EUR / USD

The main event of yesterday, of course, was the outcome of a two-day meeting of the FOMC Fed, on the outcome of which a very interesting accompanying statement was made public. First, the traditional phrase about improving the prospects for the economy disappeared from the text. Probably, this was the reason for the initial growth of the euro by 65 points in the first 20 minutes after publication. But the document also said that the level of inflation is "symmetric" to the current goal and approached it. Unemployment remains at a low level, and the Committee will strive for full employment. As a result, the euro closed the day lower by 40 points.

Outwardly, the FOMC theses do not give a hint of a 4-fold increase in the rate this year, and for a meticulous observer, you can find doubts even in a 3-fold increase, but investors did not make hasty conclusions and wait for tomorrow's comments by William Dudley and John Williams. In fact, the data on employment. On Saturday night, R. Kvars, R. Bostik, and R. Kaplan will perform.

Today, inflation indicators for the euro area will emerge in the day. The consumer price index (CPI) for April is expected to be unchanged at 1.3% y / y. The base CPI may drop from 1.0% y / y to 0.9% y / y.

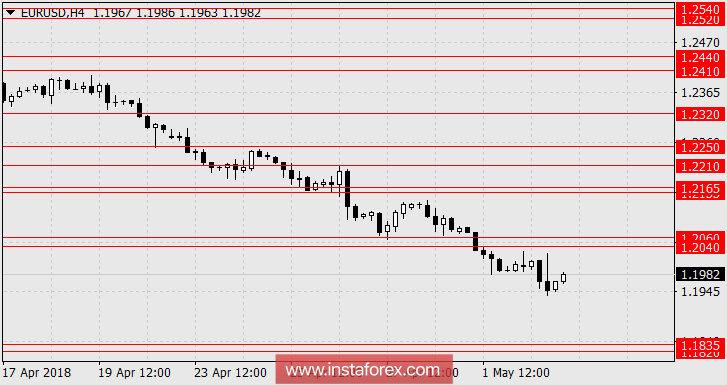

In the US, the number of weekly applications for unemployment benefits is expected at 225 thousand, which will be perceived as a natural correction after a record low 209 thousand last week. Labor productivity outside the agricultural sector in the 1st quarter is projected to increase by 0.9% after 0.0% in the previous period. Labor costs in the 1st quarter are also expected to increase by 3.1% versus 2.5% in the fourth quarter. The US trade balance for March is projected to grow from -57.6 billion to -50.0 billion dollars. The volume of factory orders is expected to increase by 1.3% from 1.2% in February. Weakening is expected ISM Non-Manufacturing PMI, the April forecast for which is 58.1 versus 58.8 in March. Well, on Friday, the unemployment rate is expected to decrease from 4.1% to 4.0%. As a result, we expect the euro to fall, as expected, to the range of 1.1820 / 35.