EUR/USD

After a small on correction Friday to Monday, the euro continued to decline. The first impulse to this was shown in the European session by weak indicators of Germany and Italy. Retail sales in Germany in the March estimate decreased by 0.6% against the forecast of an increase of 0.8%. From a complete failure, the indicator was saved by a revision of the February reading from -0.7% to -0.2%. The consumer price index in Germany in April showed a zero change after growth of 0.4% in March. In Italy, the April CPI added 0.1% against the forecast of 0.2% and the previous indicator would be lowered to 0.3% from 0.4%.

Data from US statistics supported the trend. Personal incomes of consumers in March increased by 0.3% against expectations of 0.4%. Personal expenses increased by an expected 0.4%. The index of business activity in the manufacturing sector of the Chicago region for April showed an increase, but weaker than the forecast: 57.6 against 58.2 - the previous figure was 57.4. Pending sales in the secondary real estate market also increased, but slightly weaker than the forecast: 0.4% vs. 0.6% in the March estimate.

US President Trump postponed the introduction of increased tariffs on steel for the EU until June 1. But no further optimistic prospects are reported, while agreements have already been reached with Argentina, Mexico and Brazil. Against this background, recent visits by Macron and Merkel in the US do not look as bright as it might seem at first glance.

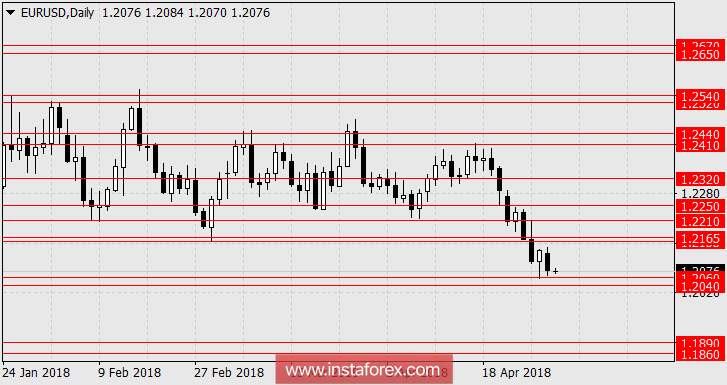

Today, data on the euro area will not (in a number of European countries a public holiday), the US is expected in general neutral data. The index of business activity in the manufacturing sector in the evaluation of Markit in the final evaluation for April is expected to remain unchanged at 56.5 points. The indicator in the ISM Institute's estimate is projected with a decrease of 58.4-58.6 against 59.3 in March. Construction costs for March are expected to grow by 0.5%. And since there is nothing to lift the euro, we are waiting for its decrease with the target of 1.1860/90 in the perspective of several days. The main event of tomorrow will be the FOMC meeting of the Fed, which could raise the idea of increasing the rate at the next meeting on June 13. The market probability of a rate hike in June is 93%.