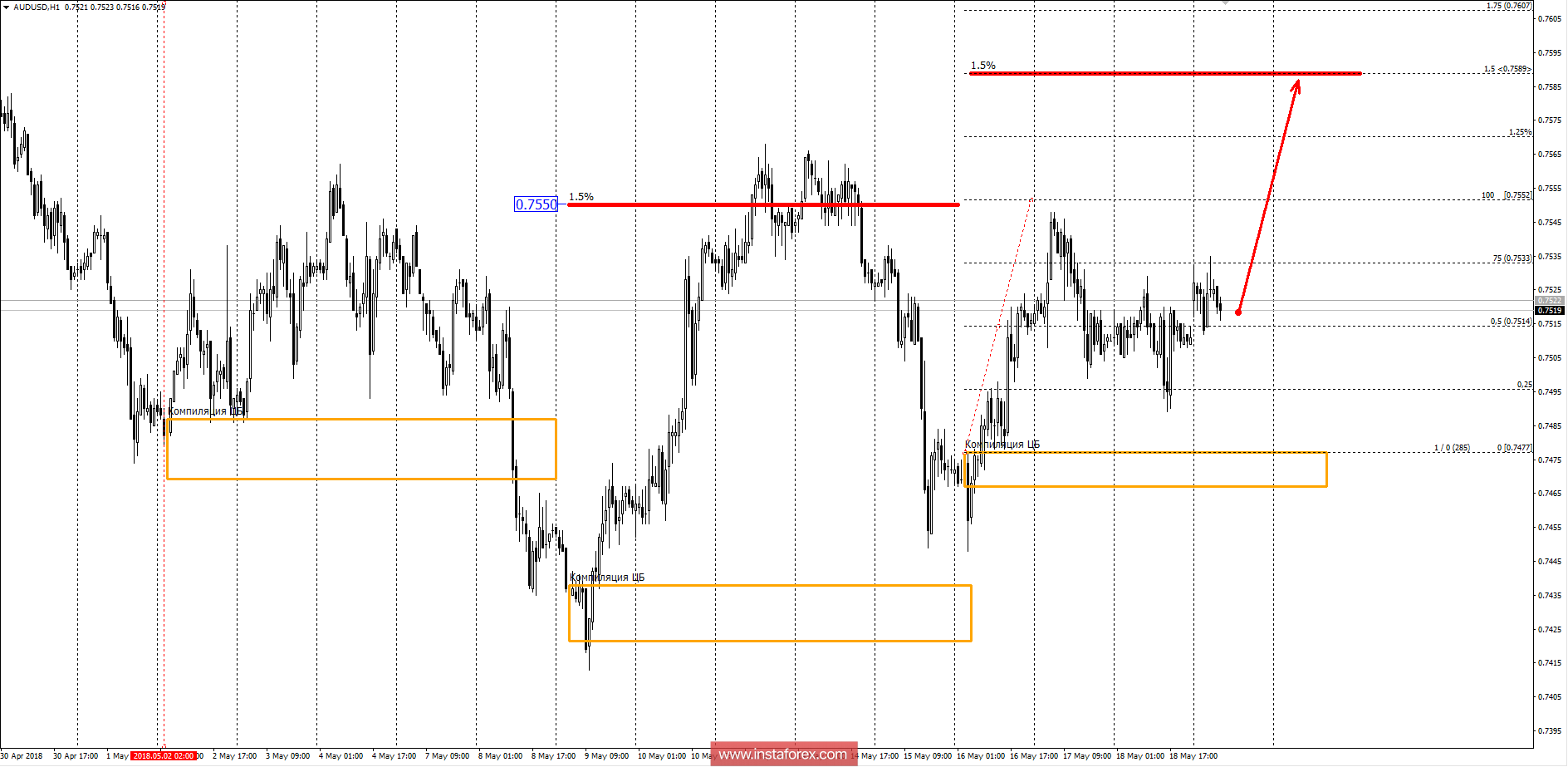

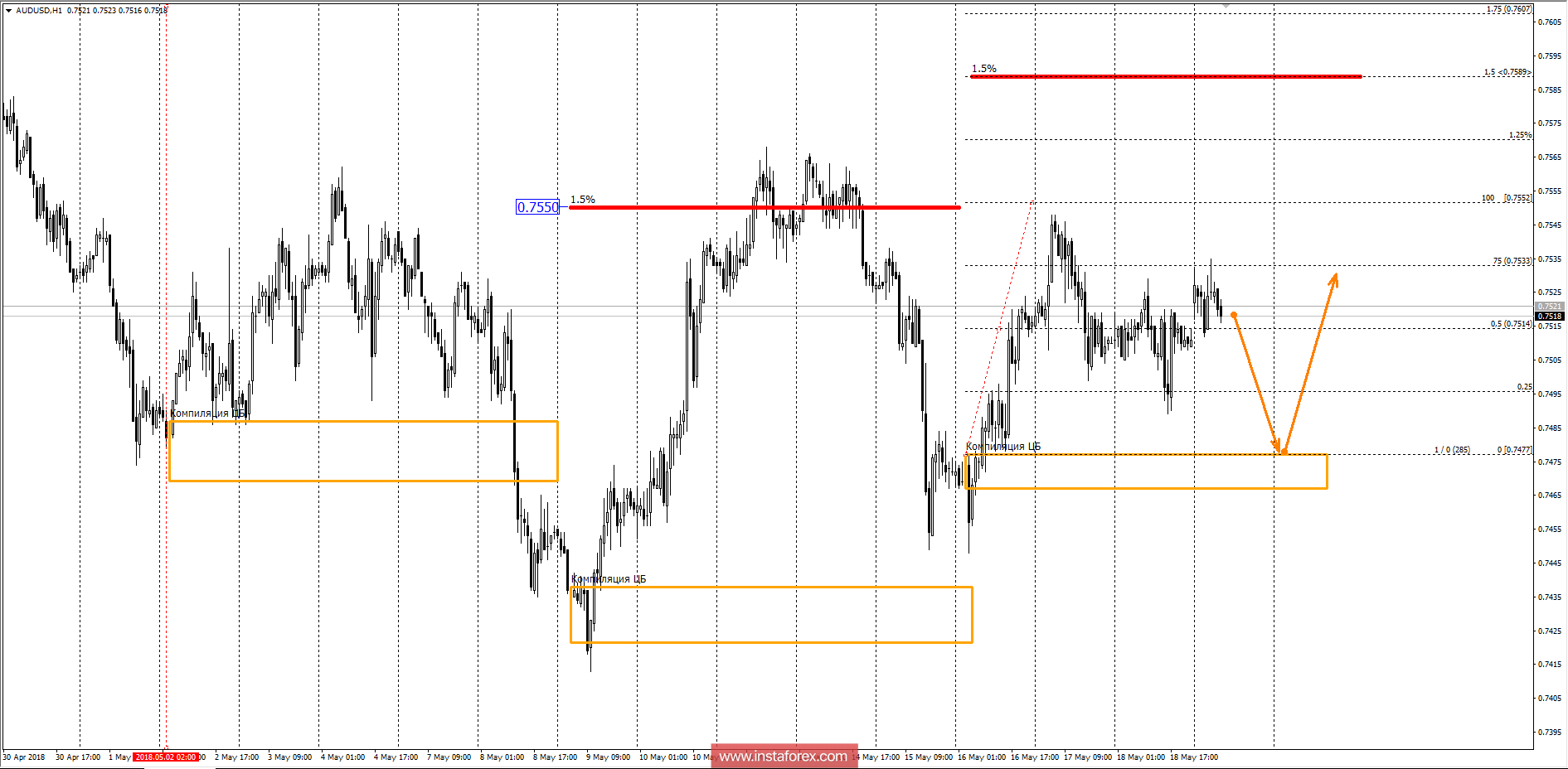

The movement of the pair in the current month indicates the formation of a medium-term accumulation zone. This can be determined by the location of the compilation zones of the Central Bank. Last week, the growth rate reached the level of 1.5% (0.7550), which led to its decline. Last week, the movement was once again rising from the compilation zone of the bank, which indicates a possible growth target with the rate level of 1.5% (0.7589). Reaching this level will require fixing purchases and finding a pattern for sale. The ascending model will remain the priority until the course trades above the compilation zone of the Bank of Australia.

When making purchases, it is necessary to take into account the risk-to-profit ratio, since it will not be profitable at the last week's high. This suggests the need to find more favorable prices for the purchase of the instrument. Reduction to the compilation zone of the bank will give an opportunity to buy at the most favorable prices. To disrupt the upstream structure, one of the important trading sessions (Asian and American) requires closing down of the compilation zone. This will allow us to consider a new top-down priority in the future. It is important to note that It is important to note that next Wednesday, there will be regular operations on the open market, which will allow us to determine the new compilation zone of the Bank of Australia and can shift the support level higher.

On current marks, it is necessary to track the formation of the pattern, since it can enable and sell to the compilation area and buy to the interest rate level. Within the intraday movement, both ranges give a good risk-to-profit ratio, so it can be ignored.