Dear colleagues.

For the of EUR / USD pair, the continuation of the movement towards the bottom is possible after the breakdown of 1.2159. For the GBP / USD pair, the main continuation of the trend towards the bottom is expected after the breakdown of the level of 1.3845. For the of USD / CHF pair, we expect a correction from the upward trend at any moment. For the USD / JPY pair, there is a high probability of leaving towards correction from the level of 109.48. For the EUR / JPY pair, the continuation to the top is expected after the breakdown of the level of 133.55. For the GBP / JPY pair, the situation is in an equilibrium state between the downward structure of April 16, as well as the formation of the potential for the top of April 20. We expect the development of the latter.

Forecast for April 26:

Analytical review of currency pairs in the scale of H1:

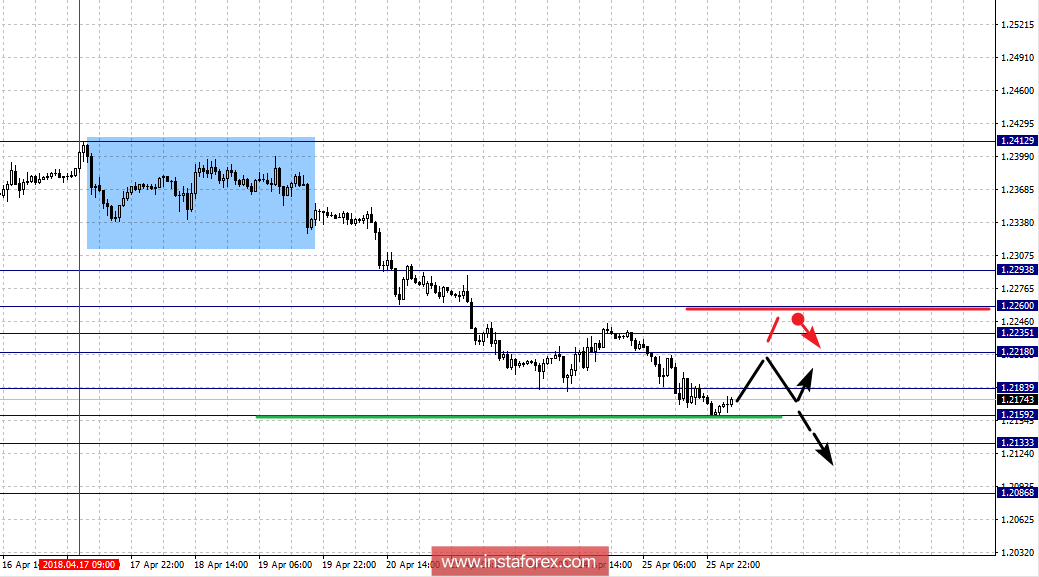

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2293, 1.2260, 1.2235, 1.2218, 1.2183, 1.2159 and 1.2133. Here, we follow the downward structure of April 17. Short-term downward movement is expected in the range of 1.2183 - 1.2159. The breakdown of the last value will allow us to count on the movement towards the potential target of 1.2133. Upon reaching this level, we expect a rollback into correction. For the potential value for the bottom, we consider the level of 1.2086. However, we consider the movement towards this value as unstable.

Short-term upward movement is possible in the area of 1.2218 - 1.2235. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2260. This level is the key support for the downward structure. Its breakdown will lead to the formation of initial conditions for the upward cycle.

The main trend is the downward cycle from April 17.

Trading recommendations:

Buy: 1.2218 Take profit: 1.2233

Buy 1.2236 Take profit: 1.2258

Sell: 1.2157 Take profit: 1.2135

Sell: 1.2130 Take profit: 1.2095

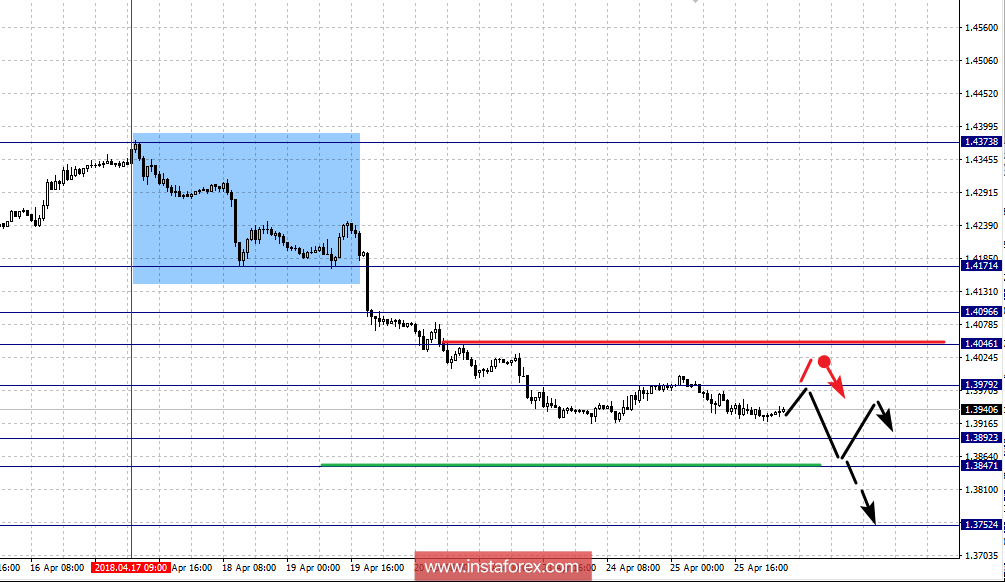

For the GBP / USD pair, the key levels on the scale of H1 are 1.4171, 1.4096, 1.4046, 1.3979, 1.3892, 1.3847 and 1.3752. Here, we follow the downward structure of April 17. Short-term downward movement is expected in the area of 1.3892 - 1.3847. The breakdown of the last value will lead to the movement towards the potential target of 1.3752. Upon reaching this level, we expect a pullback to the top.

The correction is possible after the breakdown at 1.3979. In this case, the target is 1.4046. In the area of 1.4046 - 1.4096 is short-term upward movement. This range is also the key support for the downward structure.

The main trend is the downward structure of April 17.

Trading recommendations:

Buy: 1.3980 Take profit: 1.4042

Buy: 1.4047 Take profit: 1.4094

Sell: 1.3890 Take profit: 1.3848

Sell: 1.3845 Take profit: 1.3752

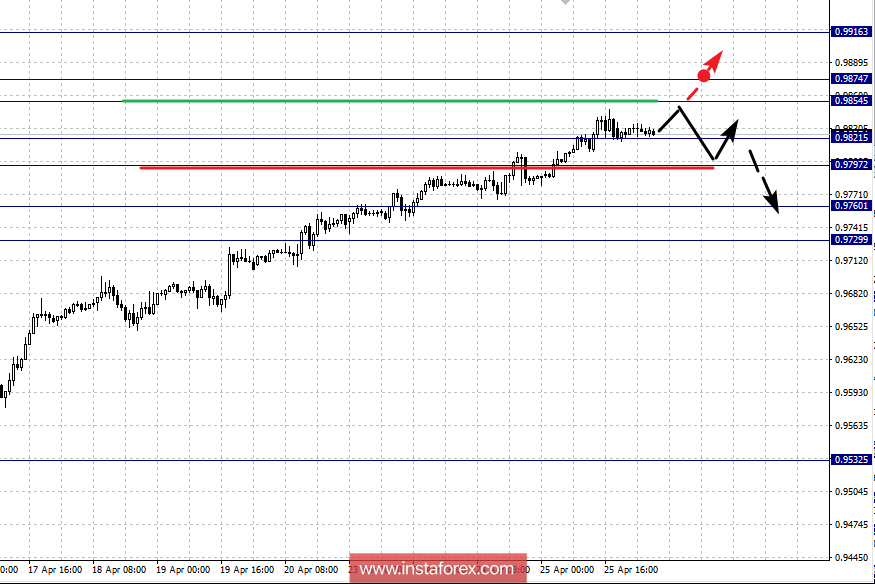

For the USD / CHF pair, the key levels in the scale of H1 are: 0.9916, 0.9874, 0.9854, 0.9821, 0.9797, 0.9760 and 0.9729. Here, we follow the upward structure of April 10. Short-term upward movement is expected in the area of 0.9854 - 0.9874 hence the probability of development of correction towards the bottom is high. For the potential value for the upward trend, we consider the level of 0.9916. However, we consider the movement towards this level as unstable.

Short-term downward movement is possible in the area of 0.9821 - 0.9797. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9760. The area of 0.9760 - 0.9729 range is the key support for the upward structure. Up to the level of 0.9729, we expect the initial conditions for the downward cycle to be formalized.

The main trend is the upward structure of April 10.

Trading recommendations:

Buy: 0.9855 Take profit: 0.9872

Buy: 0.9876 Take profit: 0.9814

Sell: 0.9818 Take profit: 0.9798

Sell: 0.9795 Take profit: 0.9765

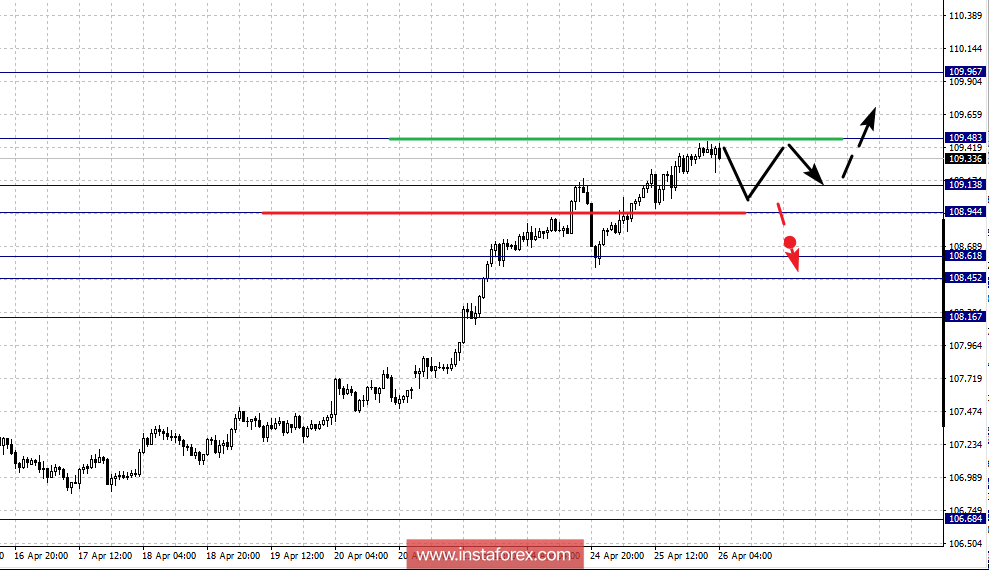

For the USD / JPY pair, the key levels on a scale are: 109.96, 109.48, 109.13, 108.94, 108.61, 108.45 and 108.16. Here, we expect a consolidated movement near the level of 109.48. The potential value for the top is the level of 109.96. However, we regard the movement towards this goal as unstable.

Short-term downward movement is possible in the area of 109.13 - 108.94. The breakdown of the last value will lead to in-depth correction. Here, the target is 108.61. The range of 108.61 - 108.45 is the key support for the top.

The main trend is a local upward cycle from April 11.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 109.13 Take profit: 108.96

Sell: 108.92 Take profit: 108.64

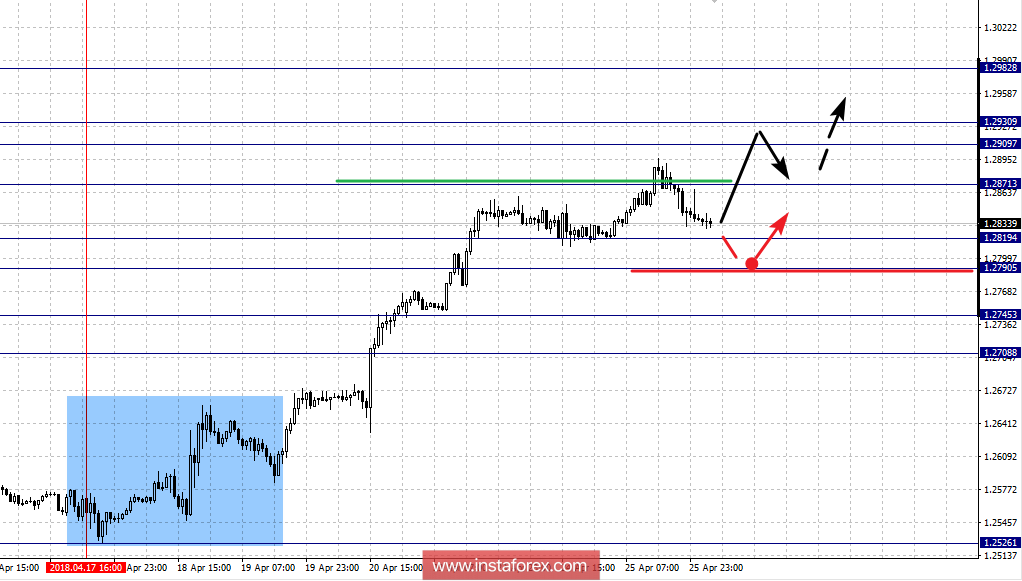

For the CAD / USD pair, the key levels on the H1 scale are: 1.2982, 1.2930, 1.2909, 1.2871, 1.2819, 1.2790, 1.2745 and 1.2708. Here, we follow the upward structure of April 17. The continuation of the movement towards the top is expected after the breakdown of 1.2871. In this case, the target is 1.2909. In the area of 1.2909 - 1.2930 is the consolidation of the price. For the potential value for the top, consider the level of 1.2982. Upon reaching this level, we expect a rollback to the bottom.

Short-term downward movement is possible in the area of 1.2819 - 1.2790. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2745. This level is the key support for the top of April 17. Its breakdown will lead to the formation of the initial conditions for the downward cycle. In this case, the target is 1.2708.

The main trend is the upward structure of April 17.

Trading recommendations:

Buy: 1.2871 Take profit: 1.2907

Buy: 1.2932 Take profit: 1.2980

Sell: 1.2817 Take profit: 1.2792

Sell: 1.2788 Take profit: 1.2747

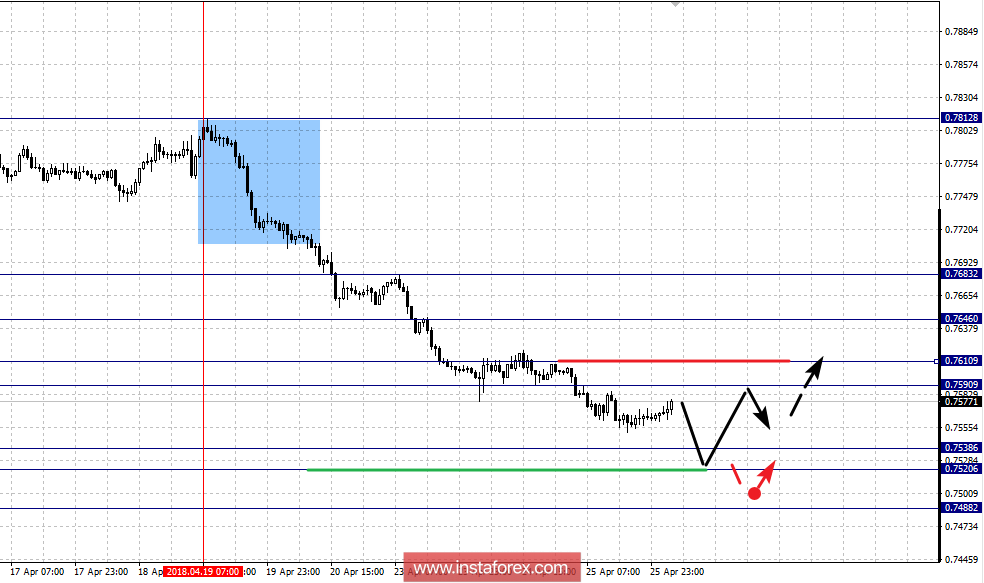

For the of AUD / USD pair, the key levels on the scale of H1 are: 0.7683, 0.7646, 0.7610, 0.7590, 0.7538, 0.7520 and 0.7488. Here, we follow the downward structure of April 19. The continuation of the movement towards the bottom is expected after passing the price of the noise range at 0.7583 - 0.7520. In this case, the target is 0.7488. From this level, we expect a pullback to the top.

Short-term upward movement is possible in the area of 0.7590 - 0.7610. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7646. This level is the key support for the downward cycle. Up to the level of 0.7683, we expect the initial conditions for the upward movement towards be formalized.

The main trend is the downward structure of April 19.

Trading recommendations:

Buy: 0.7590 Take profit: 0.7608

Buy: 0.7612 Take profit: 0.7644

Sell: 0.7520 Take profit: 0.7490

Sell: Take profit:

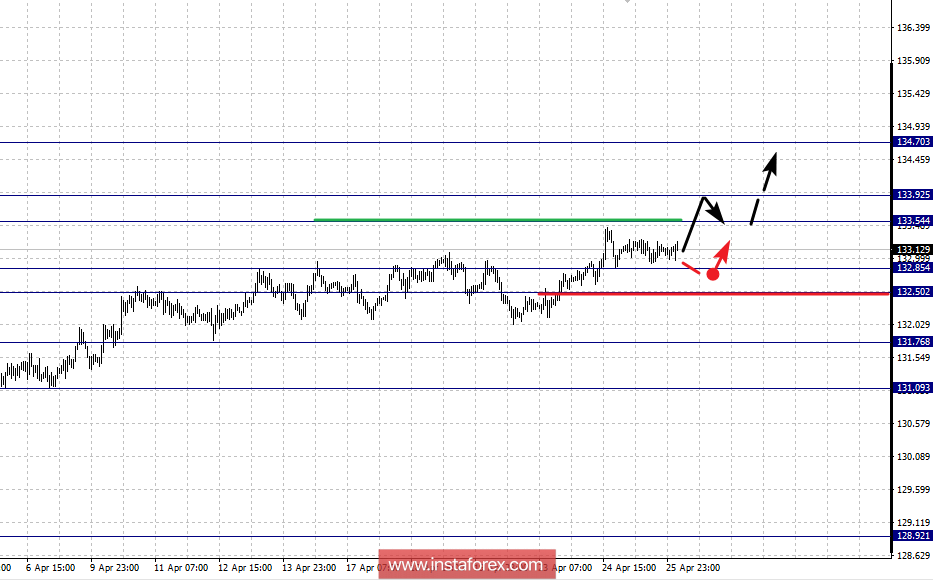

For the of EUR / JPY pair, the key levels on the scale of H1 are: 134.70, 133.92, 133.54, 132.85, 132.50, 131.76 and 131.09. Here, we continue to follow the upward structure of March 22. Short-term upward movement is possible in the area of 133.54 - 133.92. The breakdown of the last value will lead to a movement towards the potential target of 134.70. Near this level, we expect the consolidation of the price.

Short-term downward movement is possible in area of 132.85 - 132.50. The breakdown of the last value will lead to in-depth correction. Here, the target is 131.76. This level is the key support for the upward structure from March 22. Its breakdown will lead to a downward structure. In this case, the potential goal is 131.09.

The main trend is the upward structure of March 22.

Trading recommendations:

Buy: 133.55 Take profit: 133.90

Buy: 133.95 Take profit: 134.70

Sell: 132.85 Take profit: 132.53

Sell: 132.46 Take profit: 131.80

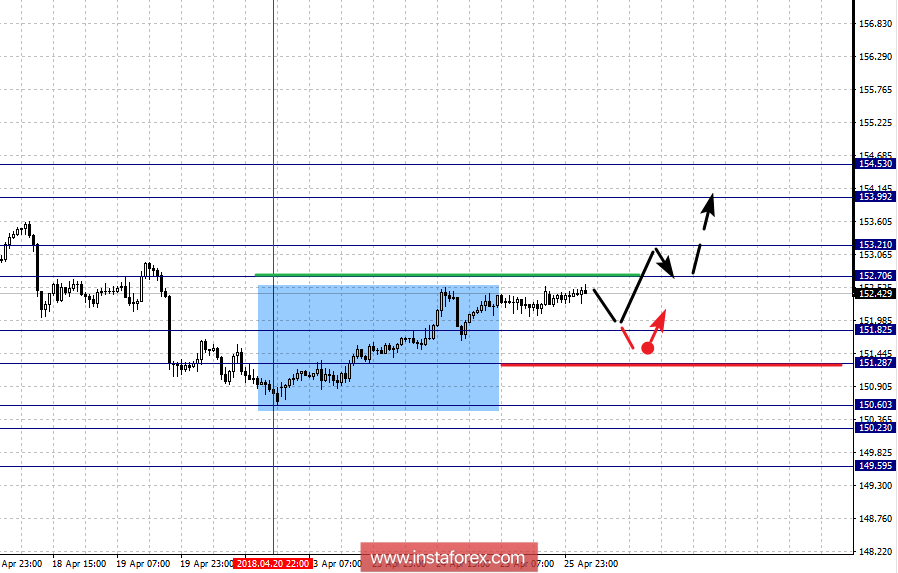

For the GBP / JPY pair, the key levels on the scale of H1 are: 154.53, 153.99, 153.21, 152.70, 151.82, 151.28, 150.60, 150.23 and 149.59. Here, the situation is in an equilibrium state: a downward structure from April 16 and the formation of an upward potential from April 20. Short-term movement towards the top is expected in the area of 152.70 - 153.21. The breakdown of the last value will lead to the movement towards the level of 153.99. For the potential value for the top, consider the level of 154.43. Upon reaching this level, we expect the consolidation of the price.

Short-term downward movement is possible in the area of 151.82 - 151.28. The breakdown of the last value will lead to the development of a downward structure from April 16. In this case, the target is 150.60. In the area of 150.60 - 150.23 is the consolidation of the price. For the potential value for the bottom, consider the level of 149.59.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 152.70 Take profit: 153.20

Buy: 153.25 Take profit: 153.95

Sell: 151.80 Take profit: 151.33

Sell: 151.25 Take profit: 150.65