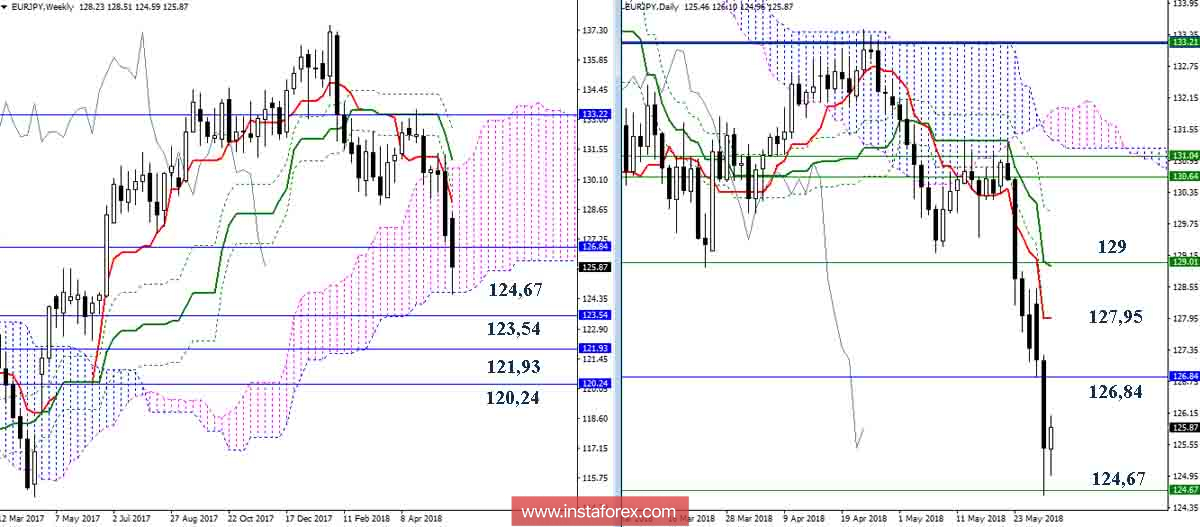

EUR / JPY pair

After securing the weekly cloud (Senkou Span A 130.64), the main task for the players to fall was to lower and test the cloud's lower boundary (Senkou Span B weeks 124.67). Bears coped with the task as the target point has been reached. As a result, it is now possible to break through, rebound or even the formation of lights out. The closest benchmarks for the recovery of bullish positions can be 126.84 (the monthly Kijun + main lines of junior timeframes) - 127.95 (daylight Tenkan) - 129 (week Tenkan + day Kijun). If the players on the fall are limited now by the breakout and will not allow the opponent to regain support for important levels, we can expect that they will attempt a breakdown of the weekly cloud (124.67). Overcoming the cloud will create a new large-scale benchmark to reduce.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.