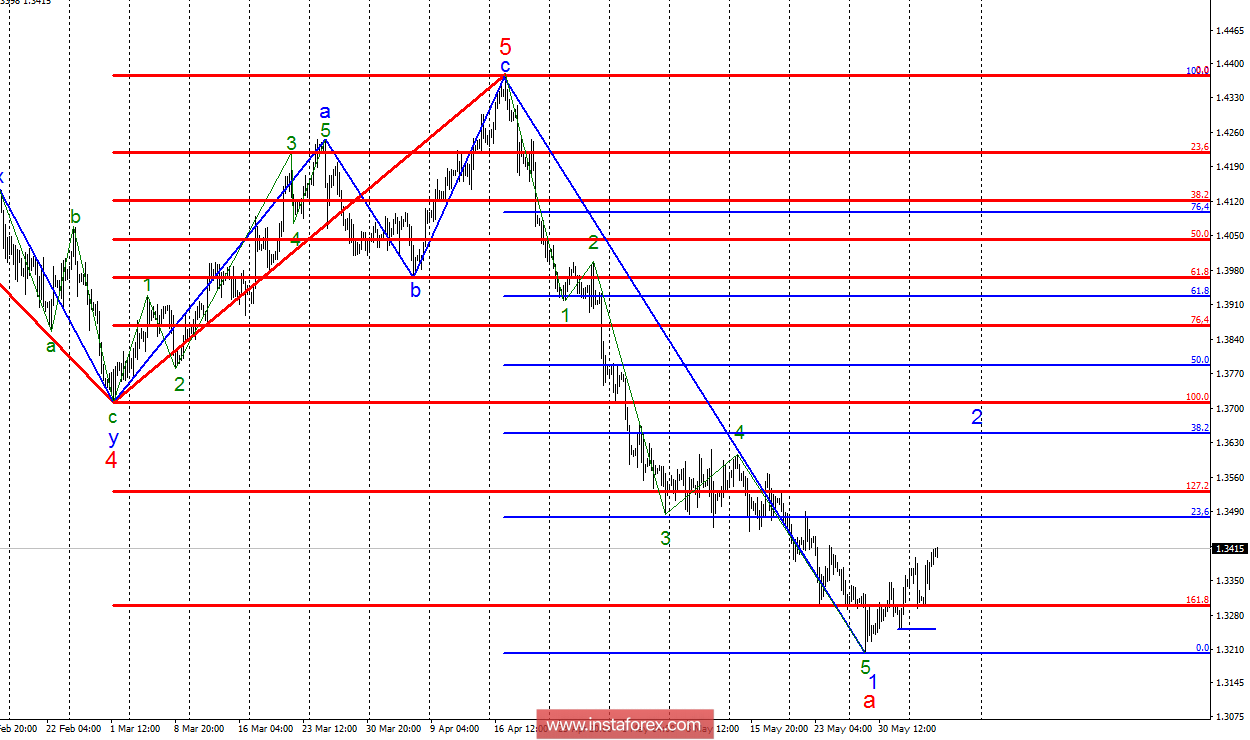

Analysis of wave counting:

During the trades on June 5, the GBP / USD currency pair added about 100 percentage points and continued to build up the wave set in the proposed wave 2. If this assumption is correct, then the quotes increase will continue to the levels of 1.3478 and 1.3651, which corresponds to 23.6% and 38.2% of Fibonacci of the size of the assumed wave 1, a. The break of the minimum from June 1 will warn about the pair's readiness to resume building the downtrend section of the trend and will lead to complication of the entire wave 1, a.

The objectives for the option with purchases:

1.3478 - 23.6% of Fibonacci r

1.3528 - 127.2% of the Fibonacci of the highest order

1.3651 - 38.2% of Fibonacci

The objectives for the option with sales:

1.3045 - 200.0% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The attempt to construct the supposed wave 2, a, still looks unconvincing. At the same time, the increase in quotations continues. Thus, I recommend buying a pair of small volumes with the first goal, located around 1.3478, which corresponds to 23.6% of Fibonacci of the size of wave 1. I recommend going back to sales if the pair makes a successful attempt to break the low from June 1, as this with a high degree of probability will mean the complication of wave 1, a, with the first targets located near the mark of 1.3045, which is equivalent to 200.0% of the Fibonacci of the highest order.