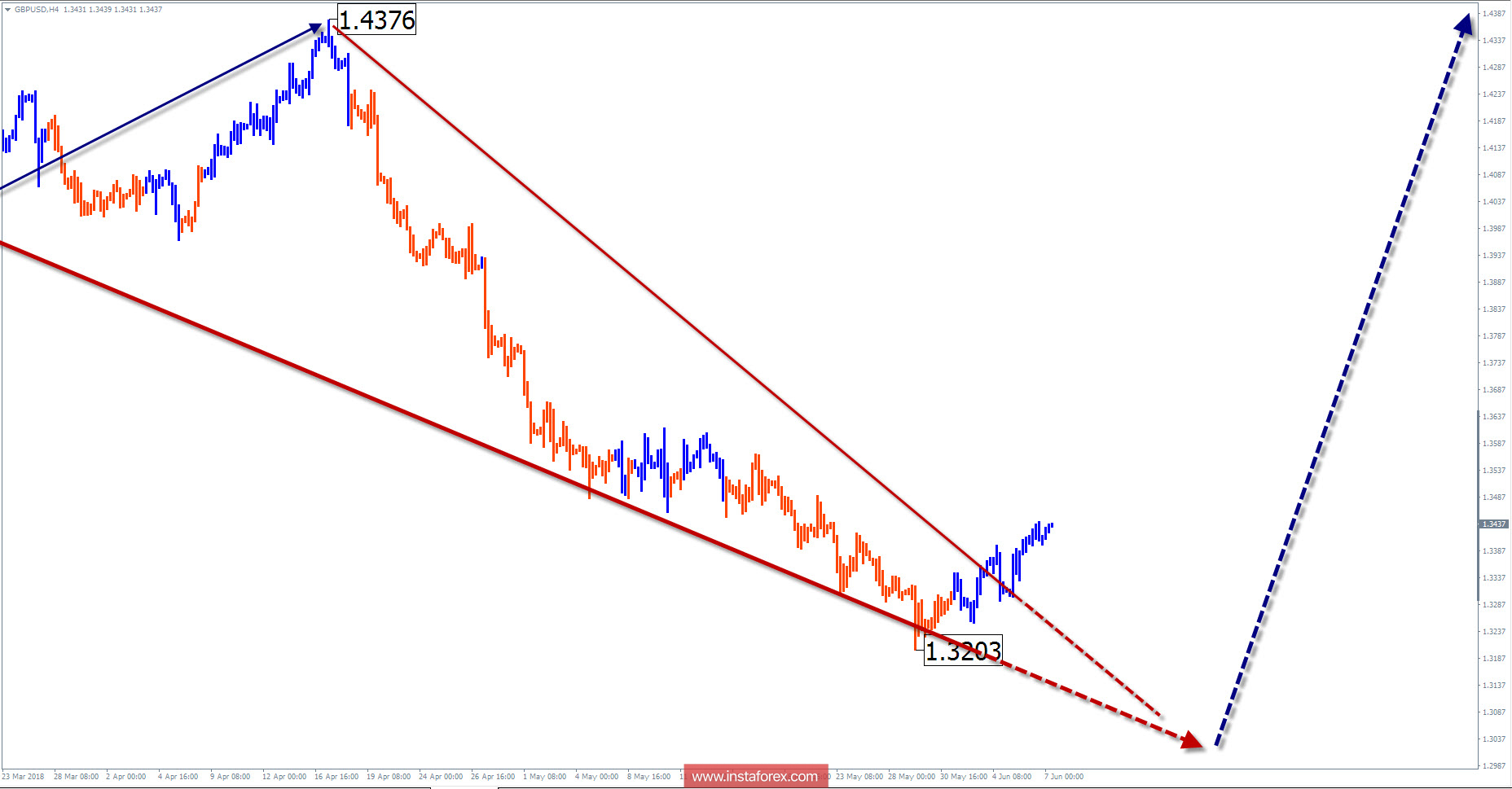

The wave pattern of the H4 graph:

The direction of short-term trends of the pound sterling major pair since the end of January is set by the downward wave. On a higher timeframe, it became a correction. The wave has reached the minimum possible extension. The necessary proportions of all its parts have been achieved.

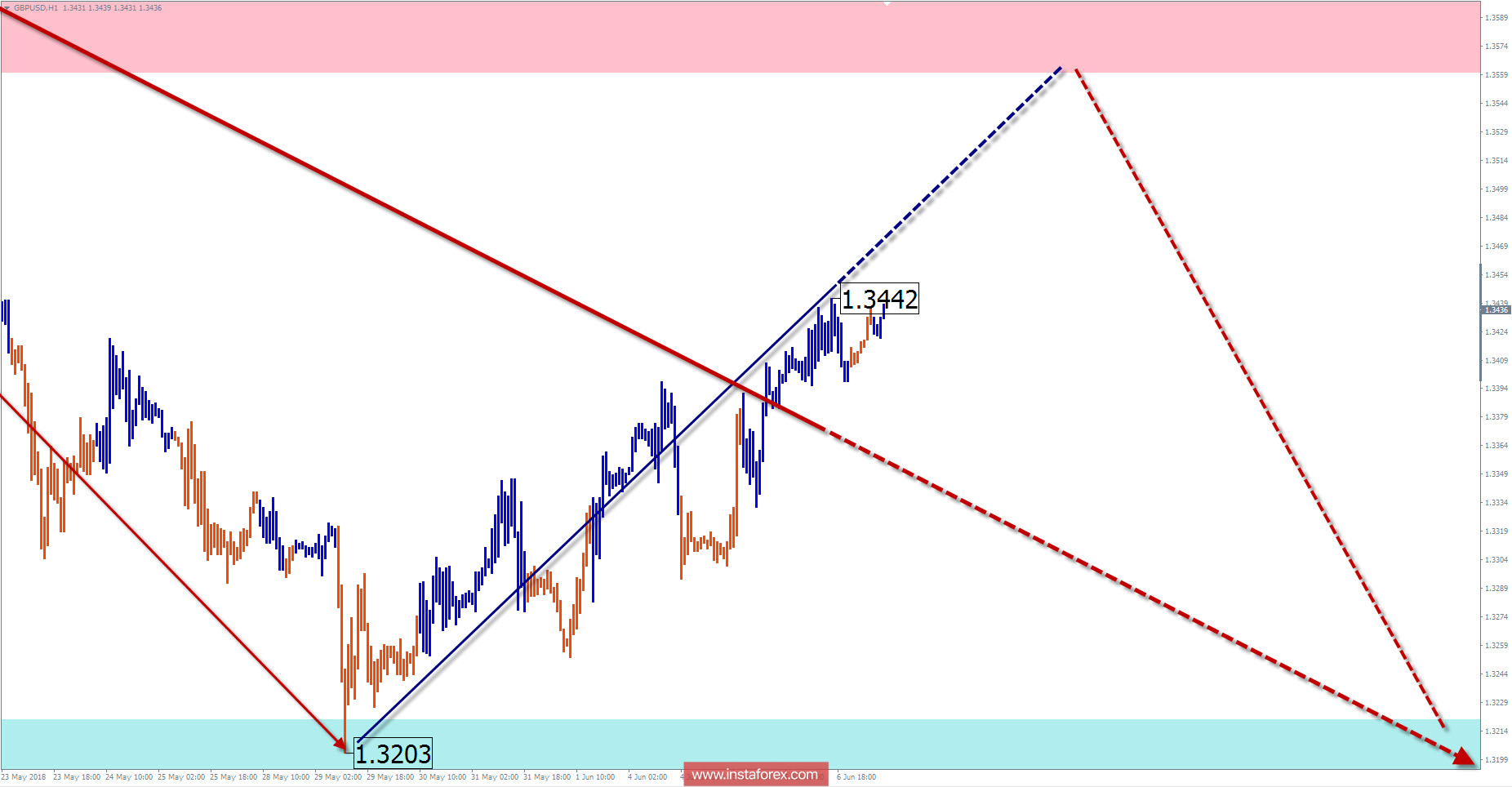

The wave pattern of the H1 graph:

The bearish wave of April 17 forms the final part (C) of a larger model. The price reached the section of a powerful turning zone. Turn signals have not been observed.

The wave pattern of the M15 chart:

The bullish wave of May 29 does not have a reversal potential. In the structure of the dominant wave, it forms a section for correction. The growth potential is limited by the zone of resistance.

Recommended trading strategy:

Trading on high timeframe is worth paying attention to the emerging signals of purchase. Supporters of inter- and intraday trading have the opportunity to make short-term sales.

Resistance zones:

- 1.3560 / 1.3610

Support zones:

- 1.3220 / 1.3170

Explanations to the figures:

A simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). The last incomplete wave for every timeframe is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the counting of wave according to the technique used by the author. The solid background shows the generated structure and the dotted exhibits the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need to confirm the signals used by your trading systems.