To open long positions on GBP/USD, it is required:

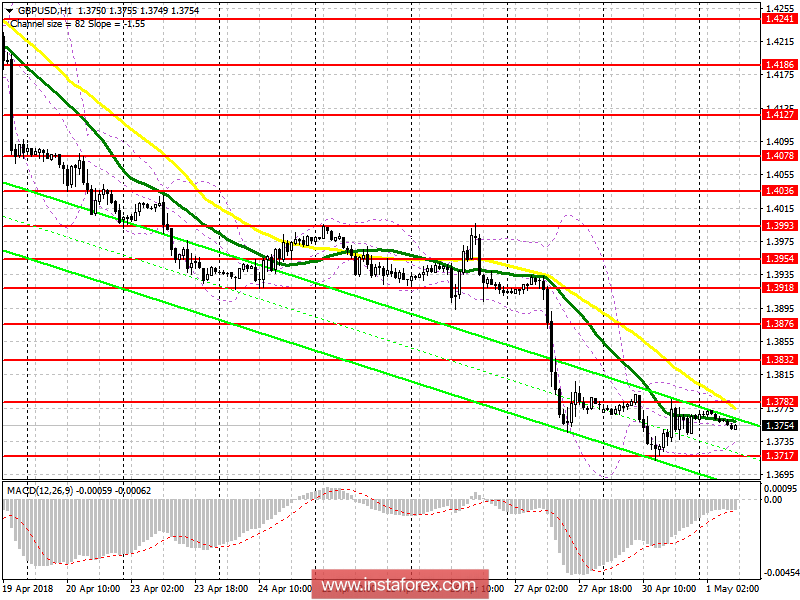

Only the formation of a false breakout at 1.3717 in the first half of the day will be a signal for the opening of long positions on the pound in return for the recovery and consolidation above resistance level of 1.3782, where the demand for GBP/USD may increase significantly, leading to a larger upward correction to 1.3832 area and 1.3876. With the break of 1.3717, it's best to go back to buying after upgrading 1.3648 and 1.3613.

To open short positions on GBP/USD, it is required:

As long as the trade is below 1.3782, the pressure on the pound will be maintained, which will lead to a further decrease in the monthly low of 1.3717, which, after having penetrated, opens the straight road at 1.3648 and 1.3613, where it is recommended fixing profits. In case of growth of 1.3782, selling can be estimated after the renewal of resistances 1.3832 and 1.3876.

Descriptors

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20