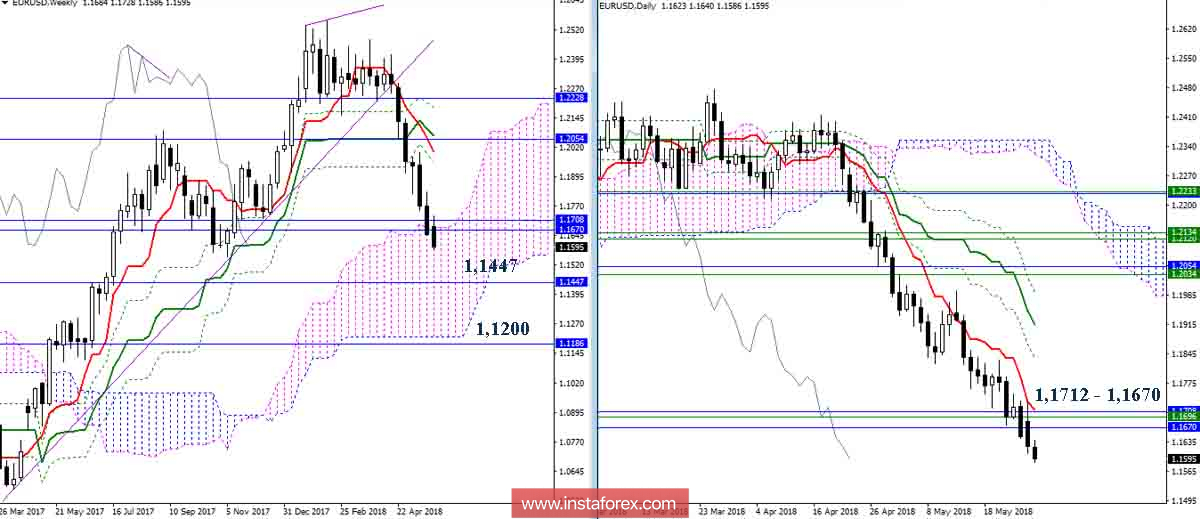

EUR / USD

Despite the strength of the supported supports, the expectation of a rebound or at least a full-fledged braking, the pair continues to decline. Significant landmarks, in case of bearish sentiment and activity, are now at 1.1447 (the monthly Kijun) and around 1.1200 (monthly Fibo Kijun + weekly Senkou Span B). The benefits and initiative still belong to players on a decline. The levels (monthly Fibo Kijun + monthly Senkou Span A + week-old Senkou Span A + day Tenkan), which the pair managed to overcome the day before, have now moved to the category of significant resistance. The fastening above this resistance zone (1.1712 - 1.1670) is able to change the current balance of power, because the players will receive a short-term advantage at the same time, and on the week-and-a-half time conditions will be formed to form a clearing from the Ichimoku cloud borders.

Indicator parameters:

All time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.