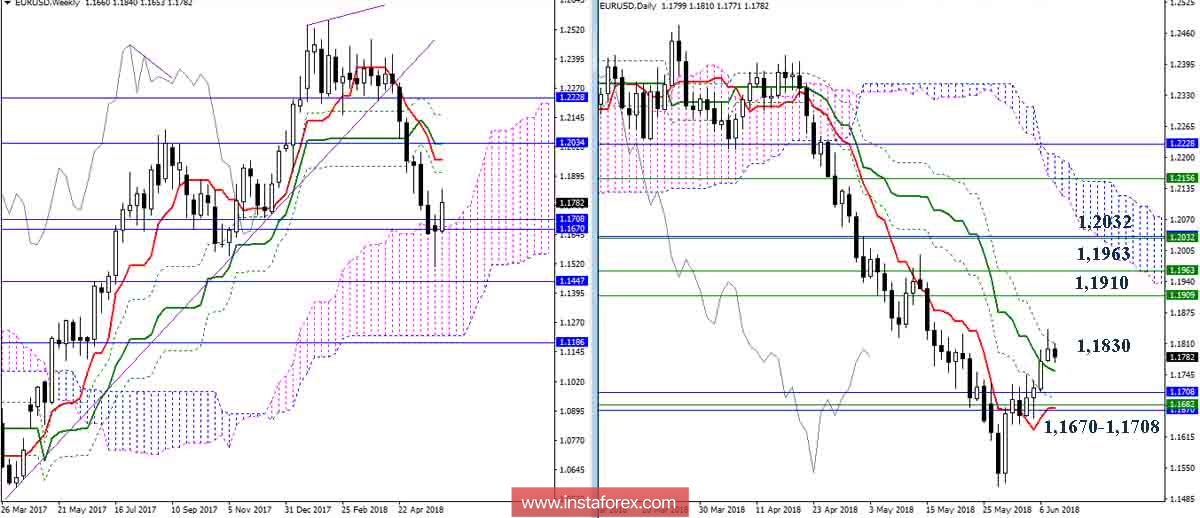

EUR / USD pair

Opposing the center of attraction (1.1670 - 1.1708), the victory was won by the players to rise. They were able to break away from the zone, turning it into a support in the daytime. At the moment, the target for the breakdown of the H4 cloud (1.1829) has been worked out and the final resistance of the daytime dead cross (Fibo Kijun) has been tested. Reliable overcoming of this zone will eliminate the daytime dead cross, due to which, there will be new upward prospects. The nearest landmarks can be noted in the area of 1.1910-60 (weekly Fibo Kijun + week Tenkan) and at 1.2030 (weekly Kijun + monthly Tenkan). At the same time, one must take into account that the strength of the resistances encountered can now contribute to the fact that players on the rise take a pause. As a support to the bulls, it is desirable today to confine the area 1.1740-50 (Senkou Span B N1 + Kijun N4 + day Kijun).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.