Data released in the first half of the day on the economy of the euro area and the UK exerted serious pressure on the euro and the British pound, allowing US dollar buyers to further increase their long positions before the publication of the Federal Reserve's protocols, from which many are waiting for signals in the direction of further interest rates .

In the first quarter of this year, the unemployment rate in France rose, indicating a slowdown in the recovery of the euro-zone economy in 2018. According to the report of the statistics agency Insee, the unemployment rate in France in the first quarter of this year rose to 9.2% from 9.0% in the fourth quarter of last year. This happened because of a sharp slowdown in the economy earlier this year.

The euro collapsed after a report came out indicating that the growth of business activity in the euro area in May this year, contrary to all forecasts of economists and ECB representatives, slowed for the fourth consecutive month.

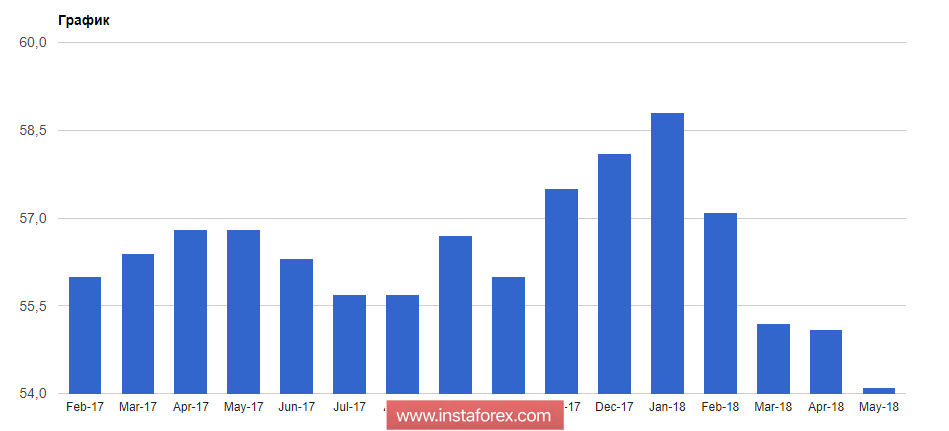

According to a report by research company IHS Markit, the preliminary composite index of supply managers for the euro area in May 2018 was 54.1 points, while economists expected the index to be at 54.8 points.It is important to note that a value above 50 points still indicates an increase in activity.

This slowdown is not surprising. For example, in Germany, the preliminary index of supply managers for the manufacturing sector in May fell to 56.8 points against 58.1 points in May, while it was projected at 57.5 points. The index for the service sector fell to 52.1 points in May against 53.0 points in April.

In general, the composite PMI of Germany dropped to 53.1 points in May, while in April of this year, it was at the level of 54.6 points.

France too, failed to please with good results.

The preliminary composite index of supply managers of the PMI of France fell to 54.5 points in May against 56.9 points in April this year.

As noted above, the British pound went to update the monthly lows paired with the US dollar after it became clear that the annual inflation in the UK in April this year dropped to the lowest level in more than a year.

According to the National Bureau of Statistics, consumer prices rose only by 2.4% in April this year compared with the same period last year. In March, growth was at 2.5%.

The main reason for the decline in prices, as noted in the ONS report, is the drop in prices for air tickets.

All the data fully coincided with the forecast of economists.

The reaction of the Bank of England, most likely, will not take long. In the near future, representatives of the Central Bank will make a number of statements, based on today's data, and most likely, they will not like the buyers of the British pound slightly.