To open long positions on EURUSD it is required:

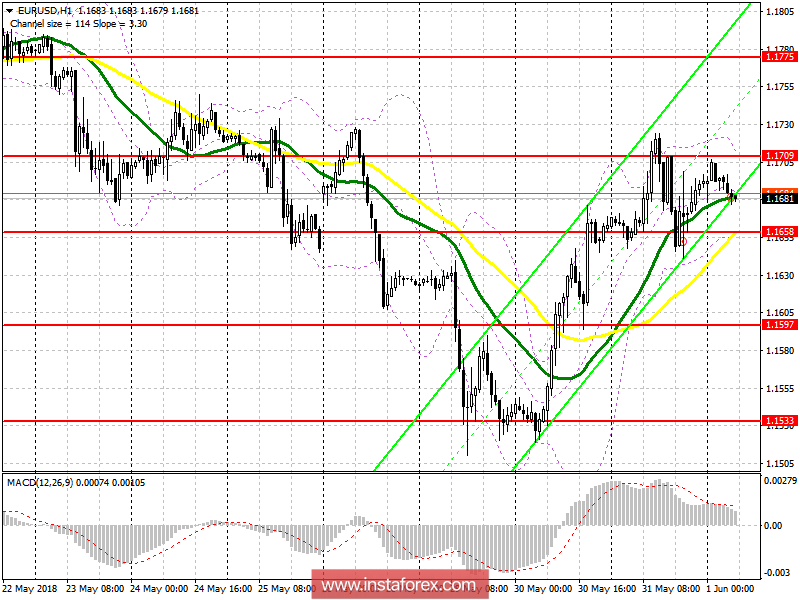

Consider buying euros after a breakout and consolidation on the resistance 1.1709, which opens the possibility of further upward correction in the area 1.1775 and 1.1828, where it is recommend fixing profits. Forming a false breakout at 1.1658 will also be an additional signal to buy. Otherwise, you can open long positions on a rebound from 1.1597.

To open short positions on EURUSD it is required:

Unsuccessful consolidation above 1.1709 with a return to this level will be the first signal for the opening of short positions in the euro with the main target of returning to support level 1.1658, where the pressure on the pair will increase even more, which will lead to a large area of 1.1597, where it is recommended fixing profits. In the case of growth above 1.1709 in the morning, selling can be searched from levels 1.1775 and 1.1828.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20