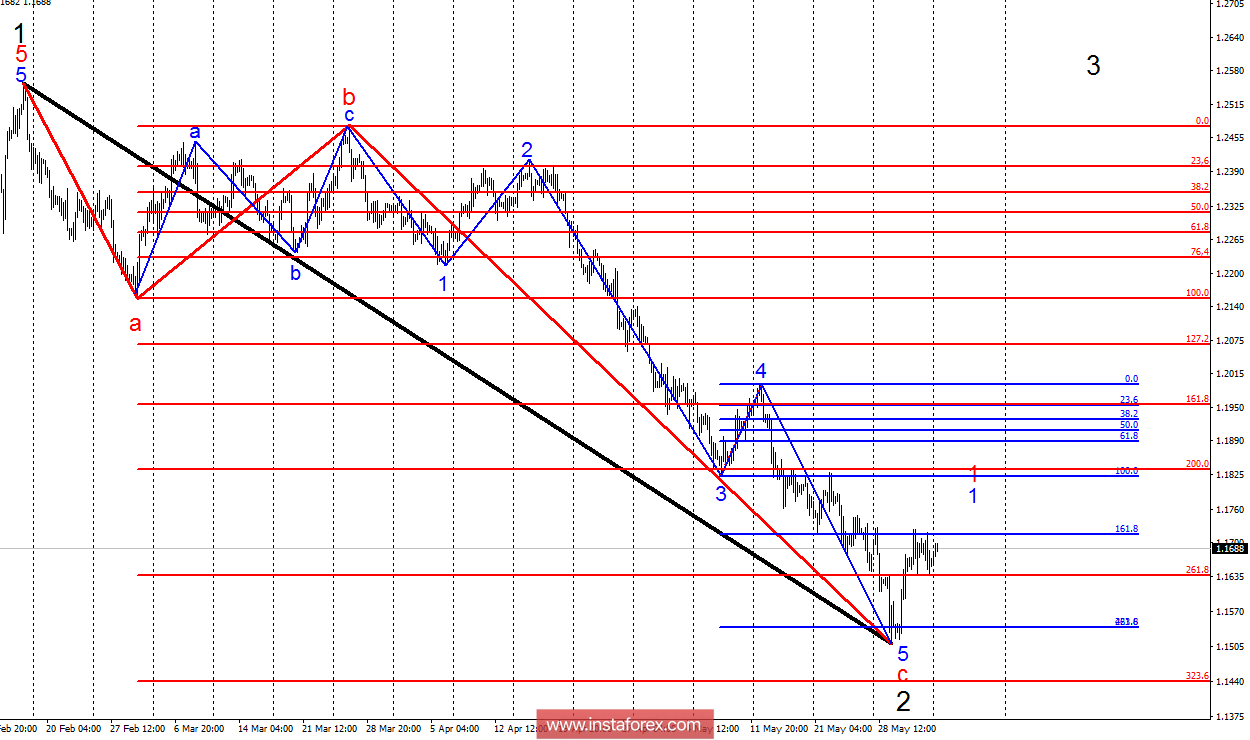

Analysis of wave counting:

The trades of the currency pair EUR / USD on Friday passed in different directions. The tool failed to break through the 161.8% Fibonacci mark, but this seems to be a temporary occurrence. Now, wave counting assumes the continuation of quotations increases within the first waves of the new upward trend part in wave 3, the goals of which are much higher than 25 figures. The objectives of the first wave 1 are about 18 figures, after which a correction wave 2 is expected to be built at wave 1, which in time can confirm the transition of the pair to the construction of the ascending trend part, rather than to a strong correctional wave with further complication of the internal wave structure of the wave c, 2.

The objectives for the option with sales:

1.1542 - 261.8% of Fibonacci

1.1438 - 323.6% of Fibonacci

The objectives for the option with purchases:

1.1835 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR / USD currency pair continues to build the proposed wave 1, 1. On this basis, it is recommended to continue the formation of purchases with the first targets located near the estimated mark of 1.1835, which is equivalent to 200.0% of Fibonacci. I recommend returning to sales after receiving confirmation of the complication of the wave c, 2, that is below the minimum of May 29.