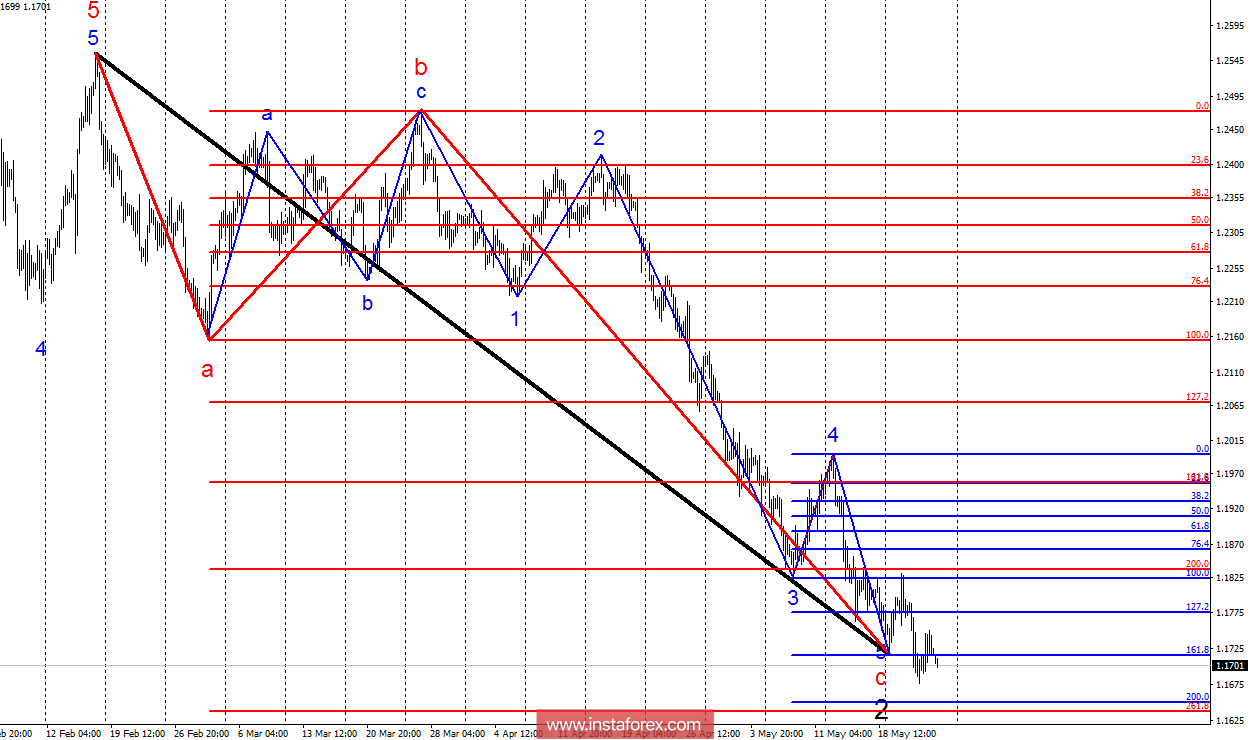

Analysis of wave counting:

Yesterday's trading of the EUR/USD pair led to the withdrawal of quotations from the lows reached by 70 p. If the current wave counting is correct, the 5th wave in c, in 2nd, takes the form of a diagonal triangle with the 5th wave, which began its construction. Thus, the targets near the 1.1650 mark can be the final targets for building the entire 5th wave. From this mark, the pair can begin to build an ascending set of waves in the future third wave of the main upward trend section.

Goals for sales:

1.1649 - 200.0% by Fibonacci

1.1636 - 261.8% of the Fibonacci of the highest order

Goals for shopping:

1.1835 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR/USD currency pair continues to build a downward trend section. Thus, I recommend that you remain in sales with targets located near the estimated levels of 1.1649 and 1.1636, which is equivalent to 200.0% and 261.8% of Fibonacci. A breakout on this zone will lead to a further decline of quotations, complicating the wave structure of the descending section of the trend. An unsuccessful attempt to break the 1.1650 mark can warn about the readiness of the instrument to build an upward wave and will be a signal for the beginning of the formation of purchases as part of the development of the future wave.