GBP / USD

In the United Kingdom, inflation indicators continued to put pressure on investor sentiment. The base CPI in April fell from 2.3% YoY to 2.1% YoY, with the expectation of a slight decline to 2.2% YoY. The total CPI fell from 2.5% YoY to 2.4% YoY, while expecting for its retention at the same level. The producer price index at the entrance gained 0.4% only in April against the forecast of 1.0% M/M. The producer price index at the output coincided with the expectation of 0.3% M/M. Retail prices in April increased to the expected 3.4% YoY against 3.3% YoY a month earlier. While housing prices fell from 4.4% YoY to 4.2% YoY. The balance of retail sales by CBI for May showed growth from -2 to 11 with the expectation of 4. The dollar index grew by 0.44% but under its additional pressure the pound sterling fell by 82 points.

Today, retail sales data for April will be published with 0.8% forecast against -1.2% in March. Against the background of the previous decline, the expected increase does not look very good. At 9:00 AM London time, Mark Carney will make a short speech at the Markets Forum 2018 event. Even if he talked about the monetary policy, he is unlikely to be optimistic after his speech in parliament and the latest economic data. Later at 8:10 PM London time, Carney will speak at the annual dinner of professional economists in London, where the exciting topic can already be touched. But here again, we do not expect any change in the tone of his speech.

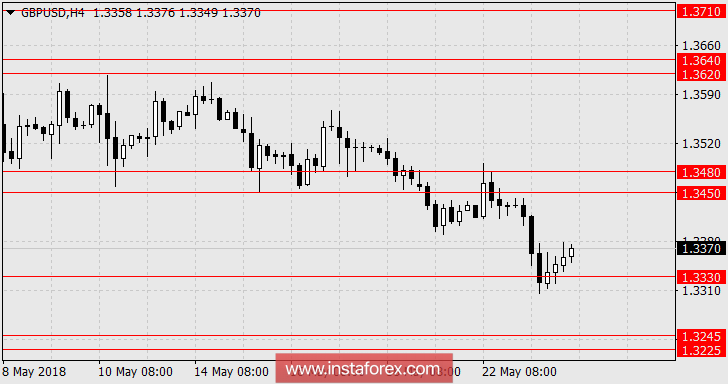

We are looking forward to the decline of the pound sterling in the range of 1.3225 / 45.

* The presented market analysis is informative and does not constitute a guide to the transaction.