On Monday, the foreign exchange market did not show any noticeable activity. The US dollar was down on the wave of fears that trade wars would put pressure on the US economy, and because of this, the world economy could also be under pressure.

Support against the dollar, although insignificant, received European currencies against the backdrop of stabilizing political situations in Italy and Spain after the appointment of local governments. Noticeable growth was restrained on the eve of the fact of the EU's trade war with the US, so the overall dynamics were not so pronounced.

On Monday, published production inflation data (PPI) in the euro area showed a decline in annualized growth in April to 2.0% versus expectations of an increase to 2.4% and March's value a year earlier at 2.1%. The monthly value of the indicator in April was at zero, while the increase by 0.3% was also expected against the March growth of 0.1%.

The euro, in fact, did not react to these figures of the indicator due to the fact that the trade war between the states and the European Union is the main obstacle.

The ruble is waiting for the decision of OPEC +, which can set the direction of crude oil prices, and their dynamics will help him decide where they should go. As for the behavior of the government bonds of the Ministry of Finance, they continue to consolidate in their yields in rather narrow ranges again against the backdrop of a lack of a stable demand for public debt assets. Thus, the profitability of the benchmark of 10-year OFZs continues to move in the range of 7.240% -7.420%.

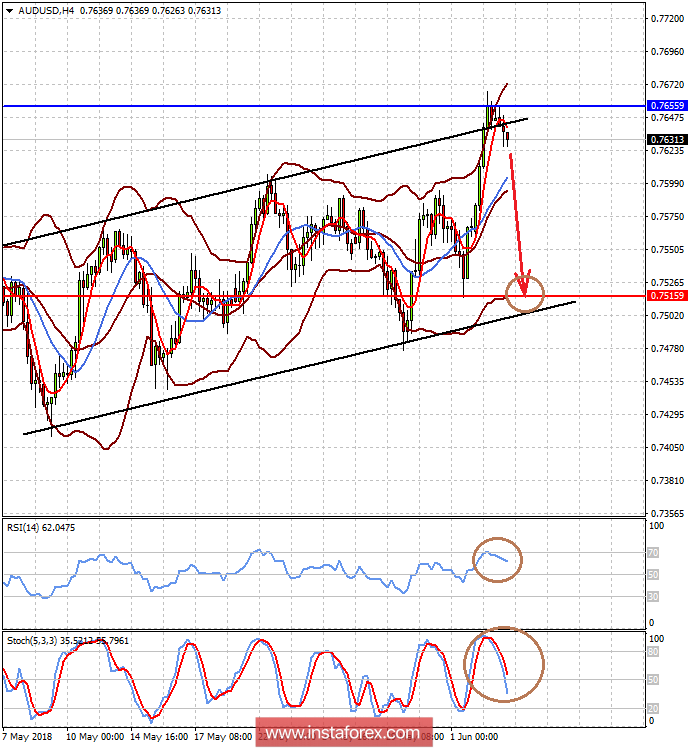

However, let's return to the Forex market. Today, the meeting of the Reserve Bank of Australia took place, the result of which was the preservation of the key interest rate at the level of 1.50%. The bank made it clear that it would not rush to raise interest rates. The day before, the Australian dollar gained appreciable support amid news that the talks between the US and China that took place this weekend did not give advantage to any of the parties, which means that there is a possibility of reaching a compromise that might positively affect the course of the "Aussie", since the economy of the Australia is very tightly bound in trade relations with the Chinese and any reduction of tension around China in this situation favorably affects the rate of the Australian currency.

Forecast of the day:

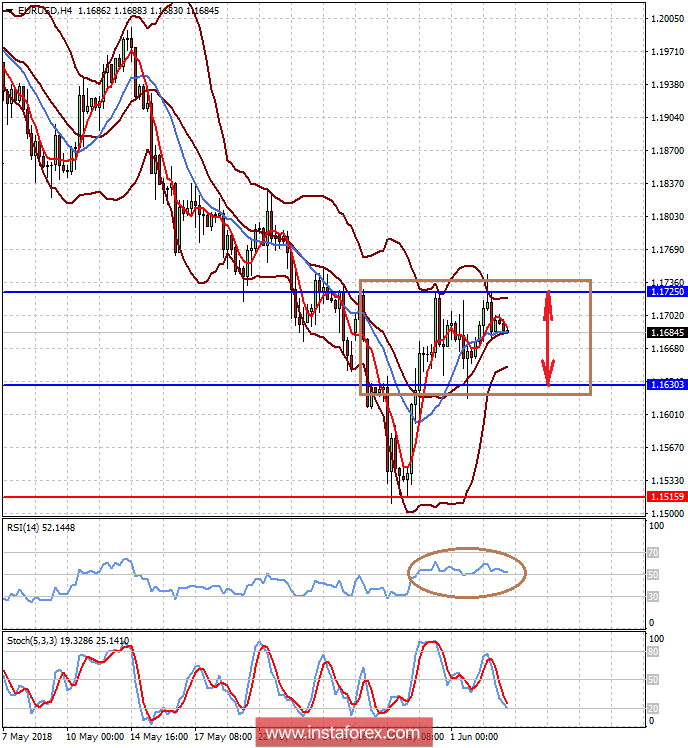

The EURUSD pair is consolidating in the range of 1.1630-1.1725 on the wave of uncertainty of how the trade wars on the euro-zone economy will recur. It is likely that today, the pair will remain in this range. It can fall to its lower boundary on the wave of positive economic statistics from the US.

The AUDUSD pair is trading lower with the RBA meeting. If the price does not pass the 0.7655 mark, it may turn down to 0.7515, if the statistics from the US turn out to be strong.