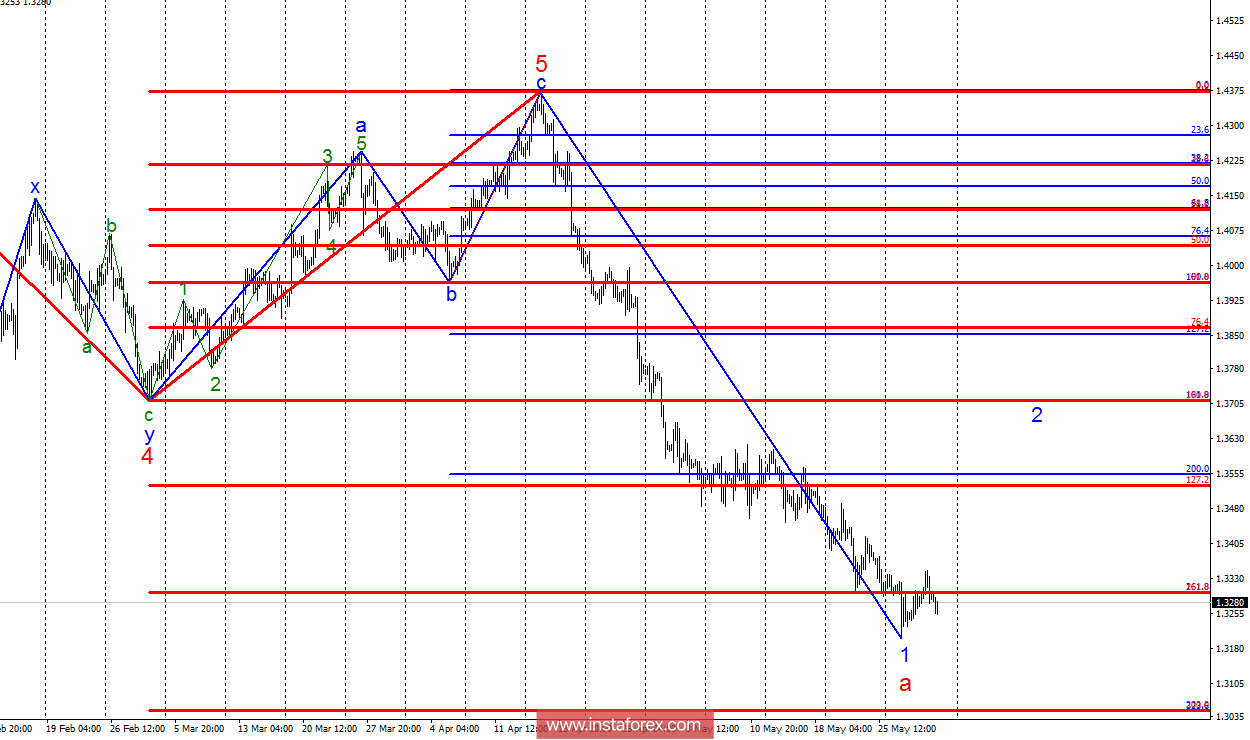

Analysis of wave counting:

At the trades on May 31, the GBP/USD currency pair lost about 60 points from the maximum of the day, questioning the construction of the future wave 2, in a of the downward trend section. The pair fails to form a significant upward trend section that could be identified as wave 2, or at least as the first low order waves in the future 2. Based on this, the pair at any time can resume the construction of wave 1 in a, which will take an even more complex and extended view.

Targets for buying:

1.3528 - 127.2% of the Fibonacci of the highest order

1.3555 - 200.0% by Fibonacci

Targets for selling:

1.3045 - 200.0% on the Fibonacci of the highest order

General conclusions and trading recommendations:

The next attempt to complete the construction of wave 1, in a, still does not look convincing at all. No sooner had the pair moved away from the reached lows, a decline in quotes threatens to resume. Leaving the trading instrument at least from May 29 will allow the return to selling with targets near the estimated mark of 1.3045, which corresponds to 200.0% of Fibonacci. It is recommended to consider buying a pair after building the convincing first two waves in the future 2.