Weak data on producer prices in the US and the performance of representatives of the Fed did not put much pressure on the US dollar, which will continue its steady growth against risky assets.

According to the report, the producer price index in the US for the month of April this year grew by only 0.1% after rising by 0.3% in March. Economists expected inflation to grow by 0.2%.

Compared to the same period in 2017, producer prices rose only 2.6%, also showing a slowdown. Economists had expected growth of 2.8%.

The speech of the President of the Federal Reserve Bank of Atlanta, Raphael Bostic, was rather optimistic.

Bostic said that a gradual increase in rates would lead to an increase in inflation above the target level and the economy is close or has already reached full employment.

He also noted that the Fed will continue to closely monitor the signs of rising price pressure, as inflation is close to achieving the target level.

According to the representative of the Fed, the main risk for the US economy is associated with uncertain prospects for trade.

The buyers of the euro managed to hold within the minimum of the month in yesterday's session, which indicates an upcoming upward correction. However, for this it is necessary to break above the resistance level of 1.1890, where the areas of 1.1930 and 1.1970 open.

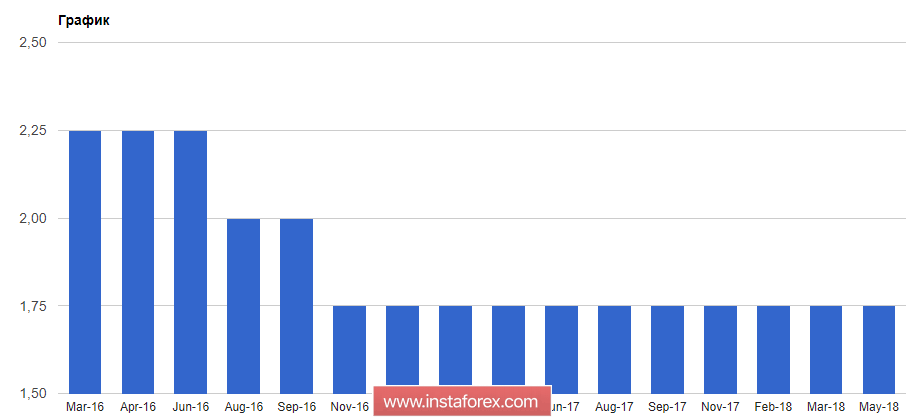

The New Zealand dollar collapsed against the US dollar after the Reserve Bank of New Zealand left the official interest rate unchanged at 1.75%, saying that monetary policy will remain stimulating for a long time.

According to the RBNZ, the growth of the world economy will support the demand for New Zealand exports, and government and consumer spending will support GDP growth. Economists predict annual inflation of 2% in the fourth quarter of 2020, while the current level was previously expected in the third quarter. The official interest rate is also expected at 2% in the first quarter of 2020.

Data on the Chinese economy have passed without a trace for commodity currencies. According to the report, China's consumer price index rose by 1.8% in April compared to the same period last year. It is important to note that in March, the growth was 2.1%.

As noted in the report, the main pressure on the index was created by falling prices for pork. Compared with April 2017, it decreased by 16.1%. Prices for non-food products rose by 2.1%. Economists predicted that in April, consumer prices will rise by 1.9%.