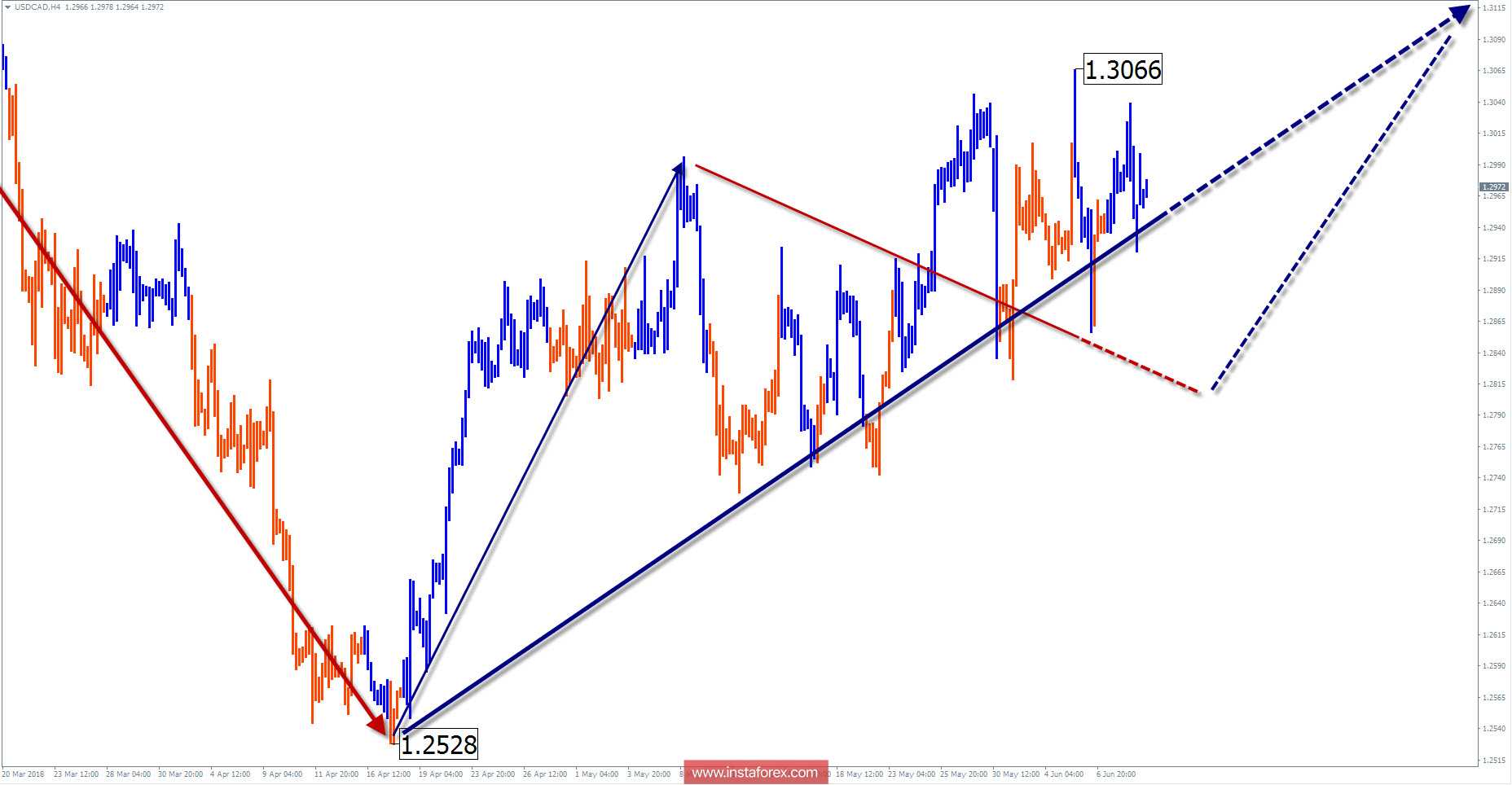

Wave picture of the chart H4:

The wave of the trading instrument that was not completed today started in late January. In a model of a larger scale, it took the place of the final part (C). The lower boundary of the preliminary target zone is approximately in 2 price figures from the current exchange rate of the pair.

The wave pattern of the graph H1:

The direction of short-term trends fits into the algorithm of the rising wave of April 17. An analysis of its structure shows the development of the first 2 parts (AB).

The wave pattern of the M15 chart:

Since may 31, it is possible to track the upward wave structure, in which the middle part (B) is formed in the recent days.

Recommended trading strategy:

Selling will become relevant after the completion of the bullish trend wave. On a weekly scale, traders need to wait for the rollback to end and look for buy signals.

Resistance zones:

- 1.3020/1.3070

- 1.3200/1.3250

Support zones:

- 1.2830/1.2780

Explanations of figures: Simplified wave analysis uses a simple 3-part waveform (A-B-C). At each TF the last incomplete wave is analyzed. Zones show the estimated areas with the greatest probability of a turn.

Arrows indicate the wave counting according to the technique used by the author. The solid background shows the generated structure, dotted - the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need confirmation signals from your trading systems!