Trading plan 06/08/2018

The general picture: the Big Seven, Trump, the decision of Central Banks.

Today and early next week, the markets will respond to the G-7 meeting today in Canada. The main question - the new import duties in the US - will President Donald Trump and his partners find a compromise. Recent reports are not encouraging - it seems that Trump is ready to go "hard" and introduce duties, ignoring the sharp discontent of all the US trade partners - China, Mexico - and even the main strategic allies of the United States - Germany, France, Canada. These countries in turn stated that they are ready in the event of a failure of negotiations to introduce reciprocal duties on imports from the US - which means that the world economy, one step away from a full-fledged US trade war, is the rest of the economy.

Still, bluffing is one of the properties of Trump - and it is quite possible that we will see a compromise.

The second theme is the decisions of the Central Banks globally. The Central Bank of India unexpectedly raised the interest rate. Before this, the rate was raised by the Central Bank of Turkey.

Next week, the Fed will most likely raise the Fed's rate (June 13) - and on June 14 the ECB meeting - and the market is preparing to see the ECB's turn to tighten monetary policy.

But today - the focus in on Trump and Group of Seven.

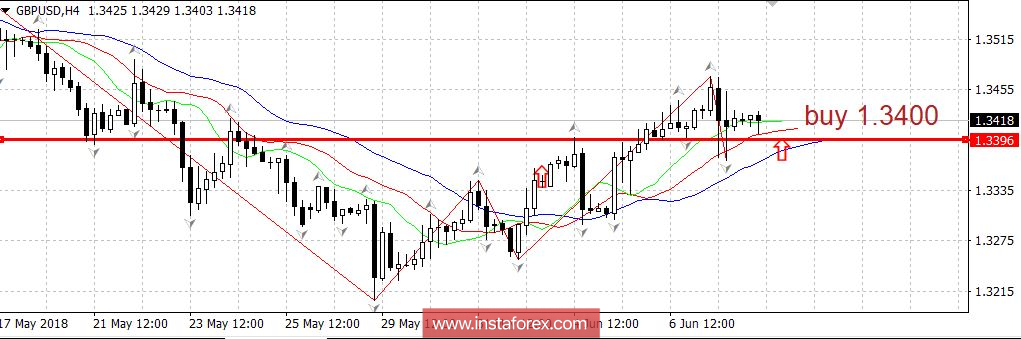

GBPUSD: Buy from 1.3400.