Today, many of the world's trading floors are closed. Europe celebrates Holy Ghost Day, and Canada celebrates Victoria Day. However, this circumstance absolutely does not prevent the US currency from actively growing its positions in all dollar pairs, provoking quite a strong volatility in the foreign exchange market.

The dollar reacts to the main event of the past weekend. The preliminary conclusion of a commercial "truce" between the US and China. And although it is too early to talk about a full-fledged deal, the markets were inspired by the optimism of the representatives of the American side. US Treasury Secretary Steven Mnuchin and US presidential adviser Larry Kudlow made unexpected statements. They said that the countries had come to a mutual agreement that they would not introduce new tariffs on goods. The trade war is at least postponed indefinitely, and the fragile, but long-awaited stability returns to the market.

Despite the importance of the topic, the Americans did not go into details of the agreements reached. At the moment, it is known that Beijing can significantly increase the export of agricultural products from the US and increase purchases in the energy sector. In addition, China promised to "eliminate the factors that prevented fair competition in the PRC market for American products." What exactly is going on is still unknown, but the very fact of this intention speaks volumes.

It is worth noting that this breakthrough was preceded by difficult negotiations. The first round of dialogue ended in failure, after which the market began talking about a full-fledged trade war. Then the Chinese denied the rumor that Beijing offered the Americans concessions in trade to reduce the trade deficit for a total of up to two hundred billion dollars. Trump and Xi Jinping were "over the fight" and did not comment on the negotiation process. The market was forced to settle for rumors and stingy comments from officials, and this fact exerted indirect pressure on the dollar.

But the Sunday speech of the US Treasury Secretary gave the dollar bulls optimism. After all, do not forget that the uncertainty surrounding US-China relations has had an impact on the members of the Fed. Now, this barrier has actually been eliminated, so the market can still count on a fourfold increase in the rate within this year. Against this background, the dollar index jumped to multi-month highs (currently - 93.84), and the yield of 10-year US bonds holds above three percent.

However, the external fundamental background can not be called calm. Another focus of tension is the DPRK. In this case, we are talking about two extremes. One scenario presupposes a meeting between Trump and Un, followed by nuclear disarmament, but even an armed conflict allows an alternative. In particular, yesterday the senator from the Republican Party (representative of the state of South Carolina) Lindsey Graham said, in case of disruption of the dialogue, the military solution of this problem will be the only option. And although this is not the official position of the White House, such statements indicate the mood among the Republicans.

At the moment, Washington is still preparing for the historic meeting of the leaders of the United States and North Korea, which is to be held on June 12 in Singapore. Other information sources say that Trump doubts the political expediency of this meeting, given the unpredictability of the North Korean side. According to some reports, the US president doubts that the DPRK will fulfill its obligations, and the "disarmament mission" initiated by Trump will turn into political embarrassment.

But as of today, the White House is still preparing for an immediate dialogue with North Korea, so traders ignore the potential geopolitical risk.

The existing fundamental background resumed the rally of the US currency, and also significantly reduced the demand for defensive assets. Gold updates the annual lows, and the dollar / yen pair is rapidly developing the northern trend. Own support for the Japanese currency is not, slowing inflation and GDP growth in Japan determined the "dovish" mood of the national Central Bank. A soft monetary policy will remain in effect for a long time, at least until stable recovery of inflation indicators.

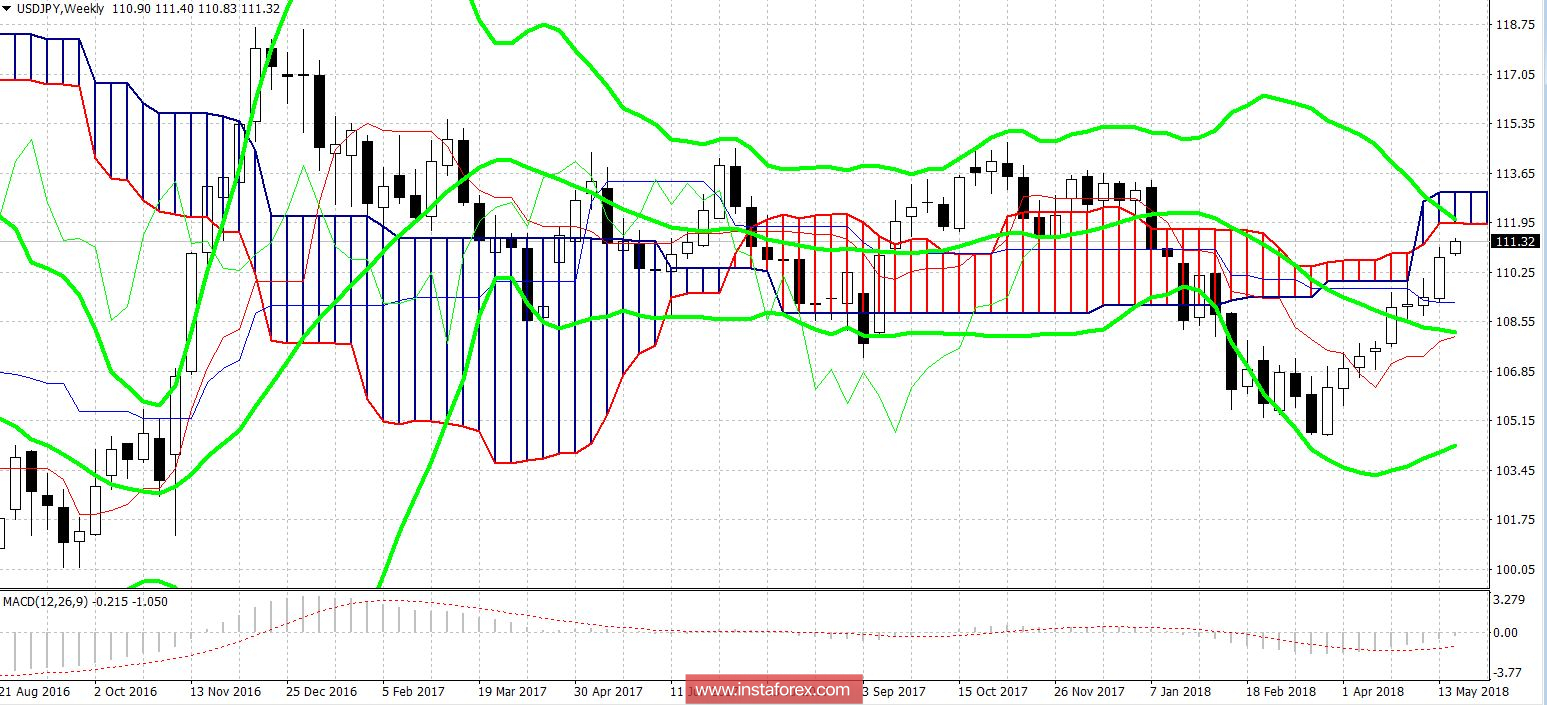

Therefore, the dynamics of USD / JPY is still determined by two factors. The behavior of the dollar and the external fundamental background. Today, these factors play in favor of the US currency, which means that the pair's price may soon reach the first resistance level of 112.0, which coincides with the lower boundary of the Kumo cloud of the Ichimoku Kinko Hyo indicator on the weekly chart. In general, the bulls of the pair USD / JPY were able to overcome two main marks (110 and 111), so reaching the border of the next figure will not be a serious test for them. The only thing that can prevent this scenario is the failure of Donald Trump's historic meeting with Kim Jong-un.