More recently, it was assumed that the slowdown of inflation in the UK will be compensated by the acceleration of growth in retail sales. However, the forecasts were revised, and instead of growth, sales growth is expected to slow from 1.1% to 0.1%. Such a significant decrease will have an extremely negative impact on the pound, and even data from the USA, where the number of applications for unemployment benefits is expected to increase by 45,000 will not help. Moreover, sales of housing on the secondary market may decrease by 0.2%.

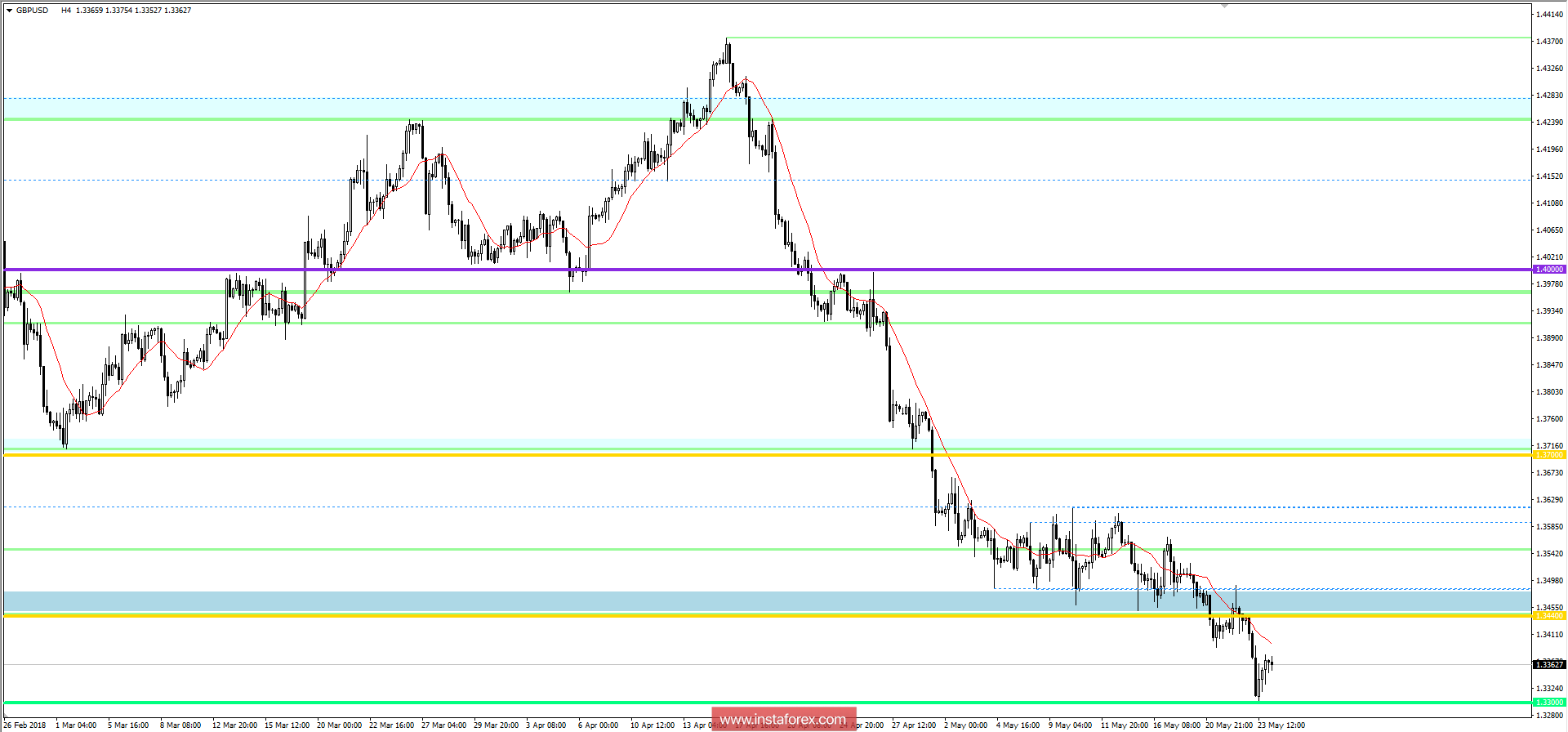

The GBP/USD currency pair felt support and rolled back the quotation after reaching the range of 1.3300. Yet, the bearish interest is still present on the market. It is possible to assume a temporary wobble of 1.3300 / 1.1380, where it is worth considering fixations outside the boundaries.