EUR / USD pair

On Tuesday, the euro showed only a symbolic decline in the expectation of today's publication of the protocol since the last meeting of the Fed. The main volatility of yesterday came from the British pound, which reacted sharply to the statement of the Central Bank head, Mark Carney, on raising the rate "in a few months", subject to normalization of economic indicators.

Today, the business activity indicators for the euro area for May are scheduled to be released at 8.00 London time. Services PMI is expected to remain unchanged at 54.7 points, while Manufacturing PMI may fall from 56.2 to 56.1. In fairness, German Manufacturing PMI is projected at 57.9 against 58.1 in April. According to the US Manufacturing PMI for the same month is projected to grow from 56.5 to 56.6, and Services PMI is also projected to grow from 54.6 to 54.9. Sales of new homes in the US in April are expected at 680,000 compared to 694,000 in March. At 18.00 London time, the protocol FOMC FRS will be published. A positive tonality of the document is expected.

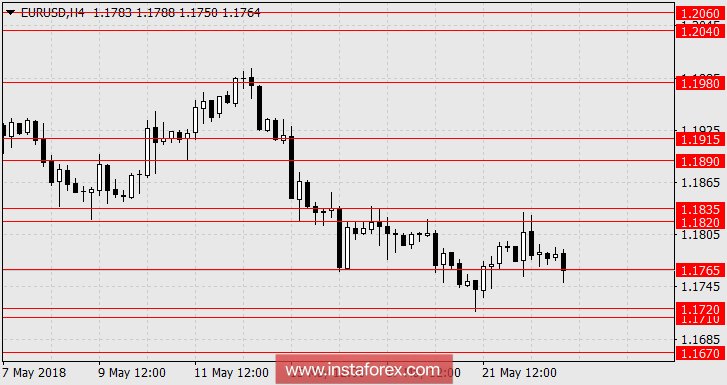

We are waiting for the decline of the euro to the level of 1.1670.