In anticipation of the outcome of the Fed meeting on monetary policy next week, as well as other major world banks, it seems that activity in the foreign exchange market begins to decline.

The latest developments around the outbreak of trade wars initiated by President Donald Trump demoralized the markets. The uncertainty factor fetters investors, not allowing them to take certain actions. In addition, the very nature of the American president does not contribute to this certainty. If in May the tension subsided somewhat in the wake of news on the agreement to take a break at the beginning of the trade war between the United States and the PRC, by the end of the month, the unexpected announcement by the US president being unhappy on the arrangements plunged financial markets into shock and led to a new demand for defensive assets such as American treasuries, yen and Swiss franc, as well as, government bonds of other economically developed countries.

On this wave, the dollar was even supported for some time, as investors believed it was fair that other major world central banks, especially the ECB would not change their monetary policy rates. But after the recently published figures for of consumer inflation in the euro area, it jumped to 1.9% yoy, which actually approached the target level of 2.0%, then the likelihood that the European regulator in September will end the program to stimulate the European economy has grown significantly. Despite the announcement by Trump on June 1, the beginning of the introduction of new customs duties on the EU, supports the euro exchange rate.

But back to the events that will undoubtedly be the most important next week - Fed's meetings on monetary policy. It is assumed that the bank will raise interest rates by 0.25% following its results. This decision is expected and actually taken into account in the dollar quotes. The market will wait for the statement of the regulator and the speech of its leader, Jerome Powell, from which they will expect frank words or hints on the prospects for further increases in rates.

Given the high importance of this event, we believe that we are in the best of it.

Forecast of the day:

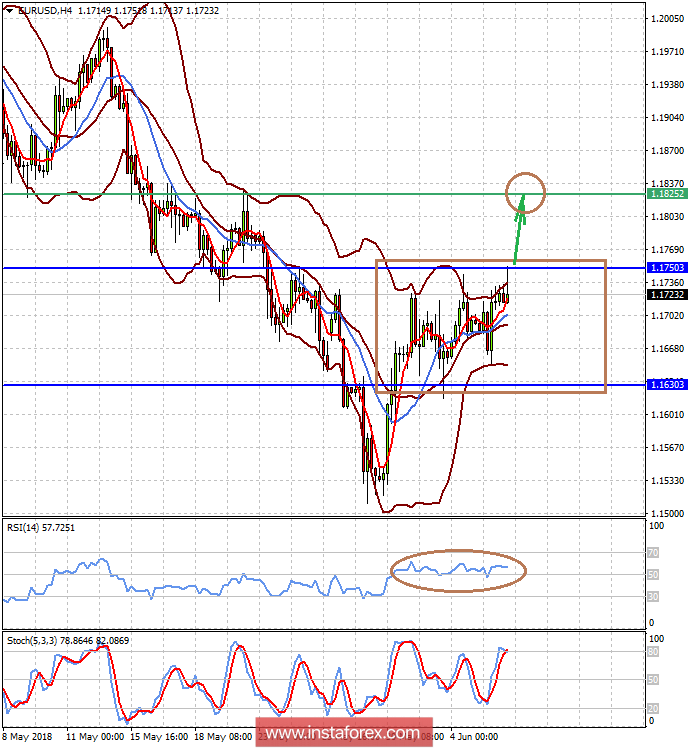

The EUR/USD pair is consolidating in the range of 1.1630 - 1.1750 amid a shift in investors' attention to the outcome of the Fed meeting next week. For this reason, it is likely that the pair will consolidate in this range, but if it overcomes the 1.1750 mark, there is a probability of its local growth to 1.1825.

The USD/CAD pair is also consolidating, but if oil prices continue to grow - this could lead to a fall in the pair to 1.2860.