The US dollar resumed its growth on Monday amid the completion of the next stage of trade negotiations between the US and China. It is announced that the parties agreed not to go into the phase of the trade war and moved towards each other, canceling the conditions imposed in recent weeks on trade restrictions.

According to the reached preliminary agreement, China agreed to increase purchases of goods and services in the US to reduce trade imbalances between countries, but no exact figures are reported. China will increase purchases not only to agricultural products and energy, but also in the technological sphere, since the United States has nothing to offer.

Also, China obviously should save or increase investments in US government bonds, because at the current stage of reforms, increasing the government's debt is the only way to finance the federal budget.

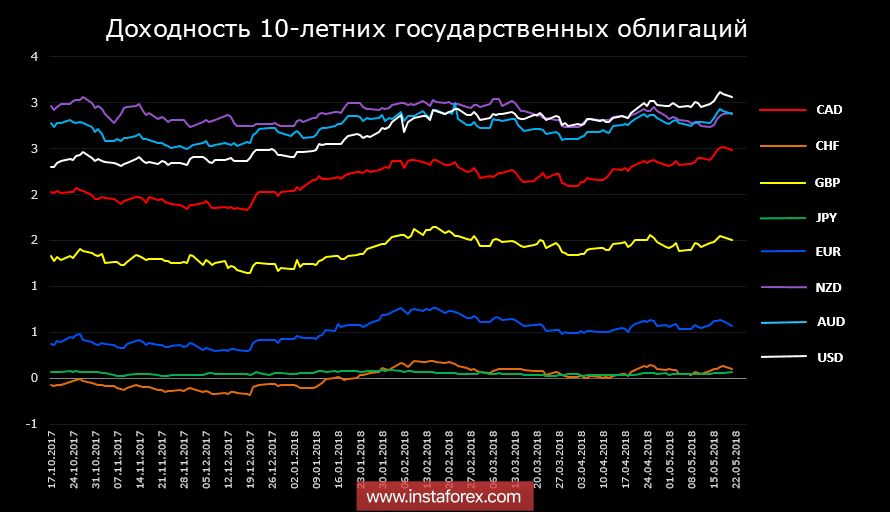

The policy of the Federal Reserve led to an increase in Treasury yields, which are significantly higher than in any other currency. If the yield of 10-year bonds was lower than that of New Zealand and Australia in January, then American bonds in May came in first place and the gap continues to grow.

This process reflects the confidence of investors in at least two factors. First, the US economy is growing faster than others and second, the Fed will continue the normalization policy at the planned rate. The dollar rises in price quite objectively, but to what extent do these factors correspond to reality?

It's obvious that the confidence in the growth of the US economy follows directly from the recent tax reform. Reducing the fiscal burden on both business and consumers has led to an increase in the business activity. But in order for this process to be considered a sign of economic growth, it is necessary to achieve growth in budget revenues. In this case, it will be possible to assert that the decrease in wages as a result of reforms is compensated by the raise in incomes due to the economic growth.

While the budget continues to crawl towards an ever-growing deficit, it is impossible to say anything definite about the growth of the economy because there is a simultaneous tightening of financial conditions, which goes immediately in several directions.

Firstly, it is a growing dollar and the People's Bank of China will reduce the financial conditions after April 17, and reduced by 1% of the norms of mandatory reserve for banks. Then, the dollar index began a sharp increase, out of range.

Secondly, the Fed continues to reduce its balance as it reduces the global dollar offer, against the background of the growth of the dollar index, that leads to an even stronger tightening of financial conditions around the world.And thirdly, oil sharply increases along with the growth of the dollar due to the US withdrawal from the nuclear deal on Iran and the resulting surge in geopolitical tensions. The dollar rises in price quite objectively, and the Fed policy and the Trump administration seems to be coordinated up to smallest details.

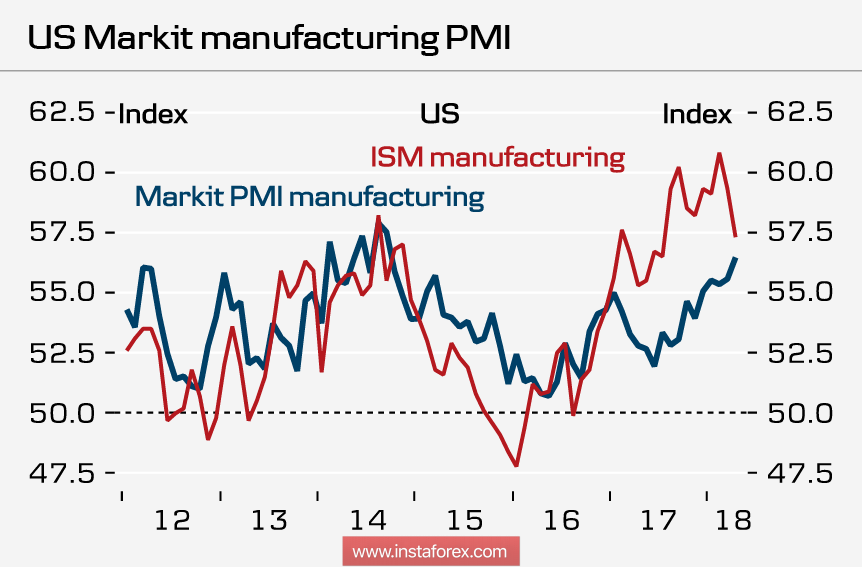

The most important day for the week is Wednesday. Markit will report preliminary PMI data in May, most likely the figures will be positive and will support the dollar, as the latest regional reports indicate an increase in activity. Also on Wednesday, the FOMC minutes of meeting dated May 2 will be published, which will be important in terms of the reasons for changing the final statement on inflation. It is expected that the speech will be slightly more dovish than in March, which could provoke a slowdown in the growth of the dollar.

On Friday, the report on durable good orders in April, which is an indicator of both demand and industrial growth, will be published. At the same day, Fed Chairman Jerome Powell will speak, and the University of Michigan's consumer confidence index will be published in May.

The most affected in the current situation are the countries that are importers of raw materials, since they have to pay both a high price for raw materials and buy dollars in conditions of a lower supply at a higher price. The euro, the franc, and the Japanese yen lose in value, and there is no reason to expect that this process will stop.

* The presented market analysis is informative and does not constitute a guide to the transaction