The main event this week is the meeting of the Committee on Monetary Policy of the US Federal Reserve on June 13-14. The main issue is the possible adjustment of the Fed's ultimate goals at the rate, as well as changes in macroeconomic forecasts.

The minutes of the previous meeting contained an indication of the readiness to change the wording on the objectives of the Fed's policy, the markets may consider that the FRS's rate targets will rise, which will lead to an increase in bond yields and, as a consequence, to the growth of the dollar. Another point is the possible asymmetric increase in the rate of excess bank reserves, which can make their storage unprofitable on the Fed's correspondent accounts and will stimulate banks to invest in the economy.

On Tuesday, the report on consumer inflation for May will be published, which is the key to justify any changes in the accompanying commentary to the FOMC meeting and in turn will give grounds for correcting the forecasts.

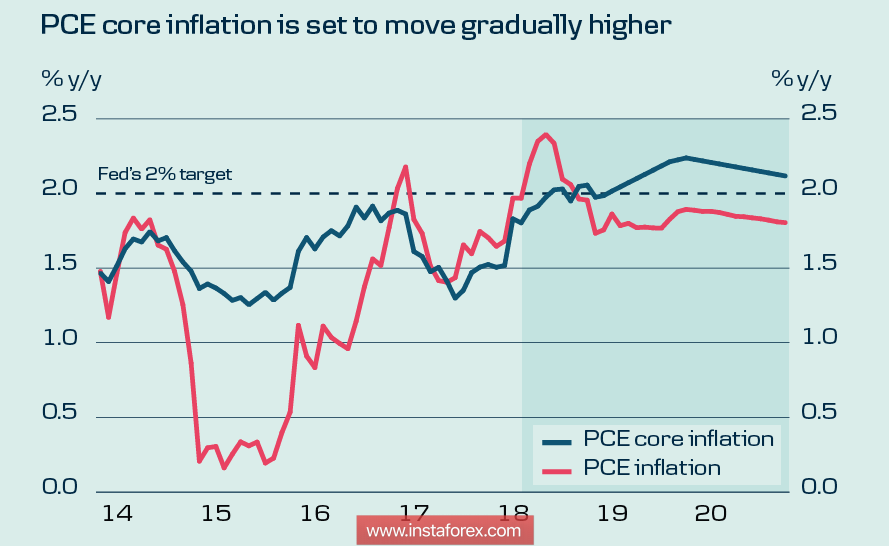

Long-term forecasts are neutral - there is neither the likelihood of rolling into deflation, nor the threat of rising inflation which may require higher growth rates. By the end of the year, Inflation Core is expected to stabilize slightly above 2%, which is completely satisfied with the Fed, after which a period of stable price growth is expected near the achieved values will be shown.

It is obvious that the Fed will publicly adhere to the above-mentioned position, since it will give the right to withstand the schedule at a rate. Actually, the main thing that the regulator needs in the current conditions is stability. The Fed informs the markets about its plans for a year or more, and it is important that the changes in these plans are insignificant. This makes it possible to predict the reaction of the markets and to manage this reaction.

From this point of view, there is a problem that is still carefully pushed into the background, but in fact, its action only increases. First of all, these are weak growth rates of average wages which remain historically very low, given the strong recovery of the labor market. Weak revenues mean low inflationary pressures, which will decrease as the rate increases, as the overall consumer demand will decline due to a decrease in consumer lending. The FRS report on consumer loans in April showed that after a peak in December 2017, there is a steady slowdown and if the general level of economic optimism goes down, the situation for the US economy will start to look much worse.

Another parameter that can influence the markets just before the FOMC meeting is the publication of the May budget report on Tuesday. Despite the fact that the media usually focuses on other indicators such as inflation, unemployment and GDP growth, since these are guidelines that the FRS sets after key meetings, but in the present, realities the state of the budget becomes one of the most important factors because it is an indicator for the success of the tax reform and even an indicator of the future steps of the administration and the Federal Reserve.

While the situation is developing negatively, the Congressional Budget Committee showed that for the first 8 months of the 2018 financial year, the deficit was 530 billion, which accounts to 97 billion more than a year earlier. At the same time, incomes grew by 3%, expenses - by 6%. The rate increase with the planned rate requires either an increase in revenues or, a reduction in costs in case of failure, which threatens to reduce the standard of living and could also lead to the defeat of Trump in the next election.

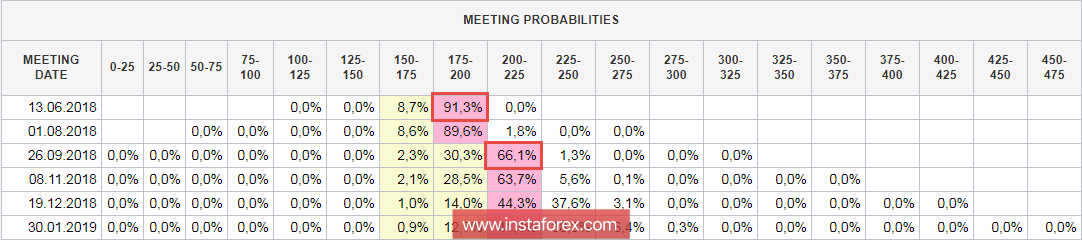

According to CME, the markets are confident in raising the rate at the meeting on June 13, and by September the probability is 66.1%.

The upcoming rate increase is fully taken into account by the markets and will not have any impact on the quotes.

Thus, the dollar is ready for two possible scenarios, either neutral - if the wordings and forecasts coincide with the forecasts, or aggressive - if the Fed changes its wordings, the rate target, and changes in the policy on surplus reserves. In the second case, the dollar will strengthen across the entire spectrum of the market immediately after the publication of the final statement.

* The presented market analysis is informative and does not constitute a guide to the transaction.