EUR / JPY pair

Higher timeframes

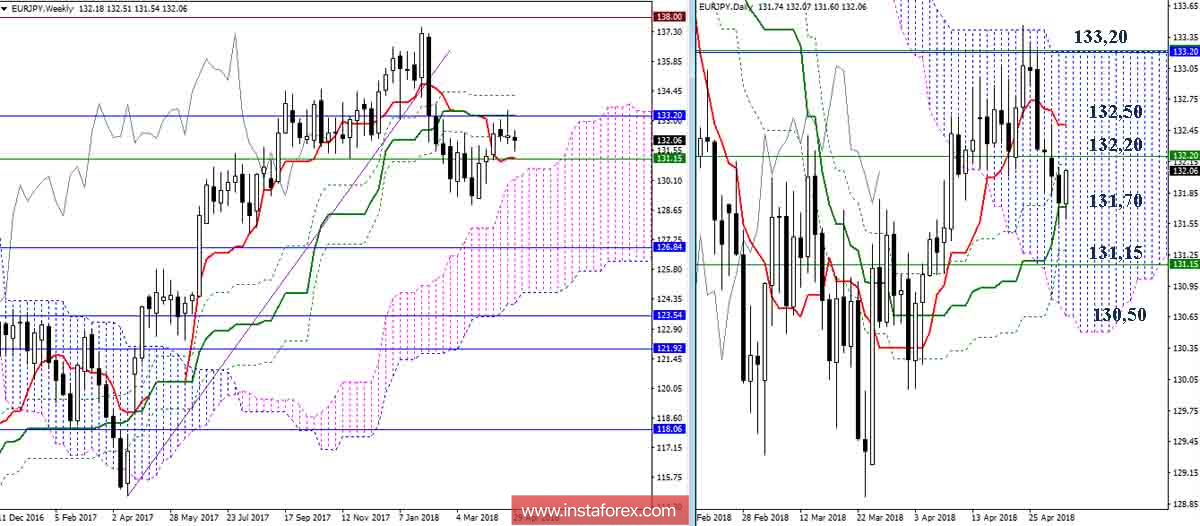

After the breakdown of 132.54, an insignificant retest will lead to a further continuation of the decline. In May, the monthly short-term trend changed its location and currently, the key area is in the area of resistance at 133.20, the daytime Senkou Span B, the weekly Kijun, the monthly Tenkan and the monthly Senkou Span A. Combining their efforts, a bullish zone relative to the clouds (day and month), as well as to eliminate a week-long dead cross which will open new prospects as a result. Support in this situation should be noted at 131.70 (daytime Fibo Kijun) - 131.15 (week Tenkan) - 130.50 (daytime Senkou Span A).

H4 - H1

Despite the upward correction, the main support for the Ichimoku indicator belongs to the bears and the downside target for the breakdown of the H4 cloud (131.07-31) remains effective for them. Today, we should note the resistance level at 132.20 (Fibo Kijun N4 + cloud H1 + high-time level). A breakdown will form an upward target of H1, and at 132,50-70 (cloud H4 + final crosses of the cross H4 + day Tenkan). The fixation above will change the existing balance of forces and note the current H4 goal. Also, this will require a new assessment of the situation.