USD/JPY

On Wednesday, the yen grew by 39 points with the support of the stock market (S&P 500 + 0.86%). The salary data came out mixed; the overall average wage growth in April eased from 2.0% y/y (revised down from 2.1% y/y) to 0.8% y/y, with 1.4% y/y expectation, the level of payment for overtime increased from 1.8% y/y to 1.9% y/y. Foreign investment in Japanese stocks is declining for the third week in a row, and perhaps today's yen weakened by 16 points with the Nikkei 225 stock index up 0.87% due to yesterday's increase in the Central Bank of India's rate from 6.00% to 6.25% for rising oil prices and fears of accelerated inflation. Indian GDP has been declining for the past six months, from 8.2% y/y to 6.7% y/y. Yield of state 10-year bonds increased to 7.95%, for two-year yields from the 1st decade of April at 6.77% to today increased to 7.60%, higher only in the first half of 2015, when India departed from the monetary crisis. It seems to us that hidden crisis processes are taking place in India, which, incidentally, we occasionally, but almost always talked about. The decline in world trade in India can hit harder than on the main participants of these political games. Perhaps the Japanese investors are beginning to slowly put in prices from the development of events and further growth of the yen can continue only with a very vigorous growth of the US stock market. In general, the Japanese yen (buying USD/JPY) is becoming a very unreliable investment pair in the medium term and calls for caution.

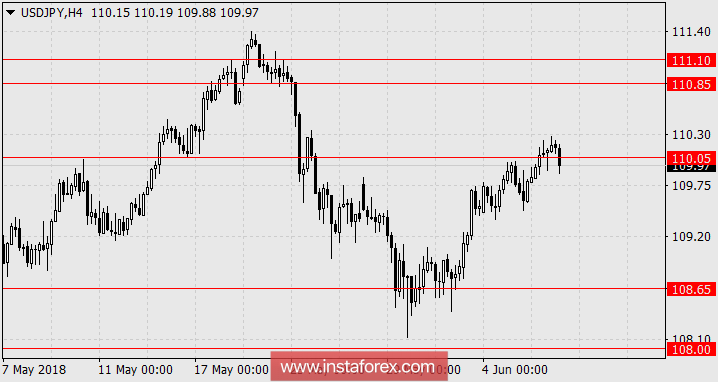

Tomorrow, Japan is expecting very good data. The final estimate of GDP for the 1st quarter is expected to be revised upwards from -0.2% to -0.1%. The balance of payments for April is expected to increase from 1.77 trillion yen to 2.10 trillion. Bank lending for May can show growth from 2.1% y/y to 2.2% y/y. We are looking forward to the growth of the yen in the range of 110.85-111.10.