The European currency continued to decline against the US dollar after the release of weak statistics indicating a slow rise in inflation in the Eurozone in April of this year. The inflationary growth rate of Germany, the largest economy in the EU, also leaves much to be desired.

According to the report of the Federal Bureau of Statistics, annual inflation in Germany in April this year compared to April 2017 remained at 1.6%, as in March. The data coincided with the forecasts of economists. On a monthly basis, compared with March, inflation in Germany did not show any change, remaining at 0.0%.

As for the core inflation, which does not take into account energy and food prices, it fell to 1.4% from 1.5% in March. It should be noted that all indicators are much lower than the target level set by the European Central Bank, which creates certain problems for the regulator in the way of raising interest rates.

The consumer price index in Italy in April increased by 0.1% compared to March, which fully coincided with the forecasts of economists.

In general, according to the Statistics Agency's report, the annual inflation in the Eurozone increased by 1.2% in April this year compared to April 2017, which also fully coincided with the forecast. Core inflation showed an increase of only 0.7%.

It is this disappointing report, along with the "hot" talk associated with another increase in interest rates in the US, and led to the growth of the US dollar against the European currency.

Trading continues to develop according to the bearish scenario, which I discussed in more detail in my morning review. A breakthrough of support around 1.1820 led to a further sell-off in risky assets with the test levels at 1.1770 and 1.1740. However, the bears clearly aimed for fresh lows in the area of 1.1700.

Already in the second half of the day, weak data on the United States led to some profit taking in the US dollar.

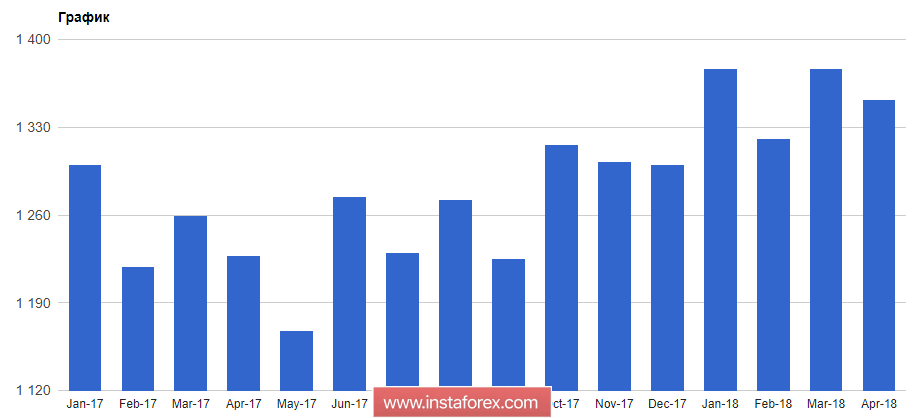

According to a report from the U.S. Department of Commerce, the number of new home mortgages in the U.S. fell sharply in April of this year, which is directly related to the weak construction of apartment buildings.

Thus, the number of new home mortgages in April fell by 3.7% compared to the previous month and amounted to 1.287 million homes per year. The number of building permits decreased by 1.8% compared to the previous month and amounted to 1.352 million homes per year. Economists had expected the number of bookmarks to fall by 1.4% and the number of permits to fall by only 0.3%.