EUR / USD

On Thursday, the markets went through in a "sacred" thought that the ECB will open a great secret in a week and it will announce the date of the final curtailment for the program of purchase of assets on its balance sheet (QE). The German 5-year government bonds fell in yields from -0.114% to -0.167%, while France's similar securities fell in yields from -0.019% to -0.045%. Also, the European stock indices fell slightly. The single European currency grew by 25 points.

We still cannot see the important factor in announcing the already revealed QE completion program in December this year, especially now because of the increasing threats on trade war with the US. The first rate increase is expected by the markets only in a year scheduled in June 2019 (with a probability of 70%), as it was in general terms determined by the ECB itself. The classical situation of selling is created on the market - the first and strong impact of the euro will be received with the Fed rate hike, while the second and final happened the next day with the announcement of the ECB plan to minimize QE.

The economic data for the euro area came out weak. The volume of industrial orders in Germany in April fell by 2.5% after the previous contraction by -1.1% (revised downwards from -0.9%). The data may also affect the current volume of industrial production in Germany, which is expected to grow by 0.4%. With a high probability, the indicator will be worse. Retail sales in Italy for April fell by 0.7% against expectations for growth of 0.2%. The trade balance of France amounted to -5.0 billion euros against the forecast of -5.1 billion euros. It remains to be seen if this will have a positive effect on the Germany's trade balance which will be published today, with a forecast of 20.3 billion euros against 22.0 billion in March, while the declining German Trade Balance since March raises doubts.

In the United States, a weekly report on the number of applications for unemployment benefits showed the presence of 222 thousand applications against the forecast of 223 thousand. The volume of consumer lending in April fell from $ 12.3 billion to $ 9.3 billion.

So today, the trade balance and the volume of industrial production in Germany for April and the industrial production of France for May will come out. For all indicators, we expect the data to came in worse than expected. According to the US, only the wholesale stock indicator for April will come out in the final estimate with an unchanged forecast of 0.0%.

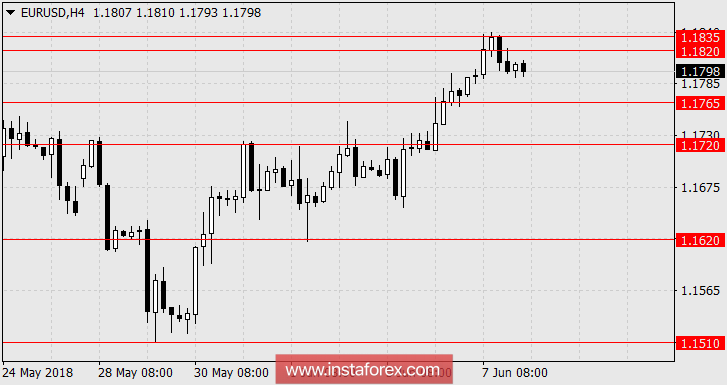

The G7 summit opens today, which will discuss the problems of trade wars. And next week, there are two major events which are the Fed's meetings and the ECB. We are waiting for investors to close short-term purchases and the decline of the euro to 1.1720.

* The presented market analysis is informative and does not constitute a guide to the transaction.