Wave picture of the chart D1:

The last section of the graph on the H4 / D1 TF forms the beginning of the final part (C) in the larger ascending wave formation W1. Previous parts (A-B) were formed over 3 years.

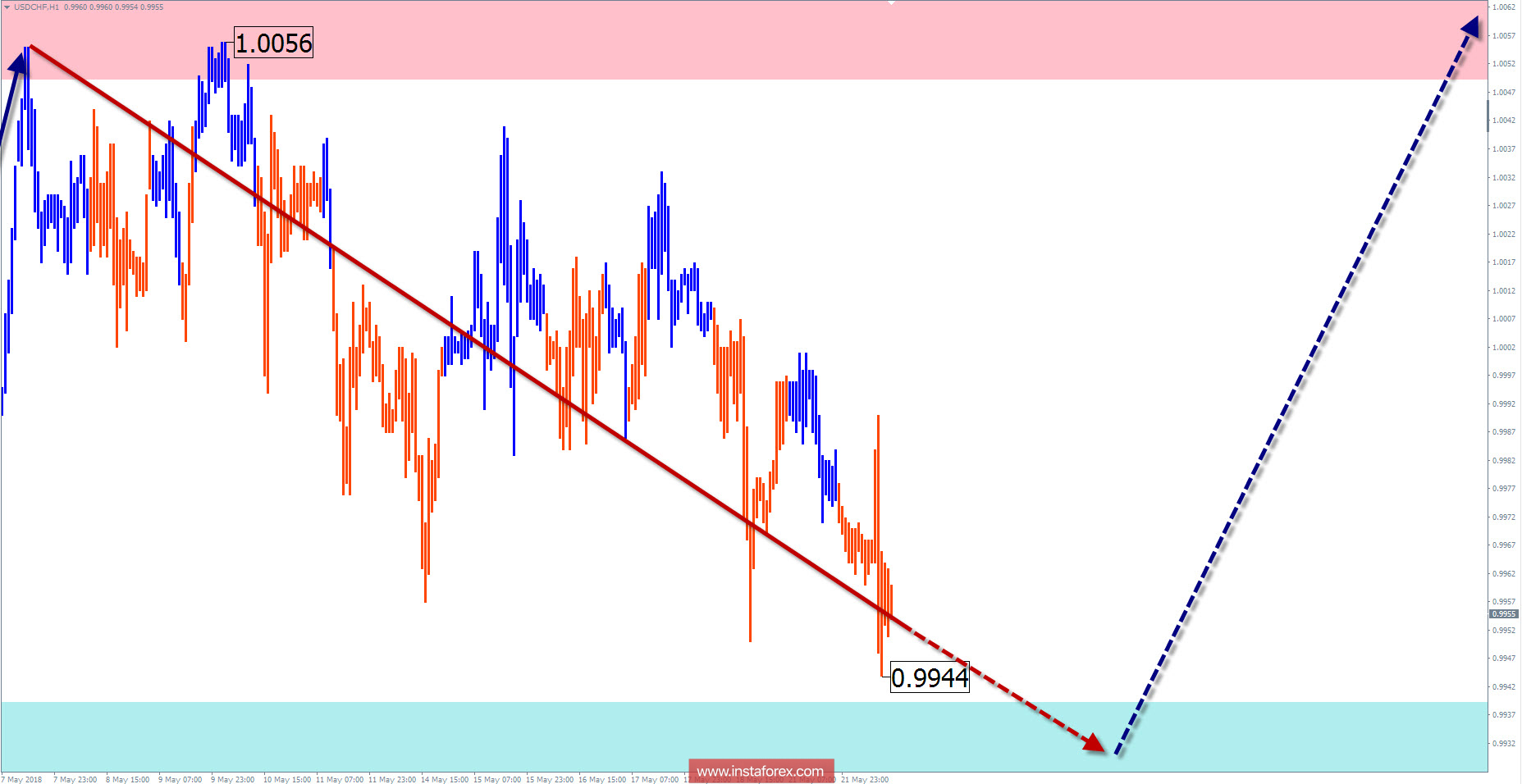

The wave pattern of the graph H1:

The bullish wave of February 16 has a high wave level. The character of the movement has a pronounced impulse form, with minimal counter correction areas. The lower boundary of the preliminary target zone is in 3 price figures from the current values of the pair.

The wave pattern of the M15 chart:

From May 7, the price is adjusted, forming an intermediate correction. The price is close to the upper boundary of the calculated completion zone.

Recommended trading strategy:

For all types of trade, only purchases are recommended. In the area of settlement support, it is possible to deposit or enter the market with minimal risk.

Resistance zones:

- 1.0050 / 1.0100

Support zones:

- 0.9940 / 0.9890

Explanations to the figures: Simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). At each TF the last incomplete wave is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the wave counting according to the technique used by the author. The solid background shows the generated structure, dotted - the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need confirmation signals from your trading systems!