The US dollar slightly lost ground by the end of the week, but the general trend towards its strengthening remains.

Consumer price growth in the US seems to be stabilizing. Following the first 10 months of decline in inflation in March by 0.1%, experts expected an increase of 0.3%, as a result of price growth, in April it was 0.2%, year-on-year 2.5%, slightly more than a month earlier.

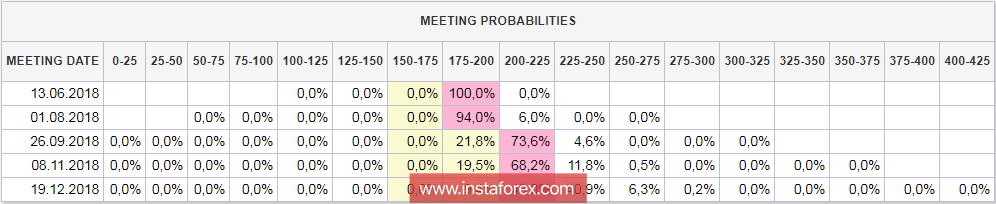

At the same time, the core inflation's value has not changed, in April it was at 2.1%, as in March, namely, this figure is oriented by the fed in the development of monetary policy. There were concerns that the average wage growth rate, lower than expected, might have a negative impact on price growth, but in practice there has not been a slowdown. Consequently, there is no threat to the fed's plans for interest rate hikes, CME futures predict 100% confidence in a quarter-percent rate hike in a month, and almost 75% for another increase in September.

With regard to the fourth hike in December, market opinions differ, but this is just a continuation of a situation of uncertainty, which did not prevent the dollar from strengthening in recent weeks. It is essential that the markets do not yet see the threat of a crisis that could be triggered by an increase in yields and problems in the debt market. Whether this problem is far-fetched, or whether the markets proceed from the fact that there is still a sufficient margin of safety – in any case, the dollar is currently standing firmly on its feet and is not going to fall.

Friday's CFTC report confirmed the conclusion that the dollar in the coming week will strengthen its position as a favorite of the foreign exchange market – speculative demand against the franc, the yen, the pound and the Australian dollar rose quite significantly. It seems that the markets proceed from the assumption that trump's aggressive trade policy combined with the fed's actions will bring results in the form of a greater demand for the dollar in the short term.

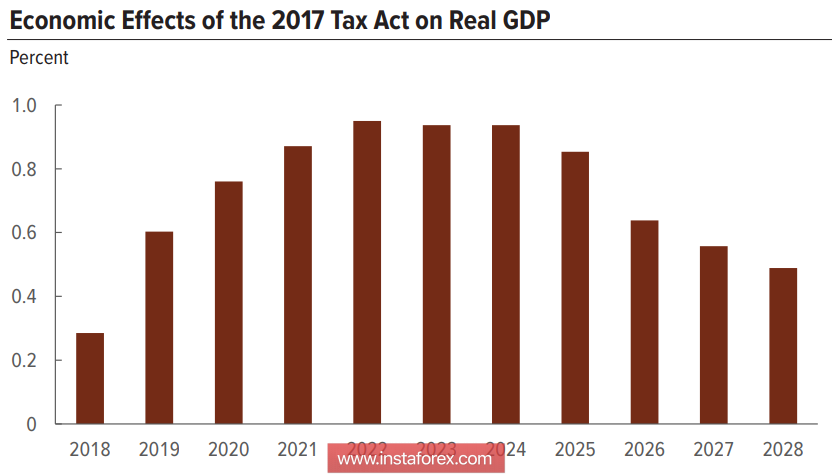

Meanwhile, a report by the U.S. Treasury on the state of the budget in April gave a surprising result – it recorded the largest monthly revenues surpassing $500 billion, which allowed it to report a surplus of 214 billion, and this result against the background of a record deficit a month earlier appears like a clear proof of the effectiveness of the tax reform.

A few days earlier there were no signs of such a result. The Budget Committee of the Congress, assessing the state of the budget for the first 7 months of 2018 fiscal year, recorded a deficit of 382 billion, which is 37 billion higher than the previous year.

Despite the fact that income growth exceeded last year's figure by 4%, the overall picture looked worse due to an increase in spending by 5%, and the increase in the surplus in April is explained more tediously– this is the most active month of the year in terms of tax contributions, and therefore any seasonal decrease in spending can lead to an increase in the surplus.

On Tuesday, the US Census Bureau will publish a report on retail sales in April, expectations are moderately positive, experts do not expect a failure, focusing on a consistently high level of consumer demand. Also on Tuesday, the Treasury will publish a report on the inflow of foreign capital to March inclusive, this report becomes quite important against the background of lower purchases of Treasuries by the Fed and the need to persuade US trading partners to continue funding the government. In fact, all the activity of trump in recent months aimed at changing the trading conditions with the main creditors is aimed at solving this problem – to achieve filling the budget either through the purchase of debt securities by foreign buyers, or at the expense of a more favorable tariff policy.

In the coming week, the dollar looks stronger than safe haven assets, such as the yen and gold, against the commodity currencies the dynamics will be mixed, given the rapidly growing cost of oil due to the Iranian factor.