To open long positions for EUR / USD pair, you need:

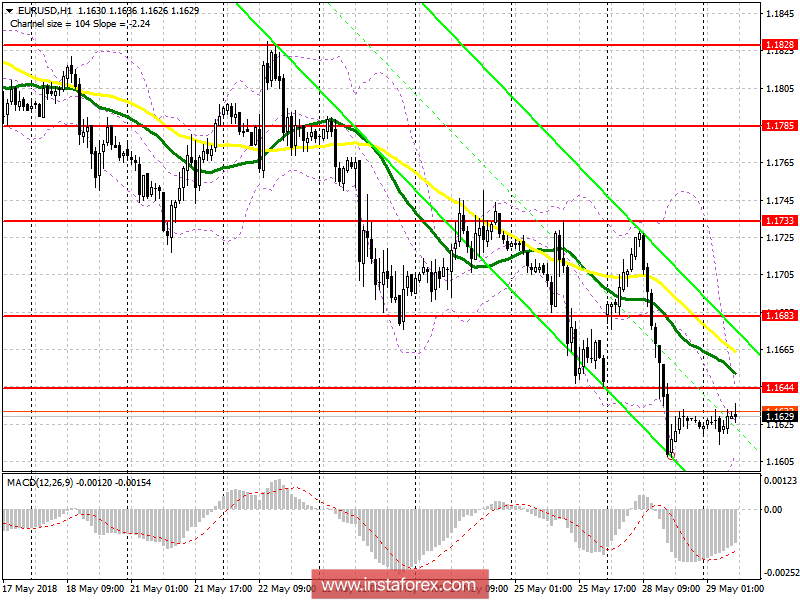

Buying a euro is possible only on a condition of a breakout and consolidation above the resistance level of 1.1644, which will allow us to count on a new wave of growth to 1.1683 and to update a larger level of 1.1733, where fixing profits are recommended. In the case of a decline of the euro in the morning, the divergence on the MACD indicator may be a good signal to buy after testing the support level of 1.1595. Otherwise, long positions can be calculated after updating 1.1565 and 1.1538.

To open short positions for EUR / USD pair, you need:

Unsuccessful consolidation above 1.1644 and returning to this level will lead to a new wave of euro sales. The purpose is to update the monthly low around 1.1595, with access to the larger levels of 1.1565 and 1.1538, where fixing profits are recommended. n case of growth above 1.1644 in the morning, sell the euro on the rebounded from 1.1683.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20