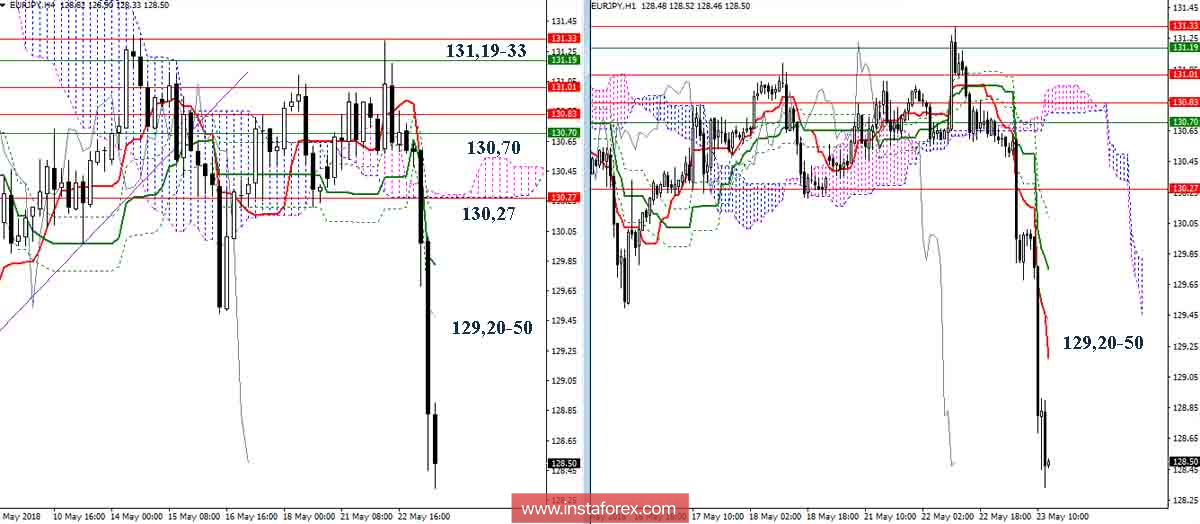

EUR / JPY pair

The resistance, which is previously designated in the area 131.19-33 (weekly Tenkan + day Kijun), coped with the task and did not allow players to rise in realizing the release from the support of the weekly cloud (Senkou Span A 130.70). Yesterday, the pair closed the day below 130.70, returned to the weekly cloud and as a result, players on the fall went into an active offensive. To date, the daily and weekly downtrend has been restored. The pair is now implementing a decline, which is guided by the lower boundary of the weekly cloud (Senkou Span B 124.67). Along the way, the support of the monthly Fibo Kijun (126.84) should be noted. In case of braking and an upward correction, the nearest zone of resistance for today can be noted in the area of 129.20 - 50.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.