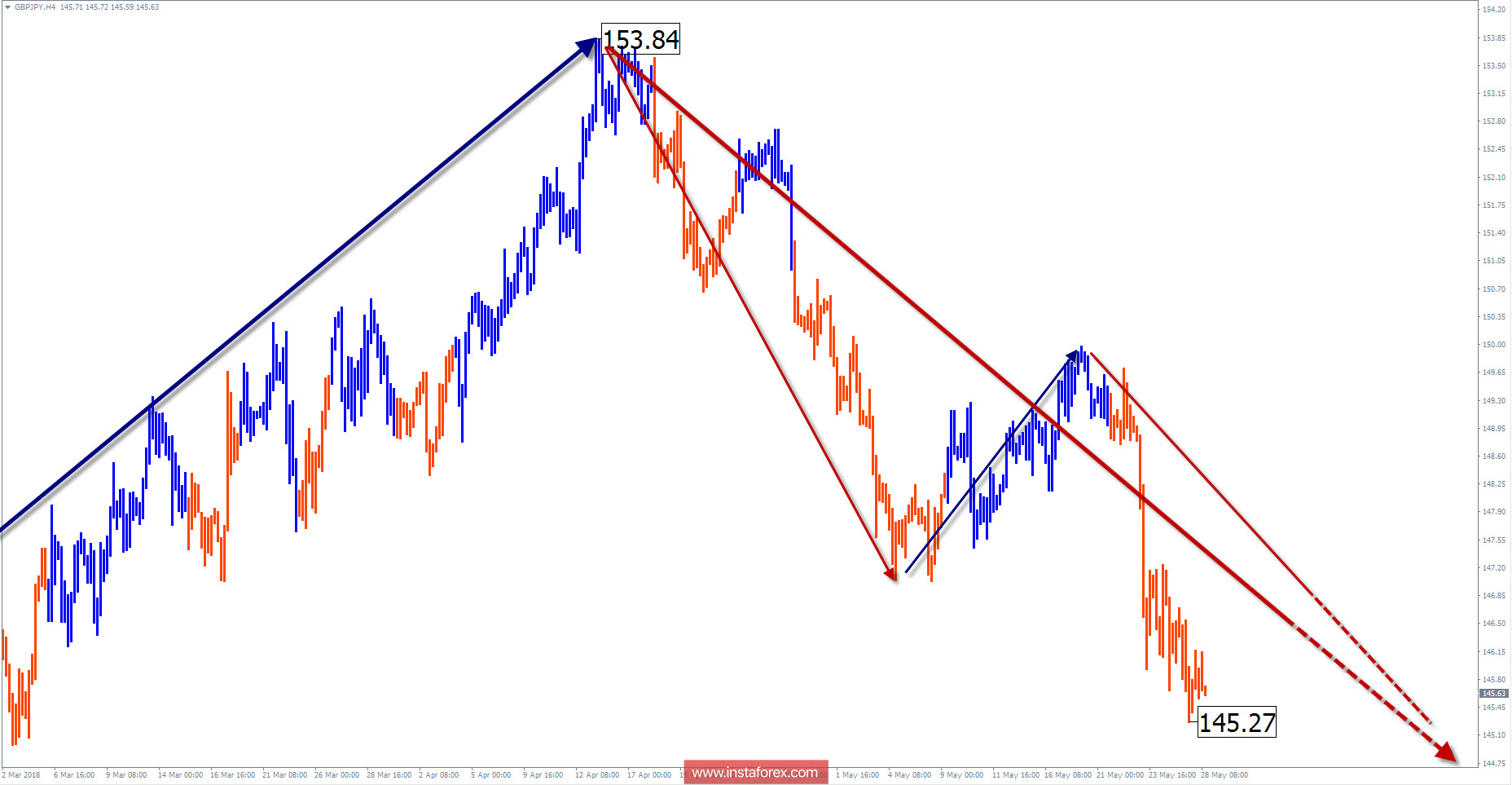

Wave picture of the chart D1:

The last, actual for this scale chart wave counts from October 2016. The wave has a high wave potential, with the prospect of moving to a larger scale of motion W1. Since February this year, the price has been adjusted.

The wave pattern of the graph H1:

The rate of price movement sets a bearish wave on April 13. In a larger wave formation, the site occupies the place of the final part (C). Calculating the stroke potential allows you to wait for at least 2 price figures down.

The wave pattern of the M15 chart:

In the downward wave of May 18, a counter-corrective wave is forming. The structure lacks the final part.

Recommended trading strategy:

For trading on large TF signals are not ripe. In the intraday, purchases are risky in view of the small potential of the price rise. In the resistance zone, it makes sense to look for sell signals.

Resistance zones:

- 147.10 / 147.60

Support zones:

- 145.30 / 144.80

- 143.70 / 143.20

Explanations to the figures: Simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). At each TF the last incomplete wave is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the wave counting according to the technique used by the author. The solid background shows the generated structure, dotted - the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need confirmation signals from your trading systems!