Dear colleagues.

For the EUR / USD pair, we expect the movement towards the level of 1.1453. For the GBP / USD pair, the continuation of the movement towards the bottom is expected after the breakdown of 1.3195. For the of USD / CHF pair, the price is in an equilibrium state. For the USD / JPY pair, the continuation of the movement towards the bottom is expected after the breakdown of 108.14. For the EUR / JPY pair, the continuation of the development of the downward structure from May 22 is expected after the breakdown of 124.83. For the GBP / JPY pair, the continuation of the movement towards the bottom is possible after the breakdown of 142.73.

Forecast for May 30:

Analytical review of currency pairs in the scale of H1:

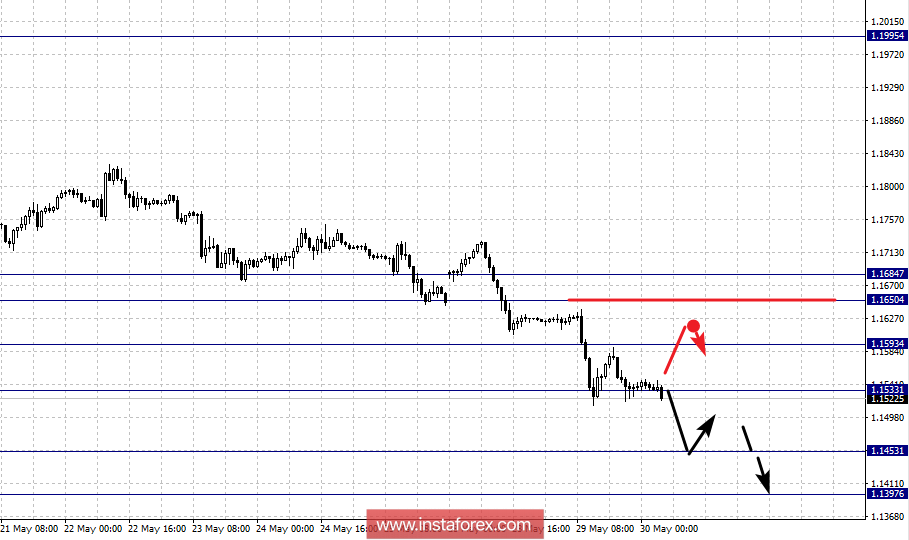

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1684, 1.1650, 1.1593, 1.1533, 1.1453 and 1.1397. Here, we expect the movement towards the level of 1.1453. Near this level is the consolidation of the price. For the potential value for the bottom, consider the level of 1.1397. Upon reaching this level, we expect consolidation as well as a rollback to the top.

Going into correction is possible after the breakdown of 1.1593. In this case, the target is 1.1650. The range of 1.1650 - 1.1684 is the key support for the downward structure. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the local structure for the bottom of May 14.

Trading recommendations:

Buy: 1.1595 Take profit: 1.1650

Buy 1.1652 Take profit: 1.1684

Sell: 1.1530 Take profit: 1.1455

Sell: 1.1450 Take profit: 1.1400

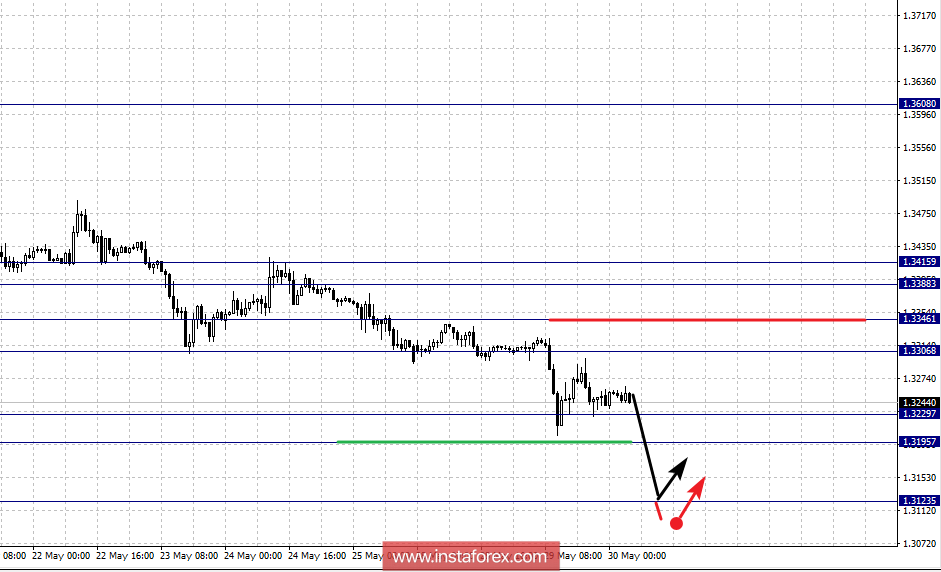

For the GBP / USD pair, the key levels on the scale of H1 are 1.3415, 1.3388, 1.3346, 1.3306, 1.3229, 1.3195 and 1.3123. Here, we continue to follow the downward structure from May 14. The continuation of the movement towards the bottom is expected after passing the price of the noise range at 1.3229 - 1.3195. In this case, the target is 1.3123. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.3306 - 1.3346. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3388. The level of 1.3415 is a potential for the top. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward cycle from May 14.

Trading recommendations:

Buy: 1.3306 Take profit: 1.3344

Buy: 1.3348 Take profit: 1.3388

Sell: 1.3227 Take profit: 1.3196

Sell: 1.3193 Take profit: 1.3125

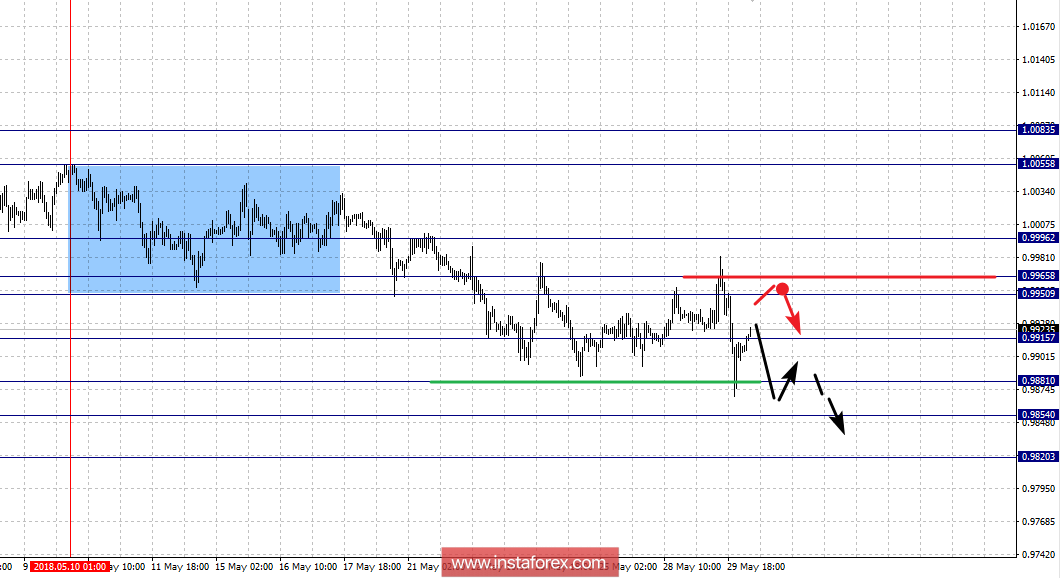

For the of USD / CHF pair, the key levels in the scale of H1 are: 0.9996, 0.9965, 0.9950, 0.9915, 0.9881, 0.9854 and 0.9820. Here, the price is in an equilibrium state. The continuation of the movement towards the bottom is expected after the breakdown of 0.9915. In this case, the target is 0.9881. In the area of 0.9881 - 0.9854 is short-term downward movement and also the consolidation of the price. For the potential value for the bottom, consider the level of 0.9820. Upon reaching this level, we expect a pullback to the top.

Short-term upward trend is possible in the area of 0.9950 - 0.9965. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9996. This level is the key support for the downward structure.

The main trend is the equilibrium state.

Trading recommendations:

Buy: 0.9950 Take profit: 0.9964

Buy: 0.9967 Take profit: 0.9992

Sell: 0.9913 Take profit: 0.9883

Sell: 0.9878 Take profit: 0.9855

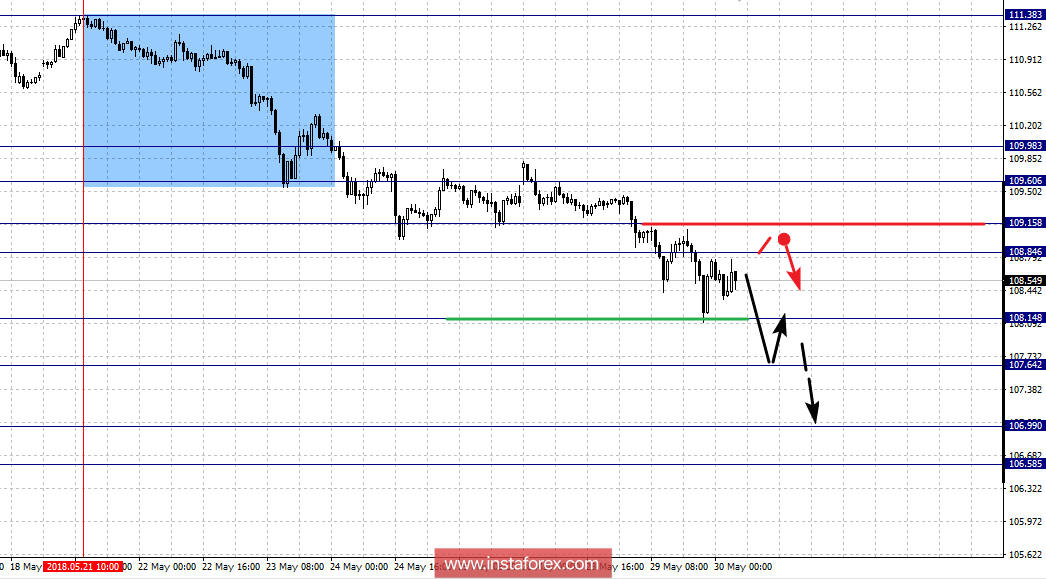

For the USD / JPY pair, the key levels on a scale are: 109.98, 109.60, 109.15, 108.84, 108.14, 107.64, 106.99 and 106.58. Here, we follow the downward structure of May 21. The continuation of the movement towards the bottom is expected after the breakdown of the level of 108.14. In this case, the target is 107.64. Near this level is the consolidation of the price. The breakdown of 107.62 must be accompanied by a pronounced movement towards the level of 106.99. For the potential value for the bottom, consider the level of 106.58. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 108.84 - 109.15. The breakdown of the last value will lead to in-depth correction. Here, the target is 109.60. The level of 109.98 is a potential value for the top. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward structure of May 21.

Trading recommendations:

Buy: 108.84 Take profit: 109.12

Buy: 109.17 Take profit: 109.60

Sell: 108.12 Take profit: 107.66

Sell: 107.62 Take profit: 107.00

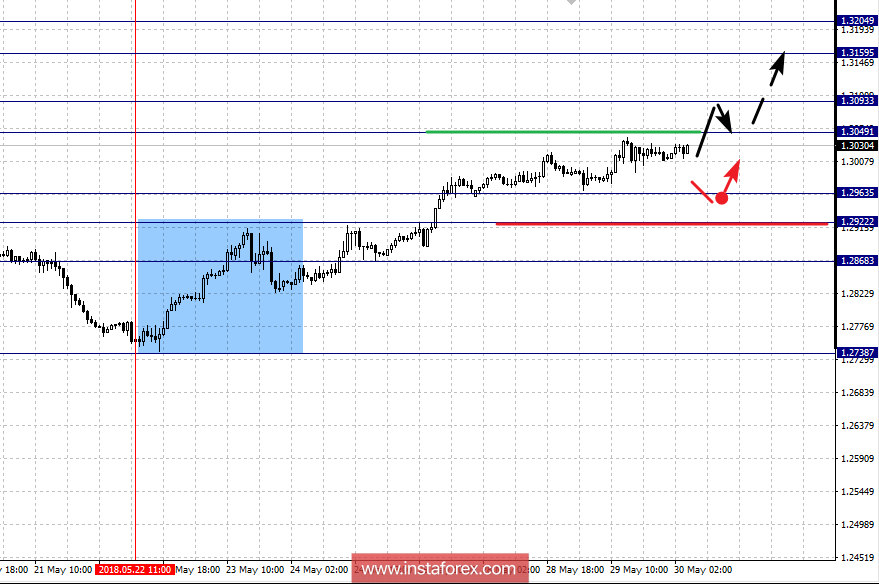

For the CAD / USD pair, the key levels on the H1 scale are: 1.3204, 1.3159, 1.3093, 1.3049, 1.2963, 1.2922, 1.2868 and 1.2809. Here, we follow the upward structure of May 22. Short-term upward movement is expected in the area of 1.3049 - 1.3093. The breakdown of the last value will lead to the development of a pronounced movement. Here, the target is 1.3159. For the potential value for the top, consider the level of 1.3204. Upon reaching this level, we expect consolidation as well as a pullback to the bottom.

Short-term downward movement is possible in the range of 1.2963 - 1.2922. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2868. This level is the key support for the upward trend.

The main trend is upward from May 22.

Trading recommendations:

Buy: 1.3050 Take profit: 1.3090

Buy: 1.3095 Take profit: 1.3157

Sell: 1.2961 Take profit: 1.2924

Sell: 1.2920 Take profit: 1.2868

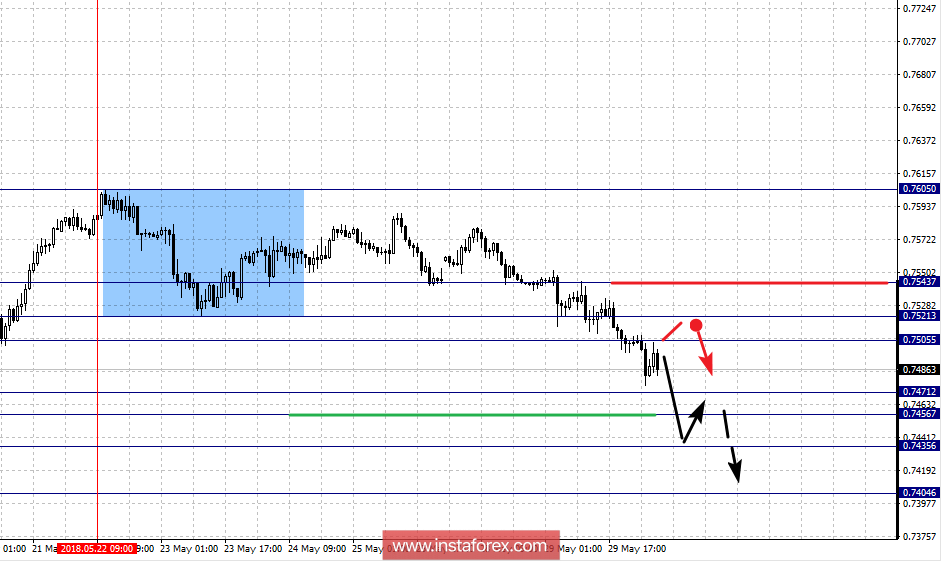

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7543, 0.7521, 0.7505, 0.7471, 0.7456, 0.7435 and 0.7404. Here, we follow the downward structure of May 22. The development of the downward trend is expected after passing the price of the noise range of 0.7471 - 0.7456. In this case, the target is 0.7435. Near this level is the consolidation of the price. For the potential value for the top, consider the level of 0.7404. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 0.7505 - 0.7521. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7543. This level is the key support for the downward structure.

The main trend is the downward structure of May 22.

Trading recommendations:

Buy: 0.7505 Take profit: 0.7520

Buy: 0.7522 Take profit: 0.7540

Sell: 0.7455 Take profit: 0.7435

Sell: 0.7433 Take profit: 0.7408

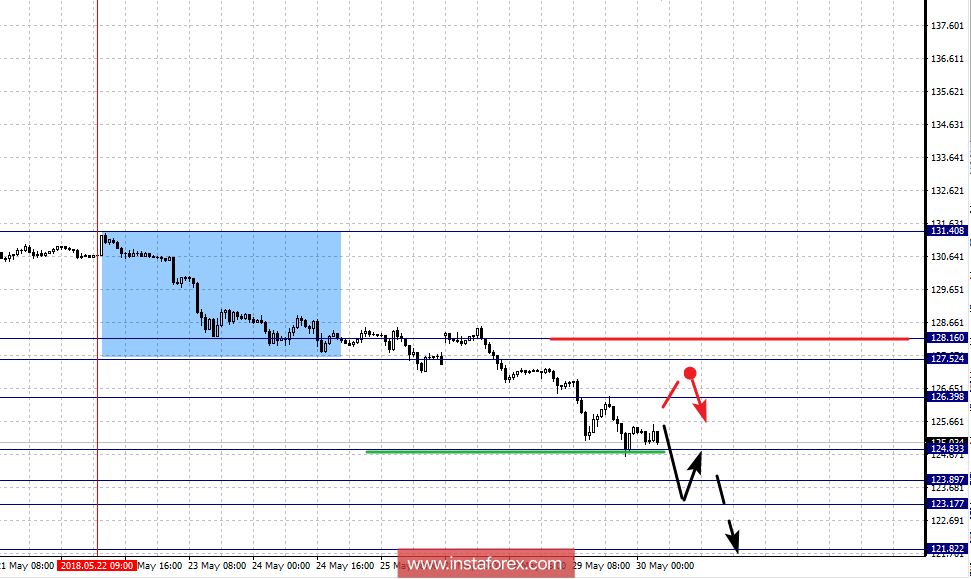

For the EUR / JPY pair, the key levels on the scale of H1 are: 128.16, 127.52, 126.39, 124.83, 123.89, 123.17 and 121.82. Here, we follow the downward structure of May 22. The continuation of the movement towards the bottom is expected after the breakdown of 124.83. In this case, the target is 123.89. In the area of 123.89 - 123.17 is the consolidation of the price. For the potential value for the bottom, consider the level of 121.82. The movement towards this level is expected after the breakdown of 123.15.

Going into correction is expected after the breakdown of 126.40. Here, the target is 127.52. The range of 127.52 - 128.16 is the key support for the downward trend. Before reaching this level, we expect the formation of potential initial conditions for the top.

The main trend is the downward structure of May 22.

Trading recommendations:

Buy: 126.40 Take profit: 127.50

Buy: Take profit:

Sell: 124.80 Take profit: 123.90

Sell: 123.15 Take profit: 121.85

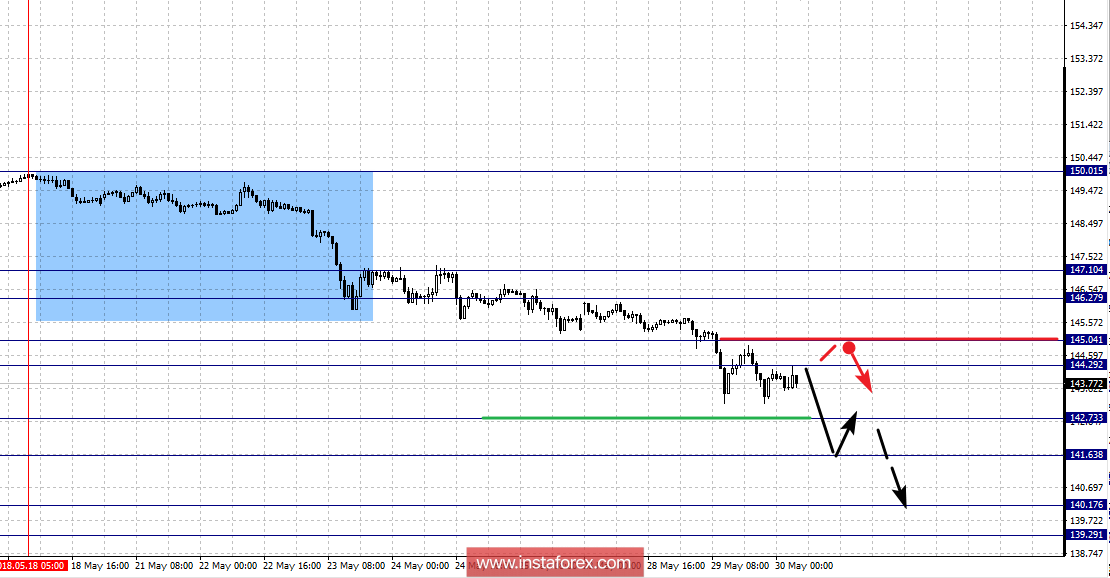

For the GBP / JPY pair, the key levels on the scale of H1 are: 147.10, 146.27, 145.04, 144.29, 142.73, 141.63, 140.17 and 139.29. Here, we follow the downward structure of May 18. The continuation of the movement towards the bottom is expected after the breakdown of the level of 142.73. In this case, the target is 141.63. Near this level is the consolidation of the price. The break at the level of 141.60 should be accompanied by a pronounced movement towards the level of 140.17. For the potential value for the bottom, consider the level of 139.29. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possible in the area of 144.29 - 145.04. The breakdown of the last value will lead to in-depth correction. Here, the target is 146.27. The range of 146.27 - 147.10 is the key support for the downward structure. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward structure of May 18.

Trading recommendations:

Buy: 144.30 Take profit: 145.02

Buy: 145.08 Take profit: 146.25

Sell: 142.70 Take profit: 141.65

Sell: 141.60 Take profit: 140.20