Profit-taking on long positions in the US dollar allowed the "bulls" to go to a counterattack on the GBP/USD. The May meeting of the Bank of England did not bring serious dividends to the British pound, which its fans already expected. Despite the BoE's desire to raise its REPO rate to 1.25% by 2020, the confusion with the GDP allowed the derivatives market to reduce the probability of a tightening in November from almost 100% to 85%. Investors considered that the door, opened for the continuation of the normalization cycle, is not a good reason for active purchases of the pair from the current levels.

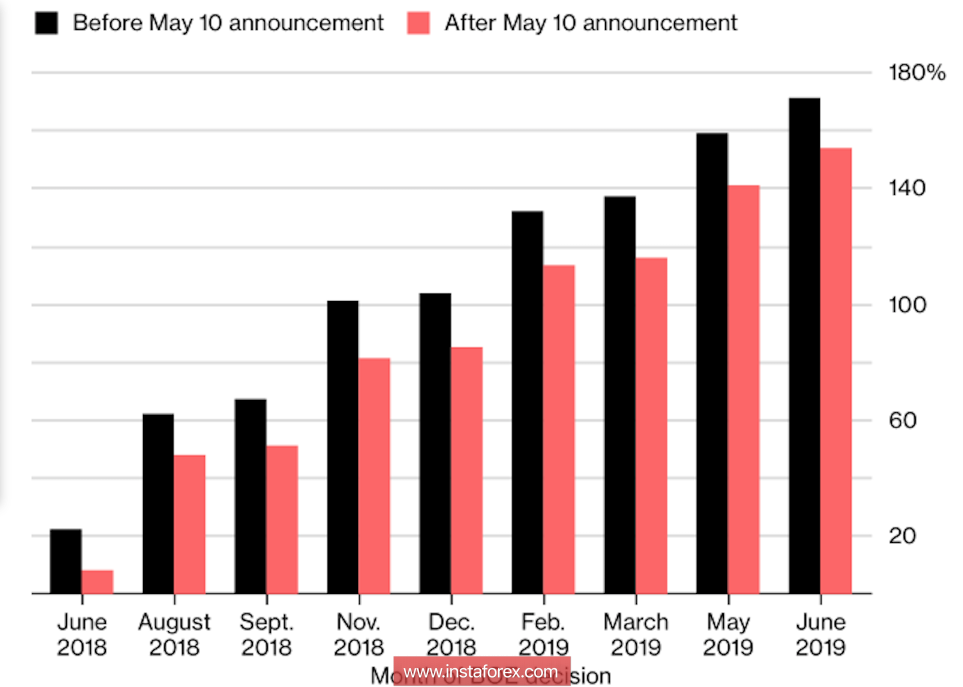

The dynamics of the probability of a rate hike in the REPO

According to the Bank of England, the economic growth of 0.1% QoQ in January-March is close to the regulator's February estimate (+0.4%), because the first estimates of areas with heavy snowfall in the future tended to be revised upwards. It expects the final figure to be +0.3%. This optimism contrasts with the decline in the GDP growth forecast for 2018 from 1.8% to 1.4% (estimates for 2019-2020 remained at the same level of +1.7%). The mess with the worldview of BoE contributes to the growth of volatility and selling of the pound. In the market, it is increasingly possible to hear conversations that the current monetary policy faced failure. Against the background of the strongest in the last 43 years of the labor market inflation above target and 9 years of economic expansion, the Bank of England is pulling rubber with an increase in the REPO rate!

However, in my opinion, the passivity of the MPC can be explained by the disappointing macroeconomic statistics that has been regularly received in recent weeks. BoE is trying to figure out whether it's about time effects or if more serious structural factors have come into play. In this regard, the release of data on the labor market of the UK scheduled for May 15 may provide another clue. According to forecasts of Bloomberg experts, unemployment will remain at 4.2%, and the average wage will slow from 2.8% to 2.7% y/y. The higher the last indicator, the wider its differential will be with inflation. In this scenario, real earnings will grow, helping to increase consumer demand and restore the previous GDP growth rates for the rest of the year.

However, in any pair there are always two currencies, so the success or failure of the "bulls" on the pound should be seen in the context of changes in investor sentiment towards the US dollar. And here, the ability of Treasury yields to break above the psychologically important mark of 3% is important. It turns out the demand for assets issued in the United States will increase, which will increase the risks of continuing the peak of GBP/USD. The signal may be the release of retail sales data in the United States. The better the statistics, the greater the confidence in the bright future of the American economy.

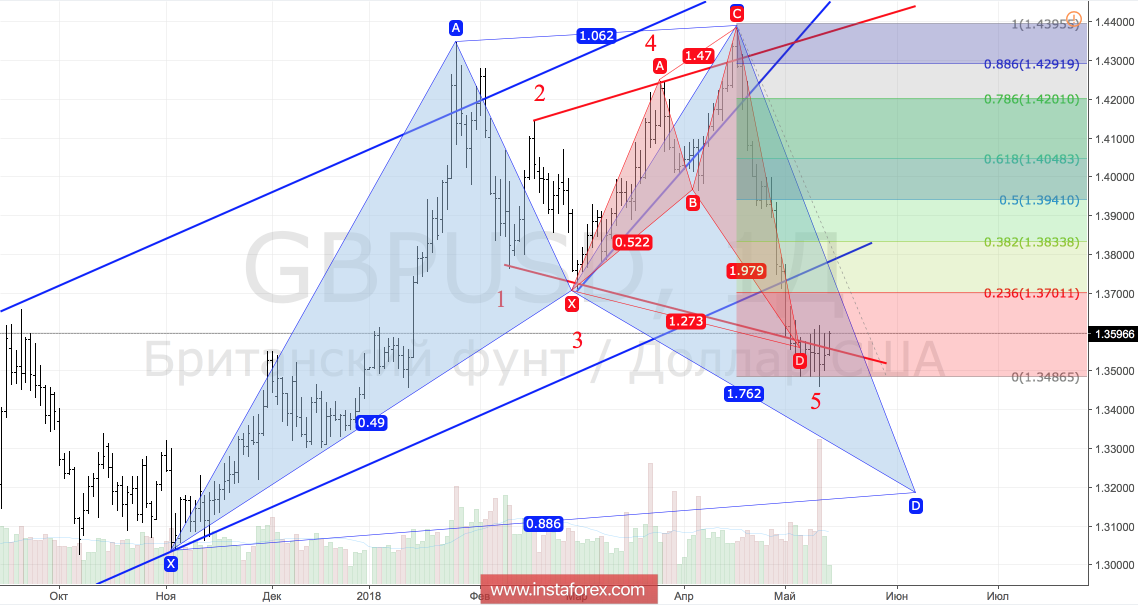

Technically, the breakthrough of the upper limit of the short-term consolidation range 1.346-1.362 will open the way for the bulls to adjust in the direction of 23.6%, 38.2% and 50% of the wave of the "Shark" CD pattern within its 5-0 transformation.

GBP/USD, daily chart