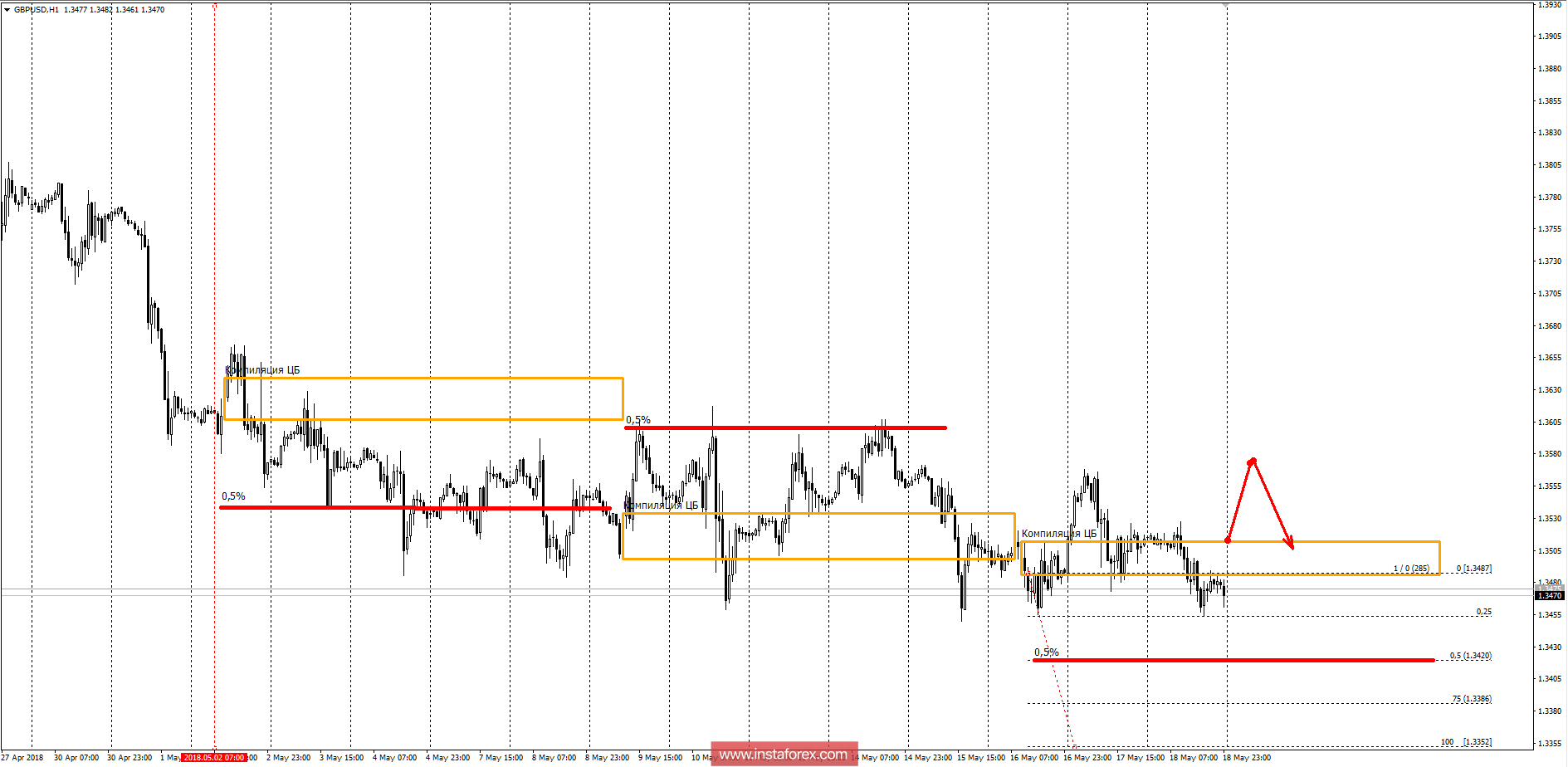

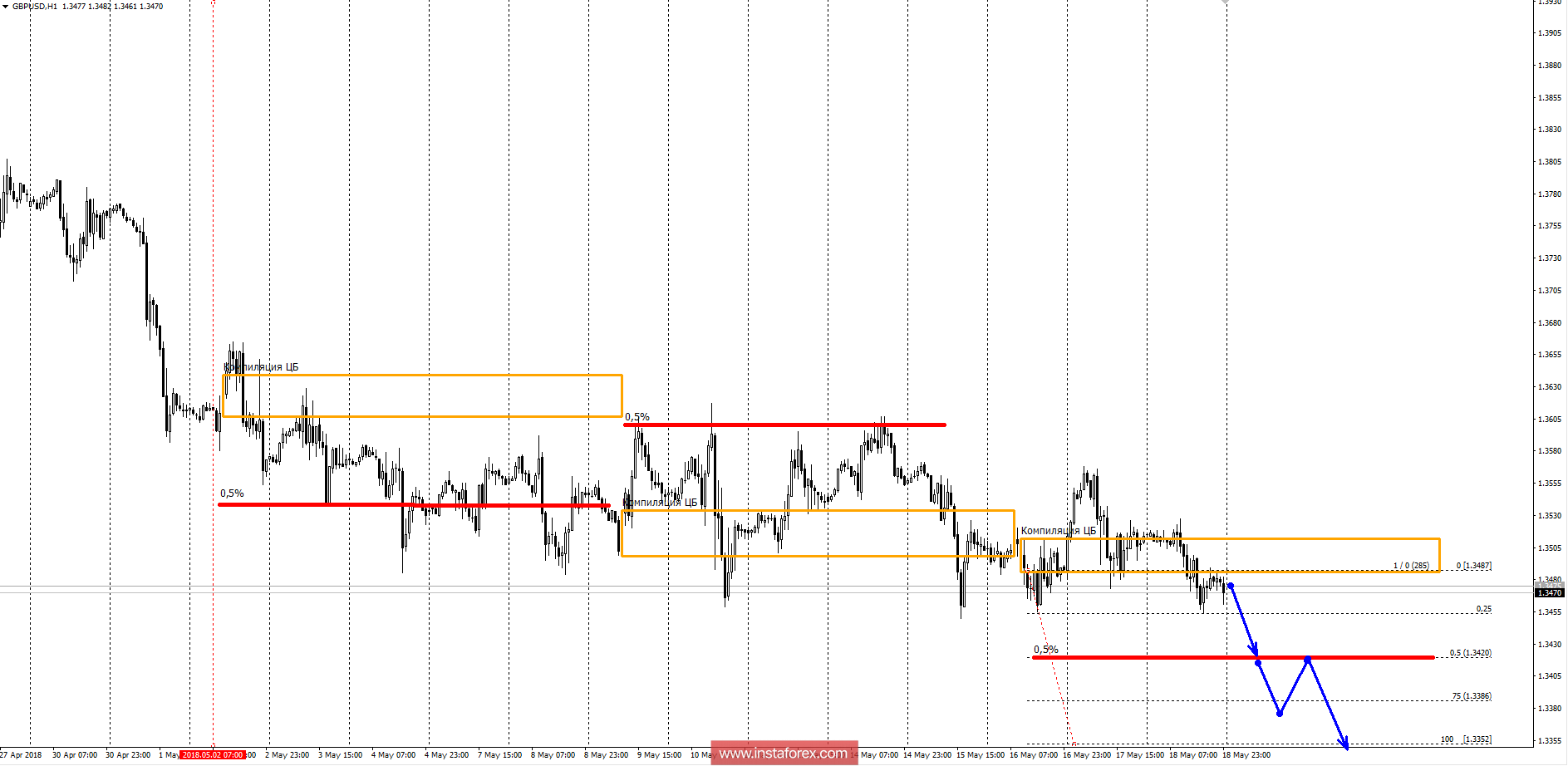

The current month is the formation of a medium-term accumulation zone with a change in the resistance zone in the direction of the depreciation rate. The second half of last week indicates the continuation of the flat movement. The closest target of the fall is the Bank of England rate range 0.5% (1.3420), the test of which will determine the further priority. In order to stay in the flat range, the pair needs to stay above the specified support level. If the closing of US sessions will occur below the rate level, the medium-term momentum will continue, and the CB compilation zone will remain a strong resistance.

According to this downward dynamics, it is clear that the priority transactions continue to be selling, while the rate is trading below the defining resistance zone. In order for the reversal pattern to take shape and the purchases to come to the front, it will be necessary to finish one of the US sessions on Monday or Tuesday above the compilation zone of the Bank of England. This will allow to consider work within the framework of an informed medium-term flat, where the first target will be the maximum of last week, and further growth will depend on the price reaction to this extremum. Purchases above the compilation zone are not profitable, as there will not be a profitable risk-to-profit ratio. For this reason, it remains favorable to wait for prices for the selling of the trading instrument and to monitor the reaction of prices to banking ranges.