To open long positions on EURUSD it is required:

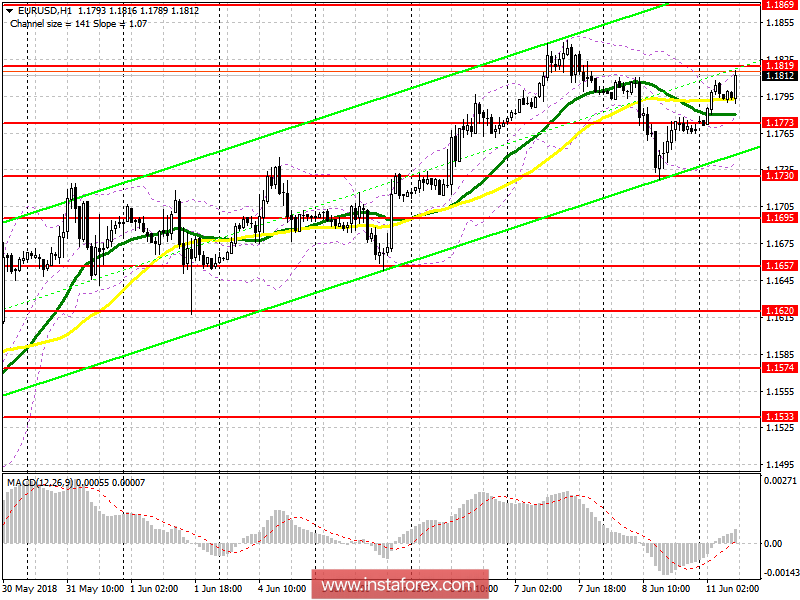

The buyers still have the same task. A break with consolidation above 1.1819 will make it possible to count on a new wave of growth of the European currency with the update of the monthly highs around 1.1869 and 1.1923. If the EUR/USD falls in the morning under the support level 1.1773, buying the euro is best after the test of 1.1730 and on the rebound from 1.1695.

To open short positions on EURUSD it is required:

Failure to rise above resistance 1.1819 with a return to this level in the first half of the day will be the first signal for the opening of short positions in euros with the main target of breakdown and consolidation below support 1.1773, which will lead to a larger downward correction to the area 1.1730 and 1.1695, where it is recommended recording profit. In the case of growth above 1.1819, the euro can be sold on a rebound of 1.1869 and 1.1923.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20