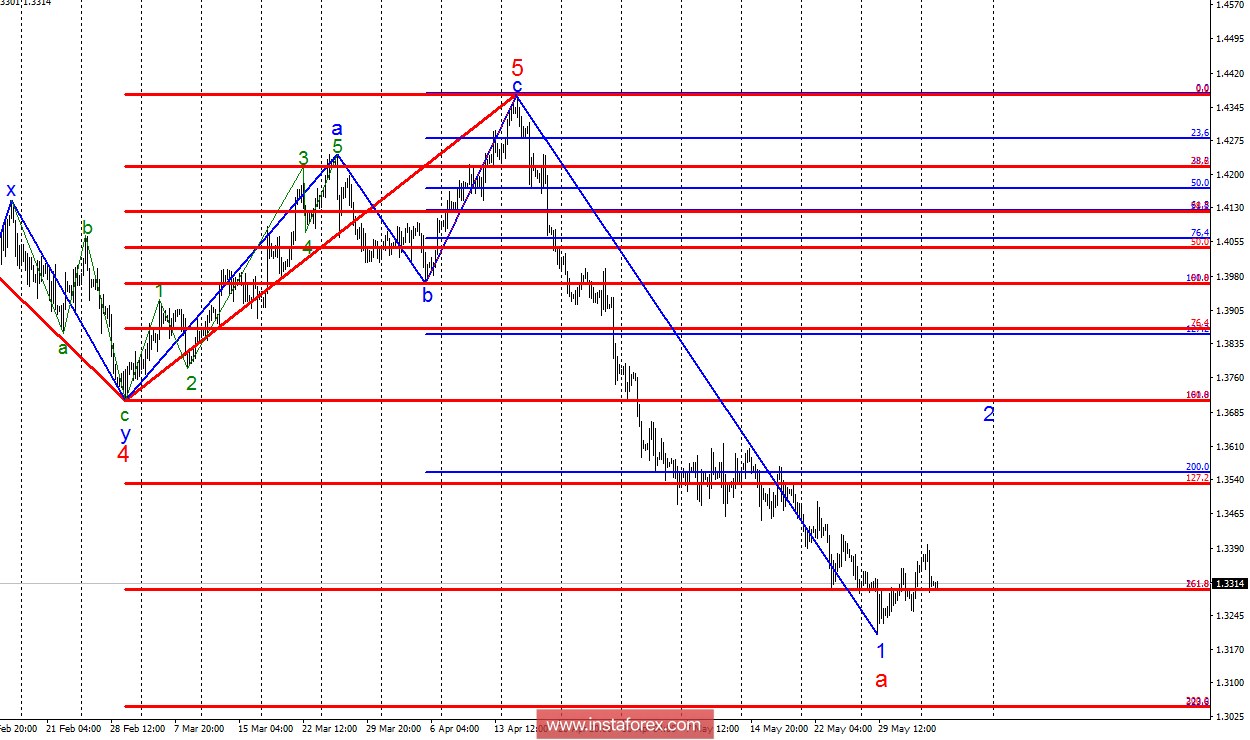

Analysis of wave counting:

During the trades on June 4, the GBP / USD currency pair lost about 100 percentage points from the maximum of the day, but still remained within the framework of the proposed wave 2, a. The pair moves up very slowly, which suggests that wave 2 can turn out to be shorter than originally thought. According to the wave theory, wave 2 should be at least 38.2% of the size of wave 1. That is, the target for wave 2 is 1.3651. However, given the fundamental component and weak demand for the pound sterling, wave 2 can take a very shortened look.

The objectives for the option with purchases:

1.3478 - 23.6% of Fibonacci

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% of Fibonacci retracement

The objectives for the option with sales:

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The attempt to construct the supposed wave 2, a, still looks questionable. Nevertheless, if the tool still moved to build wave 2, I recommend buying a pair of small volumes with the first target located around 1.3478, which corresponds to 23.6% of the Fibonacci of wave 1. I recommend going back to sales if the pair complicates the assumed wave 1, which can be understood by updating the minimum of May 29.