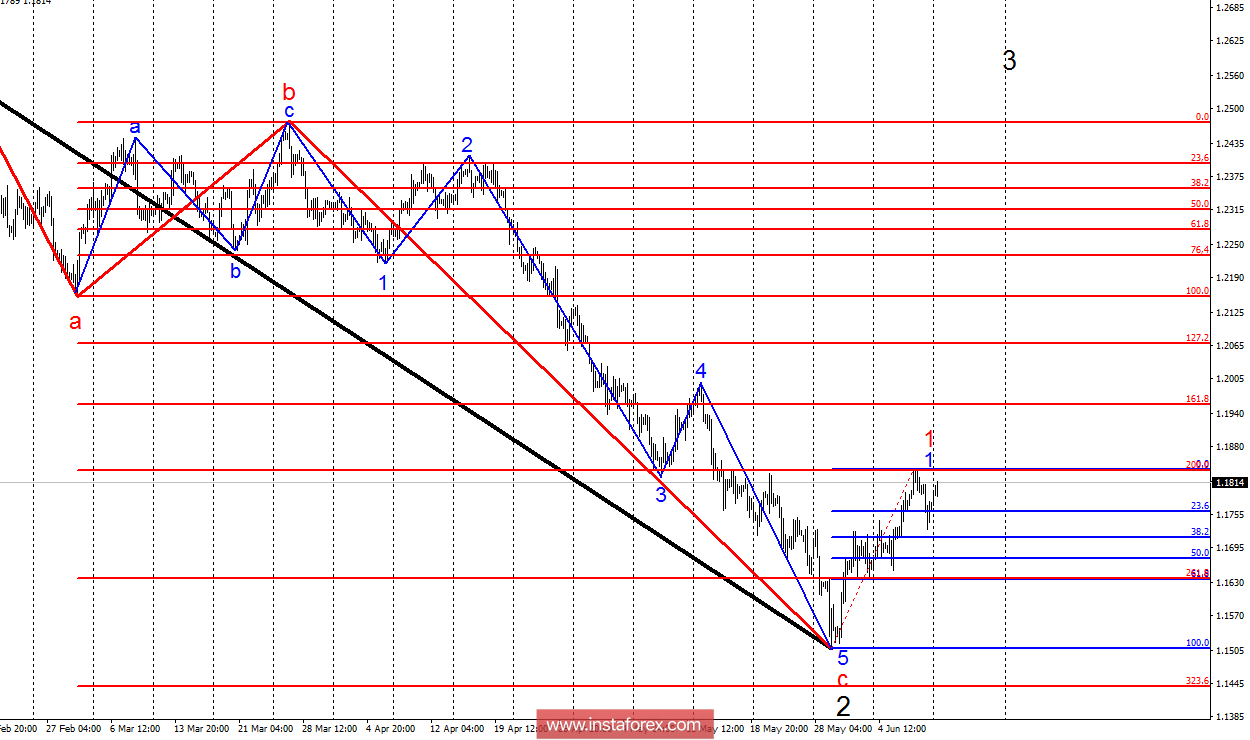

Analysis of wave counting:

During the trades on Friday, the EUR/USD fell 30 basis points, but by the end of the trading day it started to rise again. Accurate testing of the estimated 200.0% Fibonacci level gives grounds to assume the completion of the proposed wave 1, 1, 3. If this is the case, then we are waiting for the construction of a three-wave corrective structure with targets located in the range 1.1637 - 1,1675. A successful attempt to break the 1.1835 mark will lead to a complication of wave 1, in 1 or at the beginning of the construction of the supposed wave 3, at 1, at 3 with targets about 20 figures.

Targets for selling:

1.1675 - 50.0% by Fibonacci

1.1637 - 61.8% by Fibonacci

Targets for buying:

1.1958 - 161.8% by Fibonacci of the highest order

1.2070 - 127.2% by Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR/USD currency pair supposedly completed the construction of wave 1, at 1 near the mark of 1,1835. Thus, now the pair began to withdraw quotes from the reached highs with the targets of 1.1675 and 1.1637 within the wave 2, in 1. This movement can be attained, but only by small volumes, since this is still a correction. After the completion of this wave (breakthrough 1,1835), a resumption of the rise is expected and it is recommended to resume buying with targets located near 1.1958 and 1.2070, which corresponds to 161.8% and 127.2% of Fibonacci.