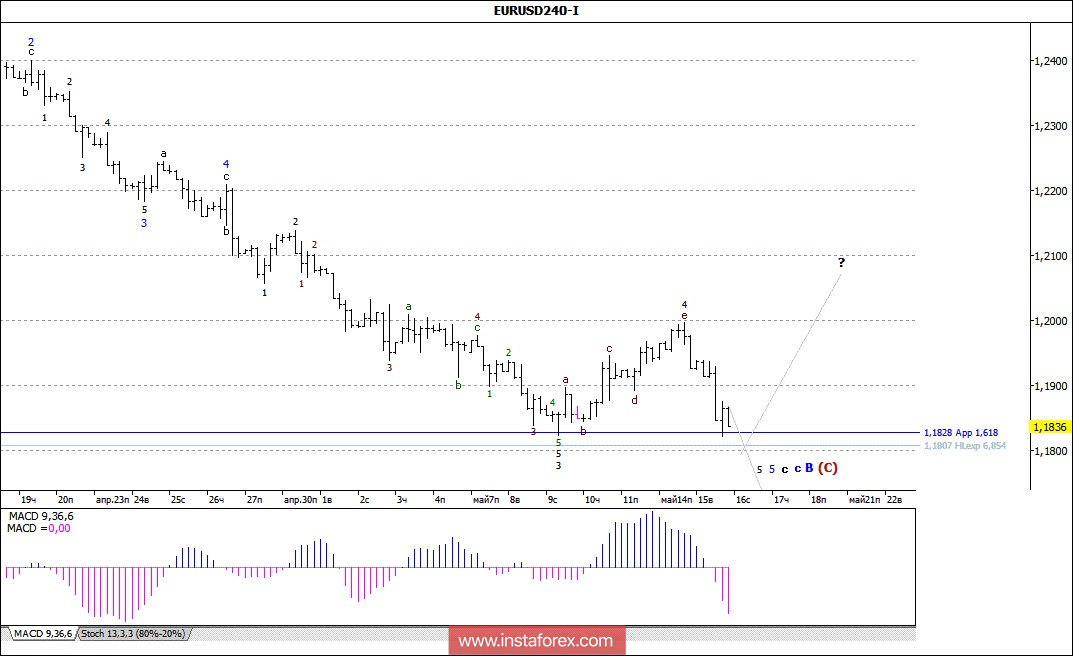

Analysis of wave counting:

Yesterday's EUR / USD pair trades began with a downward movement, breaking through the minimum reached on May 9 and was able to work out the mark of 1.1820. The wave pattern that formed at the end of yesterday's American session looked like a more complex form of the five-wave structure of the wave c, c, B, (C). If this is the case, the currency pair may complete a strongly prolonged decline, or after testing the level of the 18th figure, or after the quotes fall down to the level of 1.1650.

The objectives for the option with sales:

1.1807 - 685.4% of Fibonacci

1.1700

The objectives for the option with purchases:

1.2000 - 1.2200

General conclusions and trading recommendations:

The assumed wave c, B, (C) resumed its construction, but still approaches its completion. So, now I recommend buying a pair as part of working off a wave d, B, (C) with targets located about 20 and 21 figures. I recommend selling the pair after a successful attempt to break through the calculated level of 1,1807, which corresponds to 685.4% of Fibonacci, since this will mean an even more complicated wave c, B, (C), with targets that are about 17 figures.