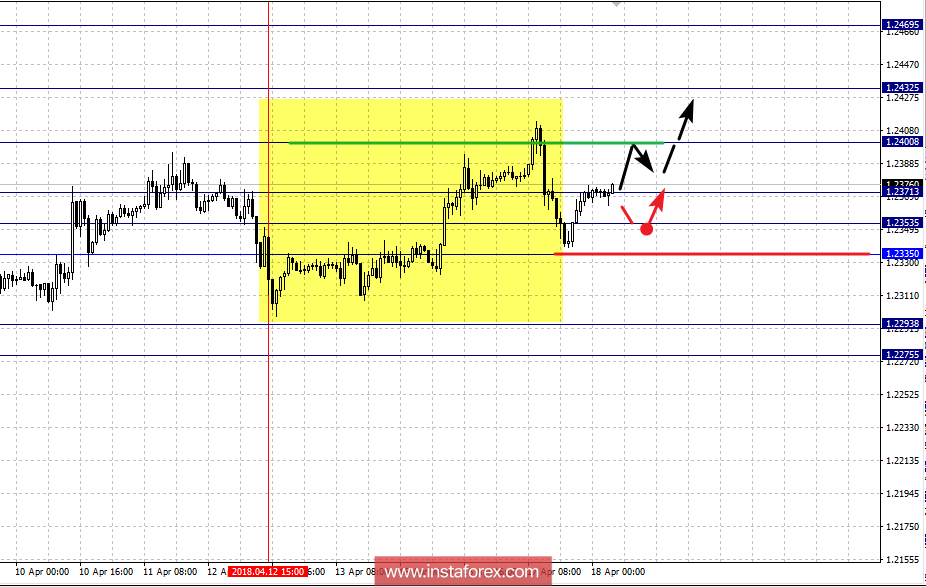

For the of EUR / USD pair, the key levels on the scale of H1 are: 1.2469, 1.2432, 1.2400, 1.2371, a1.2353, 1.2335 and 1.2293. Here, we follow the local upward structure of April 12. The continuation of the movement towards the top is expected after the breakdown of 1.2400. In this case, the target is 1.2432. Near this level is the consolidation of the price. For the potential value for the upward movement, we consider the level of 1.2469. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the area of 1.2371 - 1.2353. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2335. This level is the key support for the top. Passing the price will lead to the development of a downward trend. In this case, the potential target is 1.2293.

The main trend is the local upward structure of April 12.

Trading recommendations:

Buy: 1.2400 Take profit: 1.2430

Buy 1.2434 Take profit: 1.2466

Sell: 1.2370 Take profit: 1.2355

Sell: 1.2350 Take profit: 1.2335

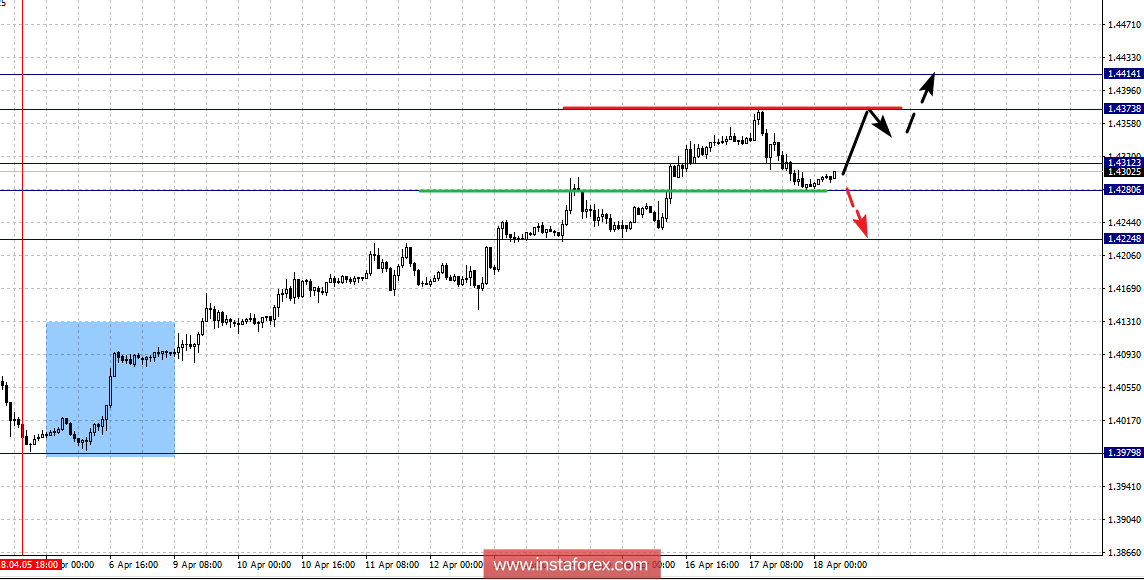

For the GBP / USD pair, the key H1 scale levels are 1.4414, 1.4373, 1.4312, 1.4280 and 1.4224. Here, we continue to follow the upward structure of April 5. At the moment, the price is in correction. The continuation of the movement towards the top is expected after the breakdown of 1.4373. In this case, the potential target is 1.4414. Upon reaching this level, we expect a rollback to correction.

Short-term downward movement is possible in the area of 1.4312 - 1.4280. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.4224. Up to this level, the design of the downward structure is possible.

The main trend is the upward structure of April 5, the correction stage.

Trading recommendations:

Buy: 1.4373 Take profit: 1.4412

Buy: Take profit:

Sell: 1.4312 Take profit: 1.4284

Sell: 1.4278 Take profit: 1.4230

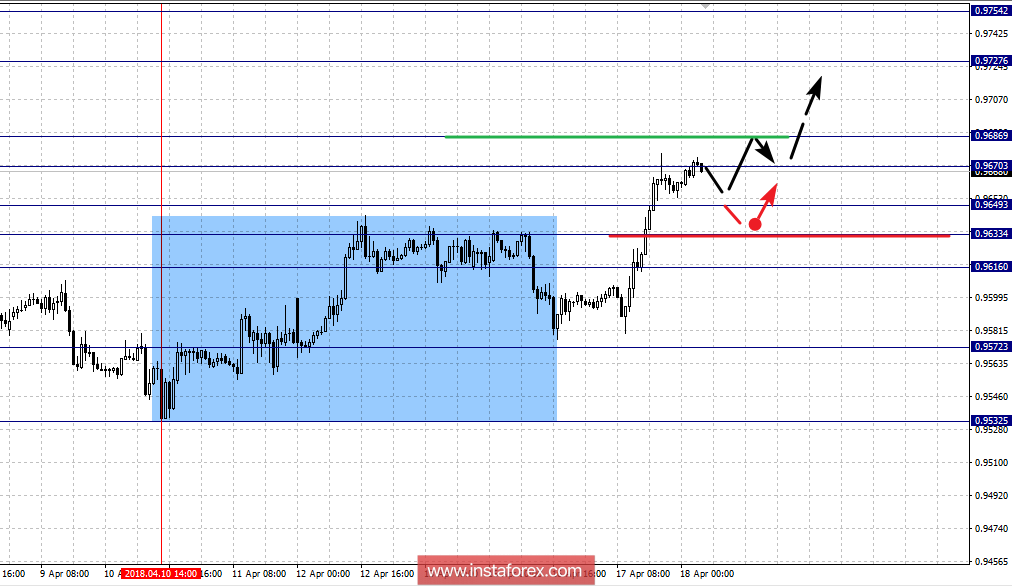

For the of USD / CHF pair, the key levels in the scale of H1 are: 0.9754, 0.9727, 0.9686, 0.9670, 0.9649, 0.9633 and 0.9616. Here, we follow the upward structure of April 10. The continuation of the movement to the top is expected after passing the price of the noise range of 0.9670 - 0.9686. In this case, the target is 0.9727. Near this level the is the consolidation of the price. For the potential value for the top, consider the level of 0.9754. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.9649 - 0.9633. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9616. This level is the key support for the upward structure. Its breakdown will allow us to count on the movement towards the potential target of 0.9572.

The main trend is the upward structure of April 10.

Trading recommendations:

Buy: 0.9688 Take profit: 0.9725

Buy: 0.9730 Take profit: 0.9752

Sell: 0.9647 Take profit: 0.9635

Sell: 0.9630 Take profit: 0.9618

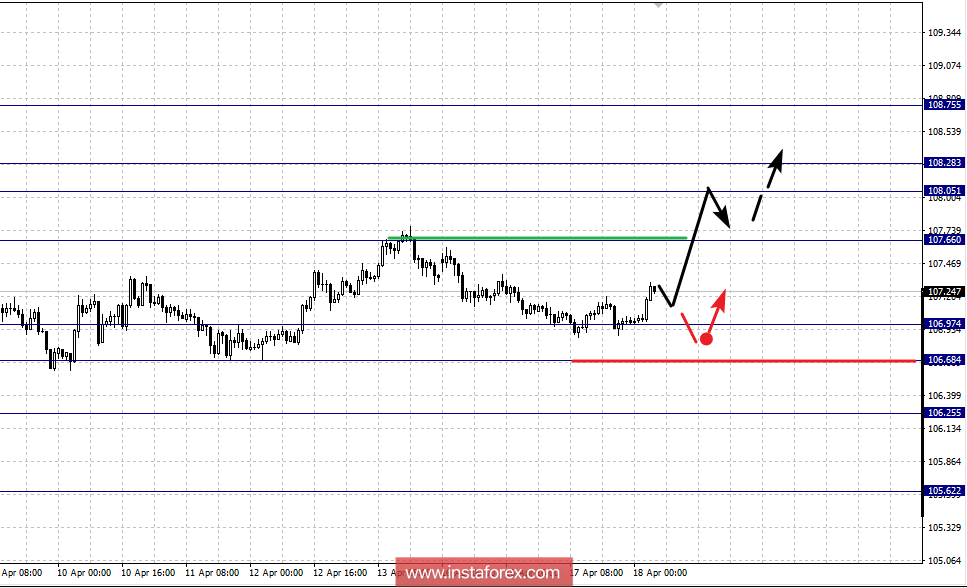

For the USD / JPY pair, the key levels on a scale are: 108.75, 108.28, 108.05, 107.66, 106.97, 106.68, 106.25 and 105.62. Here, we follow the local structure from April 2. The continuation of the movement towards the top is expected after the breakdown of 107.66. In this case, the target is 108.05. In the area of 108.05 - 108.28 is the consolidation of the price. For the potential value for the top, consider the level of 108.75. Upon reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 106.97 - 106.68. The breakdown of the last value will lead to in-depth correction. Here, the target is 106.24. This level is the key support for the top.

The main trend is the upward cycle of March 23, the local structure of April 2.

Trading recommendations:

Buy: 107.66 Take profit: 108.05

Buy: 108.30 Take profit: 108.75

Sell: 106.95 Take profit: 106.68

Sell: 106.66 Take profit: 106.27

For the CAD / USD pair, the key levels on the H1 scale are: 1.2711, 1.2643, 1.2601, 1.2540, 1.2503, 1.2455, 1.2426 and 1.2366. Here, we follow the local top-down structure from April 2. Short-term downward movement is expected in the area of 1.2540 - 1.2503. The breakdown of the last value should be accompanied by a pronounced movement towards the bottom. Here, the target is 1.2455. In the area of 1.2455 - 1.2426 is the consolidation of the price. For the potential value for the bottom, consider the level of 1.2366. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is expected in the area of 1.2601 - 1.2643. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2711. This level is the key support for the downward structure.

The main trend is the local structure for the bottom of April 2.

Trading recommendations:

Buy: 1.2601 Take profit: 1.2640

Buy: 1.2650 Take profit: 1.2710

Sell: 1.2540 Take profit: 1.2506

Sell: 1.2500 Take profit: 1.2455

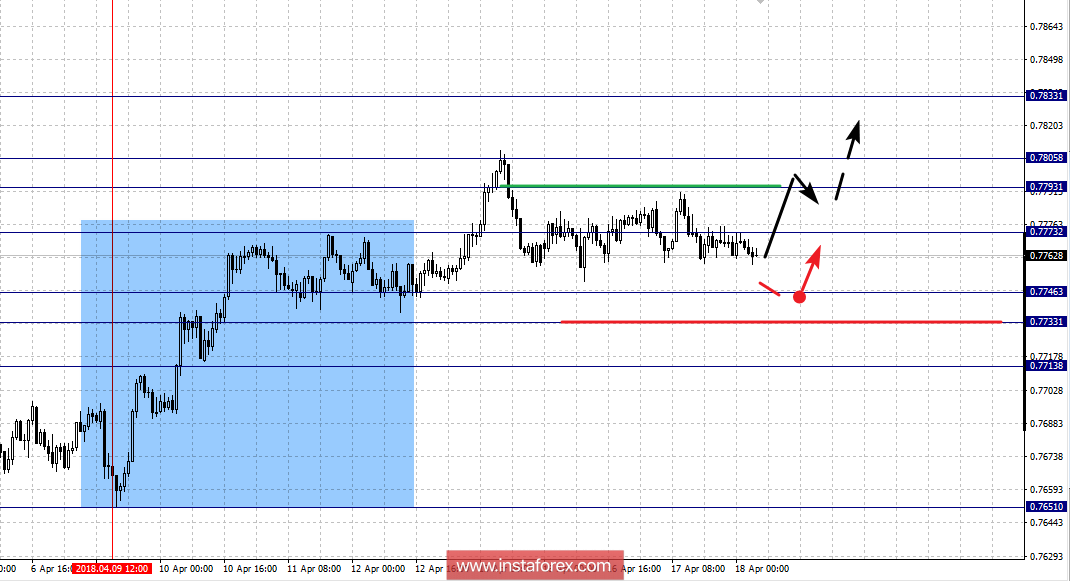

For the AUD / USD pair, the key H1 scale levels are: 0.7833, 0.7805, 0.7793, 0.7773, 0.7746, 0.7733 and 0.7713. Here, we follow the upward structure of 9 April. The continuation of the movement towards the top is expected after the breakdown of 0.7773. In this case, the target is 0.7793. In the area of 0.7793 - 0.7805 is the consolidation of the price. For the potential value for the top, consider the level of 0.7833. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.7746 - 0.7733. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7713. This level is the key support for the top.

The main trend is the upward structure of April 9.

Trading recommendations:

Buy: 0.7775 Take profit: 0.7791

Buy: 0.7807 Take profit: 0.7830

Sell: 0.7744 Take profit: 0.7735

Sell: 0.7730 Take profit: 0.7715

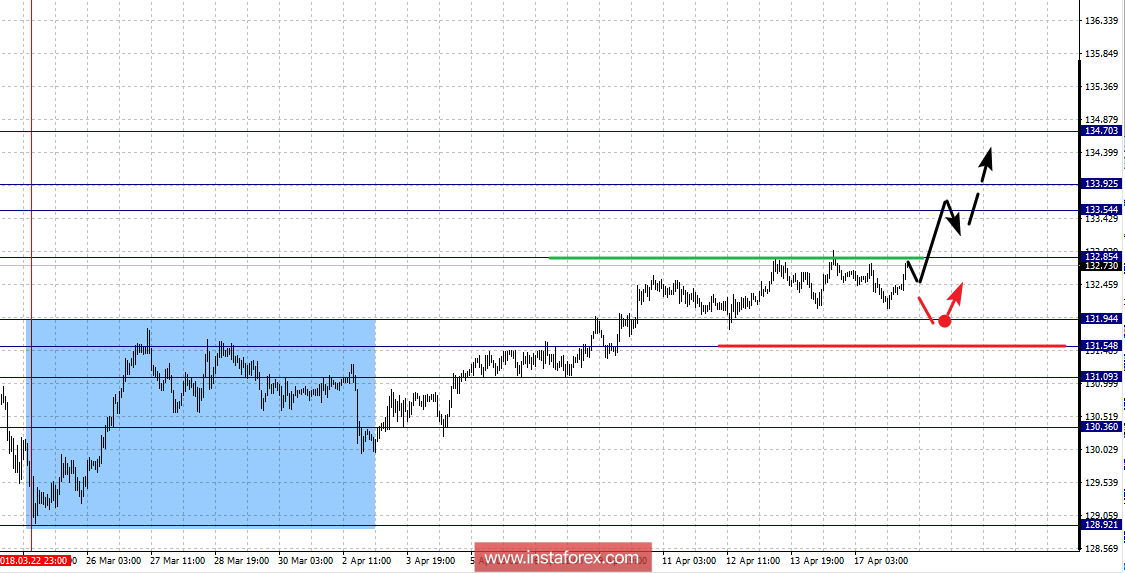

For the of EUR / JPY pair, the key levels on the scale of H1 are: 134.70, 133.92, 133.54, 132.85, 131.94, 131.54, 131.09 and 130.36. Here, we continue to follow the formation of the upward structure of March 22. The continuation of the movement towards the top is expected after the breakdown of 132.85. In this case, the target is 133.54. In the area of 133.54 - 133.92 is the consolidation of the price. The potential value for the upstream structure is 134.70.

Short-term downward movement is possible in the area of 131.94 - 131.54. The breakdown of the last value will lead to in-depth correction. Here, the target is 131.09. This level is the key support for the upward structure of March 22.

The main trend is the upward structure of March 22.

Trading recommendations:

Buy: 132.85 Take profit: 133.52

Buy: 133.95 Take profit: 134.70

Sell: 131.90 Take profit: 131.56

Sell: 131.50 Take profit: 131.10

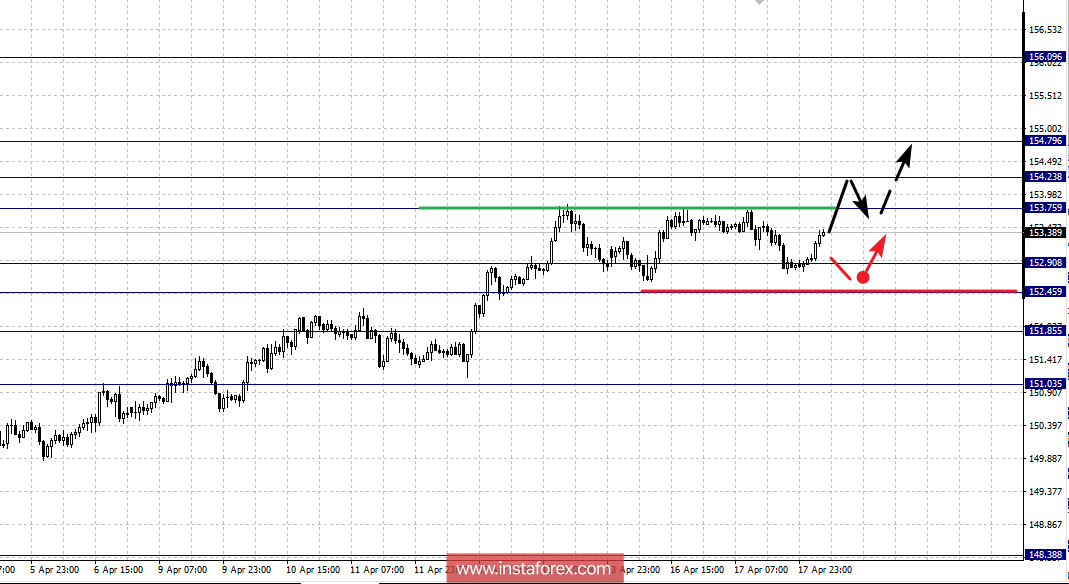

For the GBP / JPY pair, the key levels on the scale of H1 are: 156.09, 154.79, 154.23, 153.75, 152.90, 152.45, 151.85 and 151.03. Here, we continue to follow the upward structure of April 2. The continuation of the traffic to the top is expected after the breakdown of the level of 153.75. In this case, the target is 154.23. The breakdown of this level will allow us to count on the movement towards the level of 154.79. From this level, we expect a rollback into correction. The potential value for the top is the level 156.09. However, we expect the movement towards this goal after the correction is executed.

Short-term downward movement is possible in the area of 152.90 - 152.45. The breakdown of the last value will lead to in-depth movement. Here, the target is 151.85. This level is the key support for the top.

The main trend is the local structure for the top of April 2.

Trading recommendations:

Buy: 153.75 Take profit: 154.20

Buy: 154.26 Take profit: 154.76

Sell: 152.90 Take profit: 152.45

Sell: 152.43 Take profit: 151.87